Safeguard your investments and promote ethical decision-making with ESG due diligence.

Elevate Your Investment Strategy with Environmental, Social, and Governance (ESG).

Safeguard your investments and promote ethical decision-making with ESG due diligence.

Elevate Your Investment Strategy with Environmental, Social, and Governance (ESG).

We redefine due diligence by integrating Environmental, Social, and Governance (ESG) considerations into our comprehensive assessment process. Our ESG due diligence service is designed to empower investors and companies alike, ensuring sustainable and ethical practices are at the forefront of decision-making.

Our ESG due diligence goes beyond traditional assessments. We focus on identifying and disclosing ESG risks that may impact financial performance, providing a holistic view of potential obligations and their financial implications.

Neotas ESG due diligence delivers essential data and insights into a company's ESG performance and policies. This allows investors to make informed decisions based on all relevant information, minimising potential losses associated with low ESG standards.

To streamline the analysis process, Neotas leverages an all-in-one risk management platform for ESG due diligence. This technology-driven approach enhances efficiency and accuracy, allowing us to provide you with the most comprehensive assessment possible.

We believe in transparency. Our process involves collecting key performance indicators and documents, systematically identifying and disclosing environmental, social, and governance risks, and evaluating the financial impact of potential ESG obligations.

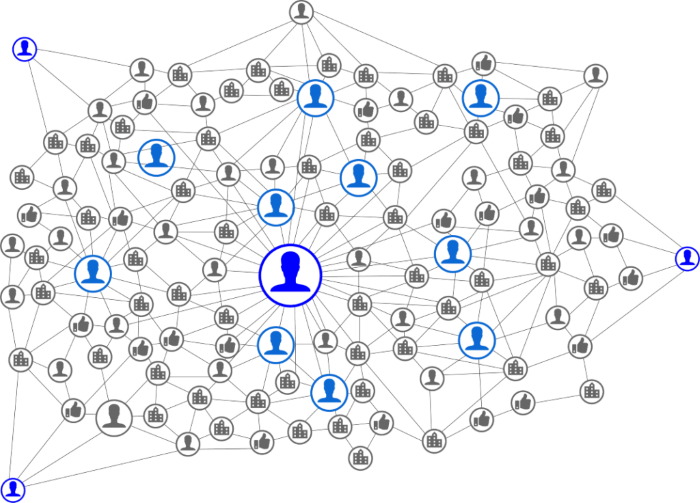

Neotas’ ESG screening identifies and monitors the ‘networks’ of your customers/suppliers.

Quickly uncover the depth of a company’s operations, including management, governance, suppliers, customers, stakeholders, employees and environmental concerns.

For companies, partnering with Neotas elevates their ESG profile. By proactively addressing risks and implementing robust policies, companies can attract responsible investors and safeguard against potential losses.

We help you build a clear and concise company risk profile.

Rapidly interrogate the largest traditional databases in the world, as well as 100% of public online data including 600bn+ archived web pages.

We understand that decisions are critical and you want insights faster. Our advanced technology enables us to interrogate billions of data points four times faster than traditional processes.

We deliver clear, concise, accurate findings that focus on relevant red flags only, all with zero false positives.

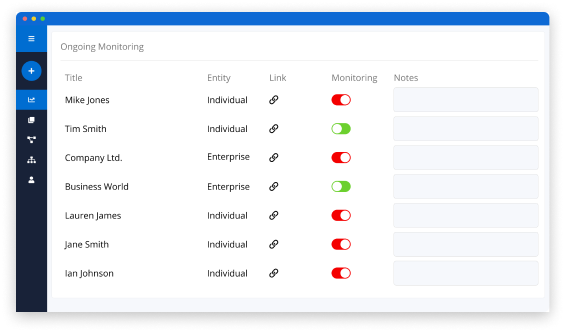

ESG reporting and benchmarking tends to represent a point in time, but this out-of-date information cannot predict an impending ESG risk or disaster.

Identify supplier ESG risk using real-time online data and monitor the risks that are most important to you.

Our ESG due diligence service instills confidence in investors, knowing that their investments align with sustainable and ethical practices. This assurance leads to stronger, more resilient portfolios.

Neotas ESG Due Diligence service is a vital tool for investors and companies committed to sustainable and ethical business practices. By integrating ESG considerations into our comprehensive due diligence process, we provide valuable insights and transparency, allowing you to make informed decisions and secure a brighter, more responsible future.

Improve analyst efficiencies, including cost and time reduction of minimum 25% with zero false positives.

The FCA recommends open source Internet checks as best practice (FG 18/5). Manage and reduce risk by incorporating 100% of online sources into your processes.

Manage risk with hyper accurate ongoing monitoring. We will monitor 100% of publicly available online data to help identify relevant risks.

Our clients can choose to use our advanced technology to interrogate vast data sources using their own methodologies. Our team of in-house expert analysts can also produce reports for you.

ESG, or Environmental, Social, and Governance, refers to a set of criteria used to evaluate a company’s ethical and sustainable practices in areas like environmental impact, social responsibility, and corporate governance.

We provide an external lens that does not rely on ‘self-reporting’. We can proactively monitor, in almost real-time all the key ESG risk factors. Beyond regulatory compliance, we can help predict future ESG risks and save losses (both monetary and reputational).

Yes. As ESG data is generally time-lagged, open-source intelligence techniques built into our Platform (ESG ‘trackers’) can generate almost real-time information. This will give you a clear picture of the ESG risks now and help to predict any potential issues. See more from Coller Capital on the use of OSINT for ESG due diligence.

As early as possible in the due diligence process. Whilst we can quickly highlight any ‘red-flag’ issues, these may take time to rectify. These ‘red flags’ may delay a transaction, but we view this as preferable to later, writing down the valuation!

ESG compliance enhances a company’s valuation as well as reduces business and reputational risks. It also attracts quality investors and ensures compliance. Fixing ESG issues later can be very costly and can damage shareholder value.

Companies with high ESG ratings typically exhibit a lower cost of capital, less volatile earnings, and lower market risk than companies with low ESG ratings. However, the lack of standardisation between ESG benchmarks as well as an incentive to provide AAA ratings might raise concerns as to the rigour of these checks – Neotas can help to ensure that your supply chain is as sustainable and as compliant as you claim.

We will look at all aspects of a ‘digital footprint’ to uncover risk, whether that be financial crime, fraud, modern slavery, exploitation of works, unsafe workplace practices, environmental concerns. We have often uncovered risks where the client least expected it.

ESG is relevant to supply chain management because it helps assess the environmental and social impacts of a company’s supply chain operations, ensuring responsible sourcing and production practices.

An ESG policy outlines a company’s commitment to addressing environmental, social, and governance issues. It includes specific goals, strategies, and initiatives to uphold responsible practices.

Non-compliance with ESG regulations could lead to legal liabilities and fines for the buyer, while they may also inherit reputational damage. For private equity and investment firms looking to acquire a business, conducting ESG due diligence will help to prevent uncovering damaging information further down the line.

Yes, our investigations are global. We process over 200 languages and we are not limited by international jurisdictions. We select only the relevant ESG factors tailored to your circumstances and offer a complete service.

We are able to provide ESG due diligence either as a standalone service, or as an integrated part of our wider enhanced due diligence services. Our team will develop a solution that fits your business needs and budget.

Our reports provide clearly flagged risks using a traffic light system (red/amber/green) with detailed evidence, a network association visual map, an audit trail and a list of all the sources used. We also look to enhance our reports by providing context to all the risks flagged.

ESG investing involves considering a company’s environmental, social, and governance performance alongside financial factors when making investment decisions. It aligns investments with ethical and sustainable practices.

ESG reporting involves disclosing a company’s performance in environmental, social, and governance areas. It provides stakeholders with transparency regarding the company’s sustainability efforts.

ESG is important because it assesses a company’s sustainability, ethical practices, and long-term viability. It enables investors to make informed decisions and encourages companies to adopt responsible business practices.

ESG sustainability refers to a company’s ability to operate in an environmentally responsible, socially conscious, and ethically sound manner, ensuring long-term viability.

ESG risk refers to the potential negative impacts on a company’s performance due to environmental, social, and governance factors.

An ESG score is a numerical rating that assesses a company’s performance in environmental, social, and governance areas. It helps investors gauge a company’s sustainability efforts.

Try Neotas Due Diligence Platform Today! All ESG due diligence information at your fingertips, without the hassle! Our advanced technology delivers new insights while managing all risk data in a single centralised hub.

esg

esg meaning

what is esg

esg investing

esg reporting

what does esg stand for

esg score

pristine esge

esg funds

esg strategy

cfa esg

esg definition

esg investment

esg policy

esg rating

esg band

esg jobs

esg meaning in business

what is esg investing

esg consulting

esg data

esg etf

esg news

esg ratings

esg report

esg scores

esg stands for

esg sustainability

cfa esg certificate

definition of esg

esg books

esg clarity

esg framework

esg today

msci esg

what does esg mean

blackrock esg

esg analyst

esg define

esg finance

esg fund

esg global

esg goals

esg investments

esg risk

esg uk

helix esg share price

iss esg

msci esg manager

msci esg ratings

ufo esg hip hop sample

band esg

define esg

esg book

esg companies

esg courses

esg full form

esg glass

esg index

esg investors

esg manager

esg metrics

esg scoring

esg the band

iot esg

esg certification

esg cfa

esg compliance

esg consultant

esg governance

esg group

esg jobs london

esg regulation

esg regulations

esg reporting requirements uk

esg reports

esg software

esg standards

esg training

fca esg

msci esg rating

pwc esg

what is esg stand for

best esg funds

esg acronym

esg agenda

esg factors

esg icon

esg investing meaning

esg investor

esg risks

esg score meaning

esg security

esg stocks

esg strategies

esg.

esge

kpmg esg

rio esg

sustainability esg

vanguard esg

what does esg stand for in business

what is esg reporting

cfa esg investing

esg and sustainability

esg asset management

esg bonds

esg company

esg credentials

esg criteria

esg environmental

esg fitness

esg frameworks

esg initiatives

esg integration

esg issues

esg logo

esg performance

esg policies

esg principles

esg recruitment

esg reporting standards

esg risk management

esg strategy meaning

esg targets

esg 是什么

legal and general future world esg

richemont esg

whats esg

why is esg important

barclays esg

bloomberg esg

cen-esg

certificate in esg investing

cfa certificate in esg investing

deloitte esg

double materiality esg

esg advisory

esg consulting firms

esg course

esg dance

esg data providers

esg developed world all cap equity index fund – accumulation

esg disclosure

esg due diligence

esg environmental social governance

esg etfs

esg funding

esg group ltd

esg insurance

esg internship

esg invest

esg investment funds

esg law

esg management

esg private equity

esg qualifications

esg rating agencies

esg real estate

esg social

what is esg

what does esg stand for

what is esg investing

what does esg mean

what is esg stand for

what does esg stand for in business

what is esg reporting

why is esg important

what is an esg

what is esg sustainability

what are esg funds

what is esg and examples

what esg stands for

what is esg and why is it important

what is esg risk

why is esg important for business

how to become esg consultant

what is an esg score

what is esg data

what is esg in business

what is esg score

what are esg practices

what is an esg fund

what is an esg report

what is an esg strategy

what is esg investment

what is governance in esg

what is msci esg

why esg is important

why is esg so relevant to supply chain management

is esg an equity factor or just an investment guide

what are esg risks

what is an esg policy

what is esg reporting uk

what is esg strategy

when did esg reporting start

does vanguard have esg funds

how to calculate esg score

how to measure esg

is cfa esg worth it

The Neotas Platform covers 600Bn+ archived web pages, 1.8Bn+ court records, 198M+ corporate records, global social media platforms, and 40,000+ media sources from over 100 countries to help you build a comprehensive risk assessment of individuals, entities, and their networks.

Neotas Platform covers 600Bn+ archived web pages, 1.8Bn+ court records, 198M+ corporate records, global social media platforms, and 40,000+ Media sources from over 100 countries to help you build a comprehensive picture of the team.

| Cookie | Duration | Description |

|---|---|---|

| AWSALBTG | 7 days | AWS Application Load Balancer Cookie. Load Balancing Cookie: Used to encode information about the selected target group. |

| AWSALBTGCORS | 7 days | AWS Classic Load Balancer Cookie: Used to map the session to the instance. This cookie is identical to the original ELB cookie except for the attribute &SameSite=None; |

| cookielawinfo-checkbox-advertisement | 1 year | Set by the GDPR Cookie Consent plugin, this cookie is used to record the user consent for the cookies in the "Advertisement" category . |

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| CookieLawInfoConsent | 1 year | Records the default button state of the corresponding category & the status of CCPA. It works only in coordination with the primary cookie. |

| debug | never | Cookie used to debug code and website issues |

| shown | session | Session cookie to control number of times a pop up is shown. |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| __cf_bm | 30 minutes | This cookie, set by Cloudflare, is used to support Cloudflare Bot Management. |

| AnalyticsSyncHistory | 1 month | Used to store information about the time a sync took place with the lms_analytics cookie |

| bcookie | 2 years | LinkedIn sets this cookie from LinkedIn share buttons and ad tags to recognize browser ID. |

| bscookie | 2 years | LinkedIn sets this cookie to store performed actions on the website. |

| lang | session | LinkedIn sets this cookie to remember a user's language setting. |

| lidc | 1 day | LinkedIn sets the lidc cookie to facilitate data center selection. |

| UserMatchHistory | 1 month | LinkedIn sets this cookie for LinkedIn Ads ID syncing. |

| Cookie | Duration | Description |

|---|---|---|

| li_gc | 2 years | Used to store consent of guests regarding the use of cookies for non-essential purposes |

| rl_anonymous_id | 1 year | Generates an unique anonymous Id to identify a user and attach to a subsequent event. |

| rl_user_id | 1 year | to store a unique user ID for the purpose of Marketing/Tracking |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | The _ga cookie, installed by Google Analytics, calculates visitor, session and campaign data and also keeps track of site usage for the site's analytics report. The cookie stores information anonymously and assigns a randomly generated number to recognize unique visitors. |

| _gat_gtag_UA_107495977_1 | 1 minute | Set by Google to distinguish users. |

| _gat_UA-107495977-1 | 1 minute | A variation of the _gat cookie set by Google Analytics and Google Tag Manager to allow website owners to track visitor behaviour and measure site performance. The pattern element in the name contains the unique identity number of the account or website it relates to. |

| _gcl_au | 3 months | Provided by Google Tag Manager to experiment advertisement efficiency of websites using their services. |

| _gid | 1 day | Installed by Google Analytics, _gid cookie stores information on how visitors use a website, while also creating an analytics report of the website's performance. Some of the data that are collected include the number of visitors, their source, and the pages they visit anonymously. |

| attribution_user_id | 1 year | This cookie is set by Typeform for usage statistics and is used in context with the website's pop-up questionnaires and messengering. |

| CONSENT | 2 years | YouTube sets this cookie via embedded youtube-videos and registers anonymous statistical data. |

| Cookie | Duration | Description |

|---|---|---|

| _fbp | 3 months | This cookie is set by Facebook to display advertisements when either on Facebook or on a digital platform powered by Facebook advertising, after visiting the website. |

| fr | 3 months | Facebook sets this cookie to show relevant advertisements to users by tracking user behaviour across the web, on sites that have Facebook pixel or Facebook social plugin. |

| IDE | 1 year 24 days | Google DoubleClick IDE cookies are used to store information about how the user uses the website to present them with relevant ads and according to the user profile. |

| test_cookie | 15 minutes | The test_cookie is set by doubleclick.net and is used to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | A cookie set by YouTube to measure bandwidth that determines whether the user gets the new or old player interface. |

| YSC | session | YSC cookie is set by Youtube and is used to track the views of embedded videos on Youtube pages. |

| yt-remote-connected-devices | never | YouTube sets this cookie to store the video preferences of the user using embedded YouTube video. |

| yt-remote-device-id | never | YouTube sets this cookie to store the video preferences of the user using embedded YouTube video. |

| yt.innertube::nextId | never | This cookie, set by YouTube, registers a unique ID to store data on what videos from YouTube the user has seen. |

| yt.innertube::requests | never | This cookie, set by YouTube, registers a unique ID to store data on what videos from YouTube the user has seen. |