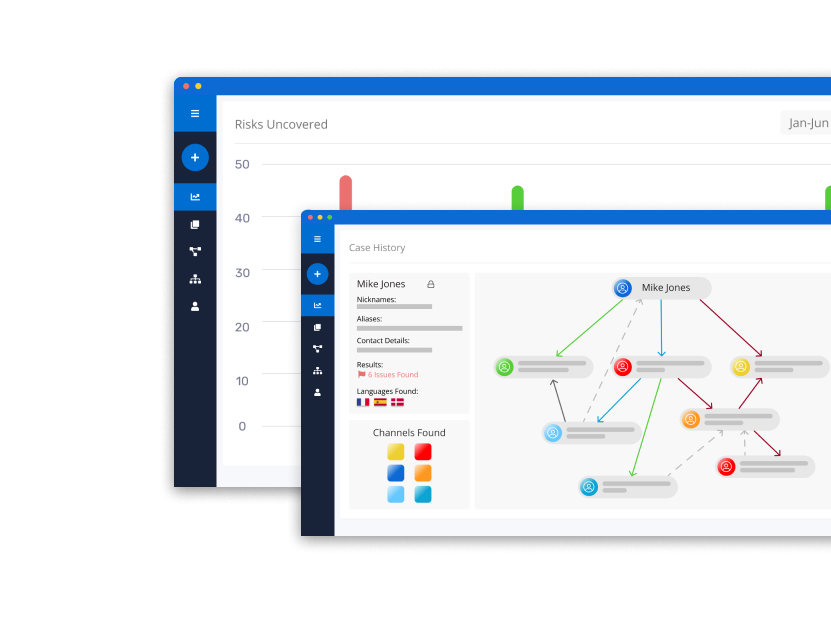

At Neotas, we are dedicated to promoting financial security and preserving the integrity of the financial sector with our Financial Intelligence Unit (FIU). We help you Locate hidden risks and connections in ‘networks’ and Run investigations with our proven search techniques.

Our primary objective is to combat money laundering, terrorism financing, and other financial crimes, making the world a safer place for businesses, individuals, and nations.

By harnessing cutting-edge technologies and sophisticated analysis techniques, we identify patterns indicative of money laundering, fraud, and other financial offenses. By intervening early, we halt the flow of funds through illicit channels, impeding criminal activities in their tracks.

The FIU collaborates closely with law enforcement and financial regulatory authorities, providing them with actionable intelligence to aid their investigations. Together, we build a formidable front against financial criminals and ensure they face the full force of the law.

Transparency is the cornerstone of a resilient financial system. We work closely with financial institutions and other stakeholders to develop and implement measures that foster transparency and deter illicit financial activities.

We foster close ties with international counterparts and participate actively in global efforts to combat financial crimes. By sharing knowledge and insights, we strengthen the collective fight against financial threats on a global scale.

Our Financial Intelligence Unit (FIU) harnesses the latest technological innovations to perform sophisticated data analysis. By employing state-of-the-art tools and AI-driven algorithms, we swiftly detect intricate patterns of financial crimes, ensuring proactive protection for our clients.

With an unwavering commitment to international collaboration, our FIU establishes strong partnerships with global financial intelligence units. This interconnected network facilitates real-time information exchange and fosters a united front against the ever-evolving landscape of financial threats.

At our core, we boast a highly skilled team of financial crime specialists, investigators, and analysts. Their deep domain expertise allows them to stay ahead of emerging trends and craft effective strategies to combat even the most complex financial crimes.

Beyond safeguarding financial systems, our FIU endeavors to raise awareness and promote financial literacy among individuals and organizations. By empowering the community with knowledge and encouraging vigilance, we create a proactive defense against potential financial threats.

At the Neotas Financial Intelligence Unit, we are driven by the belief that financial crimes can be defeated with knowledge, collaboration, and unwavering determination. Let us forge ahead together, empowering financial security for all.

Improve analyst efficiencies, including cost and time reduction of minimum 25% with zero false positives.

The FCA recommends open source Internet checks as best practice (FG 18/5). Manage and reduce risk by incorporating 100% of online sources into your processes.

Manage risk with hyper accurate ongoing monitoring. We will monitor 100% of publicly available online data to help identify relevant risks.

Our clients can choose to use our advanced technology to interrogate vast data sources using their own methodologies. Our team of in-house expert analysts can also produce reports for you.

Financial forensic investigation, often referred to as forensic accounting or financial forensics, involves the examination, analysis, and interpretation of financial records and transactions to uncover evidence of financial fraud, embezzlement, money laundering, or other financial misconduct. This field combines accounting, auditing, investigative skills, and legal knowledge to identify discrepancies, irregularities, and potential instances of financial wrongdoing.

Fraud Detection and Prevention: Financial forensic investigators are skilled at identifying signs of fraud within financial records and statements. They use various techniques to uncover fraudulent activities, such as analyzing transaction patterns, examining documents for inconsistencies, and tracing the flow of funds.

Evidence Collection and Preservation: Just like in other forensic disciplines, maintaining the integrity of evidence is paramount. Financial forensic experts gather and document financial records, invoices, receipts, emails, and other relevant documents while adhering to proper chain of custody procedures.

Tracing Assets: Financial forensic investigators often work to trace assets to determine their origin, flow, and destination. This can be crucial in cases involving money laundering or complex financial schemes.

Quantification of Losses: In cases of financial fraud, investigators calculate the monetary losses suffered by victims. This might involve estimating the value of assets misappropriated, overbilling, or other fraudulent activities.

Expert Testimony: Financial forensic experts may provide expert witness testimony in court. They can explain their findings, analyses, and conclusions to judges and juries in a clear and understandable manner, helping the court understand the financial aspects of a case.

Corporate Investigations: Financial forensic investigators also assist in corporate investigations related to allegations of mismanagement, insider trading, breach of fiduciary duty, and other financial misconduct within companies.

Bankruptcy and Insolvency: Financial forensic experts can be involved in bankruptcy and insolvency cases, where they analyze financial records to determine the financial health of a company and uncover any fraudulent activities that might have contributed to the bankruptcy.

Regulatory Compliance: These experts also assist organizations in ensuring compliance with financial regulations and preventing fraudulent activities by identifying potential vulnerabilities in financial systems and controls.

Digital Forensics in Financial Investigations: With the increasing use of digital financial transactions and records, digital forensics plays a significant role in financial investigations. Investigators analyze electronic records, digital communications, and financial transactions to uncover evidence.

International Cases: Financial forensic investigations can have an international scope, especially in cases involving cross-border financial transactions, money laundering, and transnational financial crimes.

Financial forensic investigators often work closely with law enforcement agencies, legal professionals, and regulatory authorities. They apply their expertise to uncover hidden financial activities, provide valuable insights into complex financial transactions, and contribute to resolving legal disputes and criminal cases involving financial wrongdoing.

Financial forensic investigation can uncover various types of financial fraud, including:

Forensic investigation focuses on uncovering evidence of financial misconduct, fraud, and irregularities in response to suspicions or allegations. It involves in-depth analysis, interviews, and evidence collection, often for legal purposes.

Financial audits, on the other hand, aim to provide an independent assessment of financial statements’ accuracy and compliance with accounting standards. Conducted regularly, audits follow standardized procedures to assure stakeholders of financial information reliability.

While both involve financial scrutiny, forensic investigation addresses specific incidents of misconduct, while financial audits assess broader financial reporting accuracy for stakeholders’ confidence.

Read our detailed blog on “Difference between forensic investigation and financial audit“

Learn more about Forensic accounting

Financial forensic investigations are needed across various industries, including:

The UK Financial Intelligence Unit (FIU) is a specialized division within the National Crime Agency (NCA) responsible for receiving, analyzing, and disseminating financial intelligence to combat money laundering, terrorist financing, and other financial crimes in the United Kingdom. Learn more.

The UK FIU serves as a central repository for receiving Suspicious Activity Reports (SARs) from reporting entities, analyzing financial data, and providing intelligence support to law enforcement agencies in their investigations related to financial crimes.

Certain entities, including banks, financial institutions, lawyers, accountants, estate agents, and other designated non-financial businesses and professions (DNFBPs), are legally obligated to submit SARs to the UK FIU when they suspect financial transactions may be linked to criminal activities.

financial intelligence unit

financial intelligence units

bangladesh financial intelligence unit

bank financial intelligence unit

canada financial intelligence unit

egmont group of financial intelligence units

estonian financial intelligence unit

financial crime intelligence unit

financial intelligence analysis unit

financial intelligence unit estonia

financial intelligence unit germany

financial intelligence unit india

financial intelligence unit ireland

financial intelligence unit isle of man

financial intelligence unit jobs

financial intelligence unit luxembourg

financial intelligence unit mauritius

financial intelligence unit netherlands

financial intelligence unit seychelles

financial intelligence unit tanzania

financial intelligence unit uk

gibraltar financial intelligence unit

jersey financial intelligence unit

joint financial intelligence unit

kuwait financial intelligence unit

list of financial intelligence units

national financial intelligence unit

nigerian financial intelligence unit

tanzania financial intelligence unit

the financial intelligence unit

uae financial intelligence unit

uk financial intelligence unit

us financial intelligence unit

what is financial intelligence unit

estonian financial intelligence unit license

financial intelligence unit address

financial intelligence unit analyst salary

financial intelligence unit bahamas

financial intelligence unit careers

financial intelligence unit contact number

financial intelligence unit definition

financial intelligence unit france

financial intelligence unit guyana

financial intelligence unit headquarters

financial intelligence unit malaysia

financial intelligence unit of india

financial intelligence unit trinidad

financial intelligence unit uae

financial intelligence unit usa

financial intelligence unit zimbabwe

national financial intelligence unit primary roles

nigerian financial intelligence unit salary

police financial intelligence unit

primary roles of financial intelligence unit

primary roles of national financial intelligence unit

primary roles of the national financial intelligence unit

role of financial intelligence unit

seychelles financial intelligence unit

the egmont group of financial intelligence units

what is the role of a financial intelligence unit

Try Neotas Due Diligence Platform Today! With an unwavering commitment to fostering transparency, detecting suspicious transactions, and curbing money laundering and terrorist financing, the Neotas FIU plays a pivotal role in fortifying the integrity of your organisation’s financial health.

The Neotas Platform covers 600Bn+ archived web pages, 1.8Bn+ court records, 198M+ corporate records, global social media platforms, and 40,000+ media sources from over 100 countries to help you build a comprehensive risk assessment of individuals, entities, and their networks.

Neotas Platform covers 600Bn+ archived web pages, 1.8Bn+ court records, 198M+ corporate records, global social media platforms, and 40,000+ Media sources from over 100 countries to help you build a comprehensive picture of the team.

| Cookie | Duration | Description |

|---|---|---|

| AWSALBTG | 7 days | AWS Application Load Balancer Cookie. Load Balancing Cookie: Used to encode information about the selected target group. |

| AWSALBTGCORS | 7 days | AWS Classic Load Balancer Cookie: Used to map the session to the instance. This cookie is identical to the original ELB cookie except for the attribute &SameSite=None; |

| cookielawinfo-checkbox-advertisement | 1 year | Set by the GDPR Cookie Consent plugin, this cookie is used to record the user consent for the cookies in the "Advertisement" category . |

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| CookieLawInfoConsent | 1 year | Records the default button state of the corresponding category & the status of CCPA. It works only in coordination with the primary cookie. |

| debug | never | Cookie used to debug code and website issues |

| shown | session | Session cookie to control number of times a pop up is shown. |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| __cf_bm | 30 minutes | This cookie, set by Cloudflare, is used to support Cloudflare Bot Management. |

| AnalyticsSyncHistory | 1 month | Used to store information about the time a sync took place with the lms_analytics cookie |

| bcookie | 2 years | LinkedIn sets this cookie from LinkedIn share buttons and ad tags to recognize browser ID. |

| bscookie | 2 years | LinkedIn sets this cookie to store performed actions on the website. |

| lang | session | LinkedIn sets this cookie to remember a user's language setting. |

| lidc | 1 day | LinkedIn sets the lidc cookie to facilitate data center selection. |

| UserMatchHistory | 1 month | LinkedIn sets this cookie for LinkedIn Ads ID syncing. |

| Cookie | Duration | Description |

|---|---|---|

| li_gc | 2 years | Used to store consent of guests regarding the use of cookies for non-essential purposes |

| rl_anonymous_id | 1 year | Generates an unique anonymous Id to identify a user and attach to a subsequent event. |

| rl_user_id | 1 year | to store a unique user ID for the purpose of Marketing/Tracking |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | The _ga cookie, installed by Google Analytics, calculates visitor, session and campaign data and also keeps track of site usage for the site's analytics report. The cookie stores information anonymously and assigns a randomly generated number to recognize unique visitors. |

| _gat_gtag_UA_107495977_1 | 1 minute | Set by Google to distinguish users. |

| _gat_UA-107495977-1 | 1 minute | A variation of the _gat cookie set by Google Analytics and Google Tag Manager to allow website owners to track visitor behaviour and measure site performance. The pattern element in the name contains the unique identity number of the account or website it relates to. |

| _gcl_au | 3 months | Provided by Google Tag Manager to experiment advertisement efficiency of websites using their services. |

| _gid | 1 day | Installed by Google Analytics, _gid cookie stores information on how visitors use a website, while also creating an analytics report of the website's performance. Some of the data that are collected include the number of visitors, their source, and the pages they visit anonymously. |

| attribution_user_id | 1 year | This cookie is set by Typeform for usage statistics and is used in context with the website's pop-up questionnaires and messengering. |

| CONSENT | 2 years | YouTube sets this cookie via embedded youtube-videos and registers anonymous statistical data. |

| Cookie | Duration | Description |

|---|---|---|

| _fbp | 3 months | This cookie is set by Facebook to display advertisements when either on Facebook or on a digital platform powered by Facebook advertising, after visiting the website. |

| fr | 3 months | Facebook sets this cookie to show relevant advertisements to users by tracking user behaviour across the web, on sites that have Facebook pixel or Facebook social plugin. |

| IDE | 1 year 24 days | Google DoubleClick IDE cookies are used to store information about how the user uses the website to present them with relevant ads and according to the user profile. |

| test_cookie | 15 minutes | The test_cookie is set by doubleclick.net and is used to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | A cookie set by YouTube to measure bandwidth that determines whether the user gets the new or old player interface. |

| YSC | session | YSC cookie is set by Youtube and is used to track the views of embedded videos on Youtube pages. |

| yt-remote-connected-devices | never | YouTube sets this cookie to store the video preferences of the user using embedded YouTube video. |

| yt-remote-device-id | never | YouTube sets this cookie to store the video preferences of the user using embedded YouTube video. |

| yt.innertube::nextId | never | This cookie, set by YouTube, registers a unique ID to store data on what videos from YouTube the user has seen. |

| yt.innertube::requests | never | This cookie, set by YouTube, registers a unique ID to store data on what videos from YouTube the user has seen. |