Reduce management risk and supercharge your Management Due Diligence processes. Analyse reputational risk associated with management teams.

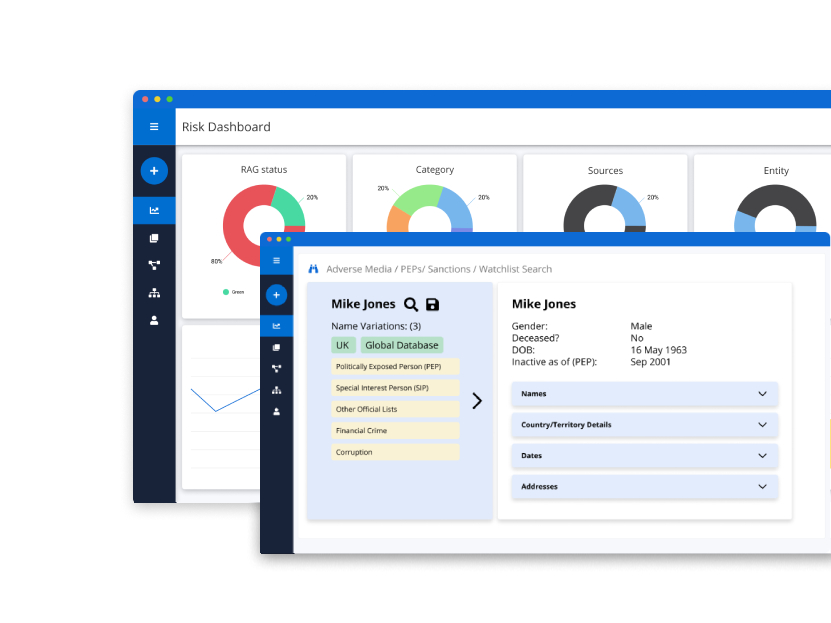

Smarter decision-making by automating data filtering and analysis from internal and external sources to highlight vital information.

Discover links and network mapping using interactive charts, detailed data view and reporting efficiency. Deep-dive into the data to derive valuable insights.

Work faster and eliminate errors by accessing all data sources from Neotas Enhanced Due Diligence platform in a single dashboard.

Maintain privacy and anonymity while conducting due diligence. Complete control on your investigations and data utilization.

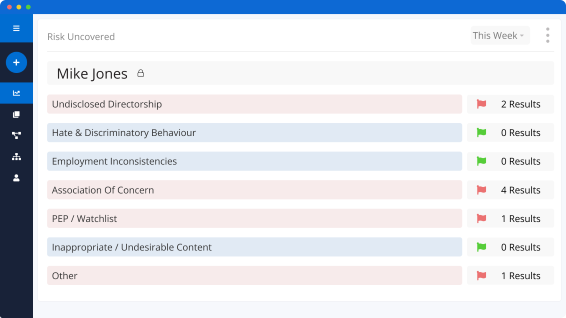

Adding behavioural and non-financial risk categories is vital to completing proper evaluation as part of management due diligence.

We help you build a clear individual risk profile, rapidly interrogating the largest traditional databases in the world, as well as 100% of public online data.

Our advanced technology enables us to interrogate billions of data points four times faster than traditional processes.

We deliver concise, accurate findings that focus on relevant red flags only, helping you gain a complete picture of those you are dealing with.

Behavioural and non-financial risk data is now proven to enable better investment decision making.

We dig deeper and faster into people, entities and networks, interrogating and analysing over 600bn data sources.

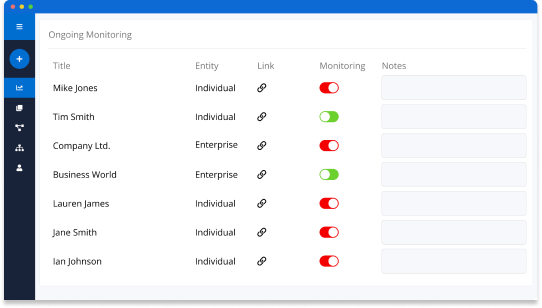

Investment risk exposure is multifaceted and needs to be monitored consistently.

Our Ongoing Risk Monitoring helps reduce exposure, providing ‘peace of mind’ for investment managers.

Neotas is trusted by leading organizations across various sectors and geographies. We have a global network of experts and analysts who can deliver timely and accurate intelligence in any jurisdiction. We adhere to the highest standards of quality, ethics and confidentiality.

Improve analyst efficiencies, including cost and time reduction of minimum 25% with zero false positives.

The FCA recommends open source Internet checks as best practice (FG 18/5). Manage and reduce risk by incorporating 100% of online sources into your processes.

Manage risk with hyper accurate ongoing monitoring. We will monitor 100% of publicly available online data to help identify relevant risks.

Our clients can choose to use our advanced technology to interrogate vast data sources using their own methodologies. Our team of in-house expert analysts can also produce reports for you.

Management Due Diligence is a thorough assessment of senior leadership’s effectiveness in achieving strategic goals. It matters because it provides valuable insights into leadership capabilities, guiding informed decision-making, and ensuring the success of critical business endeavors.

Read more on Role of Management Due Diligence

Management assessment primarily involves appraising the leadership skills and qualities of the organization’s managers, like their adaptability to change and effective communication abilities. These traits are crucial for successful leaders.

Leaders must factor in all aspects of strategic choices, including potential impacts on employees and customers. Engaging them in decision-making fosters stronger relationships, benefiting both parties.

Read more on Role of Management Due Diligence

Management Due Diligence (MDD) ensures informed decision-making during critical business transactions, such as mergers and acquisitions. It mitigates risks, enhances leadership performance, and supports long-term growth.

Management Due Diligence is a dynamic process that holds the key to unlocking an organization’s potential for success. It goes beyond financial metrics and operational benchmarks, delving into the heart of leadership effectiveness. Through meticulous assessment and analysis, MDD equips organizations with the insights needed to make strategic decisions, mitigate risks, and cultivate a leadership team that drives growth.

Management Due Diligence (MDD) ensures informed decision-making during critical business transactions, such as mergers and acquisitions. It mitigates risks, enhances leadership performance, and supports long-term growth.

No, MDD is valuable for organizations of all sizes, as effective leadership is crucial for growth and success.

In M&A scenarios, effective integration of leadership teams is pivotal. Neotas’ Management Due Diligence is vital as it aids in identifying potential cultural misalignments, minimizing risks associated with management transitions, and promoting a harmonious post-deal integration process.

Neotas offers advanced technology-driven solutions for data analysis, risk assessment, and behavioral insights, enhancing the accuracy and efficiency of Management Due Diligence processes.

Management Due Diligence finds application in various business scenarios:

Yes, MDD can be tailored to address industry-specific leadership qualities, skills, and challenges.

Conducting Management Due Diligence offers several benefits, including:

Informed Decision-Making: MDD provides valuable insights into the effectiveness of senior management, enabling well-informed decisions during critical business transactions.

Risk Mitigation: By identifying potential weaknesses or challenges within the management team, MDD allows for proactive risk management and strategic planning.

Strategic Alignment: MDD ensures that management goals and actions are aligned with the organization’s overall strategic objectives, leading to focused efforts.

Cultural Integration: Assessing the management team’s alignment with company culture enhances post-merger or acquisition integration, reducing conflicts.

Performance Enhancement: Effective leadership positively influences employee engagement, morale, and overall organizational performance.

Talent Optimization: MDD aids in placing skilled individuals in appropriate roles, enhancing team performance and maximizing returns on human capital investment.

Effective Communication: Management transparency and involvement in decision-making foster open communication, strengthening employee and customer relationships.

Confident Investments: Investors gain confidence in the organization’s leadership team, leading to better investment decisions and improved financial outcomes.

Long-Term Success: MDD contributes to sustained growth by identifying areas for improvement and aligning leadership capabilities with future business needs.

Read more on Role of Management Due Diligence

Methods include behavioral interviews, 360-degree feedback, psychometric testing, technical skill assessment, and alignment with strategic goals.

No, Management Due Diligence should be an ongoing process to monitor leadership effectiveness, adapt to changing circumstances, and drive continuous improvement.

Yes, Management Due Diligence helps uncover potential risks and vulnerabilities within management teams, allowing proactive risk management strategies.

By assessing leadership styles and interpersonal skills, MDD offers insights into managers’ abilities to effectively handle conflicts. Effective leadership assessed through MDD positively influences employee engagement, morale, and overall team performance.

Management Due Diligence by Neotas is a proactive risk management strategy. By identifying potential weaknesses within senior management, it enables organizations to mitigate risks, make informed decisions, and establish contingency plans to address any challenges that may arise.

Neotas employs a comprehensive approach by evaluating various aspects of leadership, including adaptability, communication, decision-making, and alignment with strategic objectives. This multifaceted assessment ensures a holistic understanding of senior management’s impact on an organization’s success.

Try Neotas Due Diligence Platform Today! All due diligence information at your fingertips, without the hassle! Our advanced technology delivers new insights while managing all risk data in a single centralised hub.

The Neotas Platform covers 600Bn+ archived web pages, 1.8Bn+ court records, 198M+ corporate records, global social media platforms, and 40,000+ media sources from over 100 countries to help you build a comprehensive risk assessment of individuals, entities, and their networks.

Neotas Platform covers 600Bn+ archived web pages, 1.8Bn+ court records, 198M+ corporate records, global social media platforms, and 40,000+ Media sources from over 100 countries to help you build a comprehensive picture of the team.

| Cookie | Duration | Description |

|---|---|---|

| AWSALBTG | 7 days | AWS Application Load Balancer Cookie. Load Balancing Cookie: Used to encode information about the selected target group. |

| AWSALBTGCORS | 7 days | AWS Classic Load Balancer Cookie: Used to map the session to the instance. This cookie is identical to the original ELB cookie except for the attribute &SameSite=None; |

| cookielawinfo-checkbox-advertisement | 1 year | Set by the GDPR Cookie Consent plugin, this cookie is used to record the user consent for the cookies in the "Advertisement" category . |

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| CookieLawInfoConsent | 1 year | Records the default button state of the corresponding category & the status of CCPA. It works only in coordination with the primary cookie. |

| debug | never | Cookie used to debug code and website issues |

| shown | session | Session cookie to control number of times a pop up is shown. |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| __cf_bm | 30 minutes | This cookie, set by Cloudflare, is used to support Cloudflare Bot Management. |

| AnalyticsSyncHistory | 1 month | Used to store information about the time a sync took place with the lms_analytics cookie |

| bcookie | 2 years | LinkedIn sets this cookie from LinkedIn share buttons and ad tags to recognize browser ID. |

| bscookie | 2 years | LinkedIn sets this cookie to store performed actions on the website. |

| lang | session | LinkedIn sets this cookie to remember a user's language setting. |

| lidc | 1 day | LinkedIn sets the lidc cookie to facilitate data center selection. |

| UserMatchHistory | 1 month | LinkedIn sets this cookie for LinkedIn Ads ID syncing. |

| Cookie | Duration | Description |

|---|---|---|

| li_gc | 2 years | Used to store consent of guests regarding the use of cookies for non-essential purposes |

| rl_anonymous_id | 1 year | Generates an unique anonymous Id to identify a user and attach to a subsequent event. |

| rl_user_id | 1 year | to store a unique user ID for the purpose of Marketing/Tracking |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | The _ga cookie, installed by Google Analytics, calculates visitor, session and campaign data and also keeps track of site usage for the site's analytics report. The cookie stores information anonymously and assigns a randomly generated number to recognize unique visitors. |

| _gat_gtag_UA_107495977_1 | 1 minute | Set by Google to distinguish users. |

| _gat_UA-107495977-1 | 1 minute | A variation of the _gat cookie set by Google Analytics and Google Tag Manager to allow website owners to track visitor behaviour and measure site performance. The pattern element in the name contains the unique identity number of the account or website it relates to. |

| _gcl_au | 3 months | Provided by Google Tag Manager to experiment advertisement efficiency of websites using their services. |

| _gid | 1 day | Installed by Google Analytics, _gid cookie stores information on how visitors use a website, while also creating an analytics report of the website's performance. Some of the data that are collected include the number of visitors, their source, and the pages they visit anonymously. |

| attribution_user_id | 1 year | This cookie is set by Typeform for usage statistics and is used in context with the website's pop-up questionnaires and messengering. |

| CONSENT | 2 years | YouTube sets this cookie via embedded youtube-videos and registers anonymous statistical data. |

| Cookie | Duration | Description |

|---|---|---|

| _fbp | 3 months | This cookie is set by Facebook to display advertisements when either on Facebook or on a digital platform powered by Facebook advertising, after visiting the website. |

| fr | 3 months | Facebook sets this cookie to show relevant advertisements to users by tracking user behaviour across the web, on sites that have Facebook pixel or Facebook social plugin. |

| IDE | 1 year 24 days | Google DoubleClick IDE cookies are used to store information about how the user uses the website to present them with relevant ads and according to the user profile. |

| test_cookie | 15 minutes | The test_cookie is set by doubleclick.net and is used to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | A cookie set by YouTube to measure bandwidth that determines whether the user gets the new or old player interface. |

| YSC | session | YSC cookie is set by Youtube and is used to track the views of embedded videos on Youtube pages. |

| yt-remote-connected-devices | never | YouTube sets this cookie to store the video preferences of the user using embedded YouTube video. |

| yt-remote-device-id | never | YouTube sets this cookie to store the video preferences of the user using embedded YouTube video. |

| yt.innertube::nextId | never | This cookie, set by YouTube, registers a unique ID to store data on what videos from YouTube the user has seen. |

| yt.innertube::requests | never | This cookie, set by YouTube, registers a unique ID to store data on what videos from YouTube the user has seen. |