Comprehensive Guide to Anti-Money Laundering (AML) & Combating the Financing of Terrorism (CFT) – Dive into AML compliance, KYC procedures, transaction monitoring, AML laws, regulations, and risk assessments. Discover actionable strategies for banking, finance, estate agents, and more to prevent money laundering

Key Takeaways from this article:

Money laundering is a global issue that threatens the integrity of financial systems and fuels criminal activities. Anti-Money Laundering (AML) encompasses the laws, regulations, and processes put in place to prevent criminals from disguising illegally obtained funds as legitimate income. The primary objective of AML frameworks is to detect, deter, and report activities related to money laundering, protecting the financial system from being exploited by illicit activities.

Anti-Money Laundering refers to a set of laws, regulations, and procedures aimed at preventing criminals from concealing illicit funds obtained from activities such as drug trafficking, tax evasion, fraud, terrorism, and other financial crimes.

AML policies focus on identifying and stopping the flow of “dirty money” by obligating financial institutions, businesses, and professionals to implement strict measures to track and report suspicious activities.

The essence of AML is to ensure that financial systems are not manipulated for illegal gains. At its core, AML relies on transaction monitoring, reporting suspicious transactions, and conducting due diligence on customers, all to detect anomalies that could indicate money laundering.

AML regulations have developed significantly over the past decades. The origins of modern AML frameworks can be traced back to the 1970s when the United States enacted the Bank Secrecy Act (BSA) in 1970. The BSA was among the first laws designed to combat money laundering, requiring financial institutions to report certain transactions that could be linked to illicit activities.

The landscape of AML regulation changed dramatically in the wake of the 9/11 attacks. The need to curb terrorist financing (CFT – Combating the Financing of Terrorism) led to stricter laws and an emphasis on international cooperation. This resulted in landmark developments like the USA PATRIOT Act and the tightening of global regulations.

The Financial Action Task Force (FATF), an intergovernmental organisation established in 1989, has played a pivotal role in shaping AML policies. FATF’s 40 Recommendations have become the global benchmark for AML compliance, influencing national and international standards. Over time, AML regulations have expanded to cover not just traditional financial institutions but also industries such as real estate, casinos, and virtual currencies.

Today, AML continues to evolve with the advent of new technologies, emerging financial products, and cross-border transactions, making it a constantly adapting field.

AML is vital to the stability and security of the global financial system. Without effective AML frameworks, criminals and terrorist organisations can exploit gaps in financial regulations to launder funds, finance illegal operations, and undermine the rule of law.

In the global economy, money laundering poses several risks:

AML is not only about preventing crime; it is about maintaining a transparent and stable global financial system.

To understand AML comprehensively, it is essential to grasp key definitions:

Understanding these definitions is crucial for grasping how AML functions and why it matters in the global context.

There are several ways money can be laundered, including but not limited to:

These types reflect the need for a multi-faceted approach to AML, where regulations, transaction monitoring, and enforcement mechanisms adapt to the evolving methods of laundering money.

Money laundering has wide-reaching implications on both the economy and society:

The fight against money laundering is essential for safeguarding the integrity of financial systems, maintaining economic stability, and reducing the social harm caused by criminal activities. AML frameworks must continuously adapt to new risks, technologies, and methods used by criminals to remain effective.

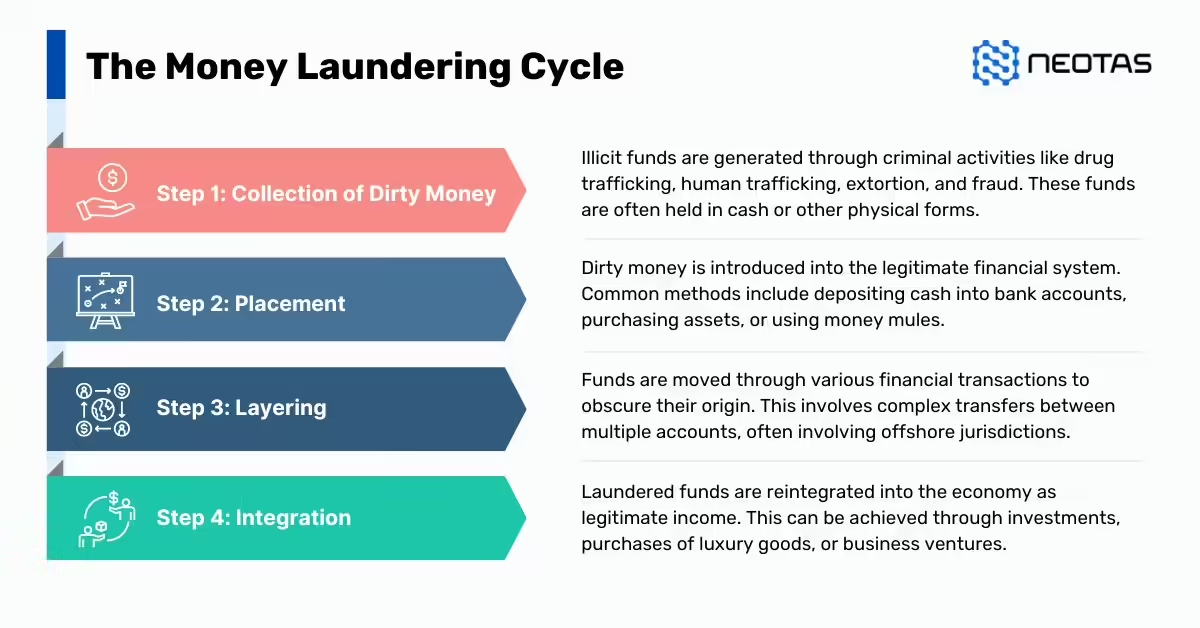

Money laundering is a criminal act where illicit funds are processed through various layers to make them appear legitimate. Understanding the stages and processes involved in money laundering is critical to implementing effective Anti-Money Laundering (AML) controls. The process of money laundering generally follows three main stages: Placement, Layering, and Integration.

Placement

The placement stage is the initial step where the illicit money is introduced into the financial system. At this stage, the money launderer attempts to distance themselves from the proceeds of crime by moving the funds from direct association with the illegal activity. Common methods include depositing large sums of cash into bank accounts, purchasing high-value assets such as real estate or luxury goods, or gambling at casinos.

Examples of Placement:

Risks: This stage is risky for criminals because financial institutions are often required to report suspicious or large cash deposits, making the placement of illegal funds potentially detectable.

Layering

The second stage is layering, which seeks to obscure the origins of the money by conducting complex transactions that make tracing the illegal funds difficult. In this stage, the launderer uses various techniques to create multiple financial transactions, moving the funds between accounts, institutions, or even countries. The aim is to confuse investigators by creating a complex trail that disconnects the money from its original source.

Examples of Layering:

Risks: Modern AML systems employ sophisticated technology and algorithms to detect unusual transaction patterns, making it harder to succeed in this phase without detection.

Integration

The final stage of money laundering is integration, where the illicit funds are fully absorbed into the legal economy and appear to come from legitimate sources. The launderer may use the cleaned money to invest in businesses, real estate, or other lawful ventures. Once the money is integrated into the economy, it becomes extremely difficult to distinguish it from legitimate earnings.

Examples of Integration:

Risks: Once the funds reach this stage, it is often too late to track their illegal origin without clear evidence from the earlier stages. Stronger integration controls are essential to detect illicit gains before reaching this phase.

Money laundering techniques are continually evolving, and criminals are becoming more sophisticated in their approach. Some common examples of money laundering include:

With technological advancements and the globalisation of financial markets, new trends in money laundering have emerged. These trends pose unique challenges for AML frameworks and regulatory bodies.

Cryptocurrencies, like Bitcoin and Ethereum, have gained popularity for their anonymity and decentralised nature, making them attractive to money launderers. Criminals use cryptocurrency exchanges, peer-to-peer transactions, and decentralised finance (DeFi) platforms to move and conceal funds. The rise of cryptocurrency mixing services and “privacy coins” further complicates the tracking of illicit money flows.

Trade-based money laundering exploits international trade systems by misrepresenting the value, quantity, or quality of goods. It is one of the more complex methods of money laundering, as it involves manipulating trade invoices and cross-border transactions to disguise illegal funds as legitimate revenue. TBML poses significant challenges for customs and financial institutions because it requires deep knowledge of trade operations.

The increasing use of virtual assets such as Non-Fungible Tokens (NFTs) and the broader adoption of blockchain technology introduces new avenues for money laundering. Blockchain offers transparency through immutable ledgers, but the anonymity provided by some platforms makes it difficult to trace the origin of funds. Regulatory bodies are still working to catch up with these technologies, implementing frameworks to govern the use of virtual assets in financial transactions.

A strong regulatory framework is critical for enforcing AML controls and ensuring compliance with international standards. Various global bodies and country-specific regulations have been established to combat money laundering and terrorist financing.

The Financial Action Task Force (FATF) is an intergovernmental organisation that develops international policies to combat money laundering and terrorist financing. FATF issues guidelines known as the “40 Recommendations” that countries are encouraged to implement in their national legal frameworks. FATF evaluations (known as mutual evaluations) assess how well jurisdictions comply with these standards.

The EU has implemented several Anti-Money Laundering Directives (AMLD) over the years, with the 5th and 6th AML Directives providing significant updates. These directives impose stricter regulations on virtual assets, beneficial ownership registers, and cross-border information sharing. The EU directives are binding on all member states and ensure a unified approach to tackling money laundering.

The Basel Committee develops global standards for banking regulation, including AML-related requirements. It works closely with the FATF to align banking practices with AML and CFT regulations and promotes the effective implementation of risk-based frameworks.

In the UK, AML regulations are governed by the Proceeds of Crime Act 2002 and subsequent updates, including the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017. The UK also follows the FATF recommendations and EU AML directives.

In the US, the primary AML laws are the Bank Secrecy Act (BSA) and the USA PATRIOT Act, which require financial institutions to implement AML programmes, report suspicious activities, and conduct customer due diligence (CDD). The Financial Crimes Enforcement Network (FinCEN) oversees compliance.

The EU has developed a robust AML framework through its directives, which member states must incorporate into national law. The 5th AMLD focused on enhanced due diligence for politically exposed persons (PEPs) and virtual assets, while the 6th AMLD introduced criminal liability for money laundering offences.

AML/CFT compliance involves adhering to a range of regulations designed to detect and prevent financial crimes. Key requirements include:

The UK’s Proceeds of Crime Act criminalises money laundering and provides powers for asset seizure and confiscation of criminal proceeds.

The US Patriot Act expanded the requirements of the Bank Secrecy Act to include stricter due diligence and monitoring of financial transactions linked to terrorism.

These directives are central to the EU’s AML/CFT legal framework, focusing on transparency, criminal liability, and virtual assets regulation.

Financial institutions must comply with strict AML laws to monitor transactions, conduct customer due diligence, and report suspicious activities to national regulators.

Non-financial sectors such as real estate and high-value goods traders must also comply with AML laws. Estate agents, in particular, are required to verify the identity of buyers and sellers and report suspicious transactions.

An effective AML compliance framework is essential for preventing and detecting money laundering. This framework encompasses policies, procedures, and controls designed to ensure that businesses comply with AML regulations.

AML compliance refers to the processes and systems that businesses implement to meet legal and regulatory requirements in relation to preventing, detecting, and reporting money laundering activities. It includes identifying suspicious activity, conducting due diligence on customers, and ensuring proper transaction monitoring.

An AML compliance checklist helps ensure that organisations meet all regulatory requirements. Key items include:

Note: This is a general checklist and may not cover all specific requirements for your jurisdiction or industry. It’s essential to consult with legal and compliance experts to ensure full compliance.

Remember to:

Developing an AML compliance programme requires a structured approach tailored to the unique risks faced by an organisation. The programme should be robust, risk-based, and integrated into the organisation’s overall governance and risk management frameworks. Key elements of an AML compliance programme include:

Risk-Based Approach (RBA): This is a cornerstone of an effective AML programme. Organisations must assess the risk levels of their clients, products, services, and geographic locations to focus resources on higher-risk areas. This ensures that efforts are concentrated where the risk of money laundering is greatest.

Policies and Procedures: Clear AML policies and procedures should be documented, setting out the organisation’s approach to preventing money laundering and the roles of staff members. These policies must be reviewed and updated regularly to ensure compliance with changing regulations and risks.

AML Governance & Senior Management Roles: Senior management plays a critical role in overseeing the AML compliance framework. They must ensure that appropriate resources are allocated to the programme and that governance structures, such as compliance committees or boards, are in place to oversee its effectiveness.

Staff Training & Awareness: Continuous training for employees is essential to ensure that staff can identify red flags and suspicious activities. Training should be tailored to different roles within the organisation, and regular updates must be provided to ensure awareness of emerging risks and new regulations.

Banks are on the front line of the fight against money laundering. Given the scale and complexity of their operations, banks face higher AML risks and must implement stringent controls. Key components of AML compliance for banks include:

Transaction Monitoring: Banks must use sophisticated software systems to monitor customer transactions for unusual activity. This includes setting rules to flag potential money laundering indicators, such as large cash deposits, frequent international transfers, or transactions inconsistent with a customer’s profile.

Know Your Customer (KYC) Requirements: KYC is a critical component of AML compliance. Banks must collect and verify information about their customers, such as identification documents, source of funds, and the nature of the customer’s business. Enhanced due diligence is required for high-risk customers, including politically exposed persons (PEPs).

Suspicious Activity Reports (SARs): When a bank identifies potentially suspicious transactions, it is required to file a SAR with the relevant authorities. This report should be filed without tipping off the customer, and it plays a critical role in enabling authorities to investigate and prevent financial crimes.

AML compliance is not limited to banks; other sectors also face AML obligations, depending on the nature of their business and exposure to financial crime risks.

In the UK and many other countries, estate agents are required to comply with AML regulations due to the risk of criminals using real estate transactions to launder illicit funds. Estate agents must:

The rapid growth of financial technology (fintech) companies has introduced new AML risks, particularly due to the digital nature of their services. Fintech firms must comply with the same AML regulations as traditional financial institutions, including KYC checks, transaction monitoring, and filing SARs. Given their reliance on digital platforms, fintech companies often employ advanced technology like artificial intelligence and machine learning to detect money laundering risks in real time.

AML and CFT (Combating the Financing of Terrorism) are often discussed together, as both involve efforts to prevent the use of the financial system for criminal purposes. While AML focuses on the proceeds of criminal activities, CFT deals specifically with the prevention of terrorism financing. Integrating AML and CFT efforts ensures a comprehensive approach to financial crime prevention.

Both AML and CFT frameworks rely on robust regulatory oversight, customer due diligence, and ongoing transaction monitoring to identify suspicious activity.

| Aspect | Anti-Money Laundering (AML) | Counter Financing of Terrorism (CFT) |

| Definition | Measures to prevent the conversion of illegally obtained money into legitimate assets. | Measures to prevent the financing of terrorist activities. |

| Objective | To identify and report suspicious transactions that may involve the proceeds of crime. | To identify and disrupt the flow of funds to terrorist organisations and activities. |

| Focus | Primarily focuses on financial crimes such as fraud, drug trafficking, and corruption. | Primarily focuses on activities related to terrorism and extremist groups. |

| Regulatory Framework | Governed by laws and regulations that require financial institutions to implement AML measures. | Governed by laws and regulations specifically addressing the financing of terrorism. |

| Risk Assessment | Evaluates risks associated with potential money laundering activities and customer profiles. | Assesses risks related to the potential funding of terrorism and associated entities. |

| Key Activities | – Customer Due Diligence (CDD) – Transaction Monitoring – Reporting Suspicious Activity | – Customer Due Diligence (CDD) – Monitoring for transactions related to high-risk individuals and organisations – Reporting suspicious activities that may indicate terrorist financing |

| Enforcement Agencies | Generally enforced by financial regulatory bodies such as the Financial Conduct Authority (FCA) in the UK. | Enforced by agencies focused on national security and counter-terrorism, such as the National Crime Agency (NCA) in the UK. |

| International Standards | Follows recommendations from the Financial Action Task Force (FATF) related to money laundering. | Also follows FATF recommendations but with a specific focus on preventing terrorist financing. |

| Penalties for Non-Compliance | Financial institutions may face hefty fines, loss of business, and reputational damage. | Similar penalties as AML, but with a greater emphasis on national security implications. |

The importance of AML compliance cannot be overstated, as it serves to protect the integrity of the global financial system. Criminals are continually evolving their techniques, using increasingly sophisticated methods to launder money. As such, AML frameworks must be equally adaptable, incorporating the latest technologies and regulatory developments to stay ahead of financial criminals.

Banks, fintech companies, estate agents, and other sectors all have a role to play in this global effort. Through robust AML compliance programmes that include risk-based approaches, comprehensive customer due diligence, and effective transaction monitoring, organisations can reduce their exposure to money laundering risks and help combat financial crime on a global scale.

Know Your Customer (KYC) refers to the process of a financial institution or business verifying the identity of its clients to prevent fraud, money laundering, and financing of terrorism. KYC is a critical component of a firm’s anti-money laundering (AML) compliance programme. The KYC process involves collecting and verifying information about the client’s identity, financial activities, and risk profile.

KYC is pivotal in the fight against money laundering and terrorism financing. By thoroughly understanding their customers, organisations can assess the risk posed by each client, allowing them to implement appropriate controls to mitigate those risks. Effective KYC procedures help prevent illicit activities, enhance customer trust, and comply with regulatory requirements, thereby safeguarding the institution’s reputation and financial integrity.

KYC procedures typically include:

Customer Identification: Establishing and verifying the identity of the customer using reliable documents, such as passports, national ID cards, or utility bills.

Customer Due Diligence (CDD): Involves evaluating the risk a customer poses based on various factors, including the nature of their business and geographic location. CDD can be further classified into:

In the banking sector, KYC processes are integral to risk management. Banks are required to conduct thorough KYC checks at the outset of a customer relationship and periodically thereafter. This helps them monitor customer transactions for any suspicious activity, ensuring compliance with the Financial Action Task Force (FATF) recommendations and local regulations.

Estate agents must also implement KYC procedures to verify the identity of their clients, particularly when dealing with high-value properties. This helps prevent money laundering through real estate transactions, a common method for laundering illicit funds.

High-risk customers, including politically exposed persons (PEPs) and those from high-risk jurisdictions, necessitate enhanced scrutiny. EDD procedures must be applied, which may involve obtaining additional documentation, conducting background checks, and ongoing monitoring of their transactions.

To ensure compliance with KYC regulations, organisations should consider the following checklist:

KYC and AML processes are interconnected; KYC provides the foundation for effective AML strategies. By knowing their customers, institutions can more effectively monitor for suspicious transactions and implement appropriate responses when red flags arise.

KYC is also essential in combatting terrorism financing. By understanding their customers and their transactions, organisations can identify patterns indicative of potential funding for terrorist activities. This requires diligent monitoring and reporting of any suspicious activities to the relevant authorities.

The emergence of technology has led to the development of electronic KYC (eKYC) systems, which facilitate remote identity verification. These systems utilise digital tools such as biometrics, artificial intelligence, and blockchain technology to streamline the KYC process, ensuring a secure and efficient customer onboarding experience.

AML transaction monitoring is the process of analysing customer transactions to identify patterns or behaviours indicative of money laundering or other financial crimes. This ongoing scrutiny is vital for detecting suspicious activities that may warrant further investigation or reporting.

Transaction monitoring plays a crucial role in AML compliance by enabling institutions to detect unusual activities that could indicate illicit behaviour. Effective monitoring systems can alert compliance teams to potential risks, allowing them to take appropriate action, such as filing Suspicious Activity Reports (SARs) or conducting further investigations.

An effective AML system should incorporate robust transaction monitoring capabilities that analyse customer behaviour in real-time. This involves setting thresholds for various transaction types and monitoring for any deviations from established patterns.

Various types of transactions may be flagged during monitoring, including:

Many institutions use automated transaction monitoring systems that employ algorithms to flag suspicious transactions for review. These systems can significantly enhance efficiency and accuracy, reducing the potential for human error.

Machine learning and artificial intelligence are increasingly utilised to improve transaction monitoring. These technologies can adapt and learn from new data, allowing for more sophisticated detection of suspicious patterns and behaviours over time.

Banks are required to have comprehensive transaction monitoring systems in place as part of their AML compliance framework. This includes regular audits of the monitoring system’s effectiveness and ensuring that staff are trained to recognise and respond to suspicious activities.

Non-bank financial institutions, such as money service businesses (MSBs) and payment processors, also face stringent transaction monitoring requirements. These entities must develop tailored monitoring systems that align with their specific risk profiles and transaction types.

AML risk assessment involves identifying, evaluating, and prioritising risks associated with money laundering and terrorist financing. This process is essential for developing effective mitigation strategies and ensuring compliance with regulatory requirements.

Key Risk Indicators (KRIs) are specific metrics used to assess the risk level associated with a customer or transaction. Common KRIs include:

A Risk-Based Approach (RBA) allows institutions to allocate resources more efficiently by focusing on higher-risk areas. This involves:

Banks must conduct regular risk assessments to ensure compliance with regulatory expectations. This includes assessing the risk posed by customers, products, and geographic locations, and adapting their AML programmes accordingly.

Estate agents also face unique risks in terms of money laundering through real estate transactions. It is vital for them to implement a robust risk assessment process to identify and mitigate these risks effectively.

To mitigate AML risks, organisations should consider the following strategies:

As the financial landscape evolves, new risks emerge. Institutions must stay informed about:

An AML investigation refers to the process of examining suspicious activities or transactions that may indicate money laundering or terrorist financing. These investigations are critical for compliance and must be conducted thoroughly and objectively.

When suspicious activity is identified, institutions are required to file Suspicious Activity Reports (SARs) with the relevant authorities. SARs provide essential details about the suspicious activity and the parties involved.

Filing an SAR typically involves:

Banks must have dedicated teams to conduct AML investigations. These teams analyse flagged transactions, gather additional information, and determine whether the activity warrants further action, including filing SARs.

Financial Intelligence Units (FIUs) are governmental agencies responsible for receiving and analysing SARs. They play a crucial role in AML investigations, often collaborating with law enforcement to pursue criminal activities.

Analytical tools are employed to assess trends and patterns in suspicious activities, enabling organisations to refine their AML strategies continually.

Regular audits are essential to ensure compliance with AML regulations. These can be conducted internally or externally, with the aim of identifying any deficiencies in the organisation’s AML framework.

Internal AML audits involve a systematic examination of an institution’s AML policies, procedures, and controls. The purpose is to assess the effectiveness of the AML programme, ensure compliance with regulatory requirements, and identify areas for improvement. Key elements of internal audits include:

External audits are conducted by independent third-party firms. These audits provide an objective assessment of the institution’s AML compliance and can help identify weaknesses in the AML framework. The external auditor will typically:

Data collection and analysis are integral to effective AML compliance. Institutions must ensure that they have robust systems in place to gather and analyse relevant data. Key considerations include:

Big data analytics plays a significant role in enhancing AML investigations. By leveraging large datasets, institutions can identify trends, correlations, and anomalies that may indicate suspicious activities. This capability allows for more proactive monitoring and response strategies.

Technology has significantly transformed the landscape of AML compliance. Institutions now utilise a range of technological solutions to enhance their AML frameworks and improve operational efficiency. Key technologies include:

Artificial Intelligence (AI) and machine learning are increasingly used in AML compliance for their ability to analyse vast amounts of data and detect patterns indicative of illicit activities. These technologies enable:

Blockchain technology offers transparency and traceability, which can be advantageous in AML efforts. By using blockchain, institutions can enhance the tracking of transactions and verify the legitimacy of funds. However, challenges remain in integrating blockchain solutions with existing systems.

RPA is employed to automate repetitive tasks within AML processes, such as data entry and report generation. This allows compliance teams to focus on more complex tasks, such as investigations and strategy development.

Numerous software solutions are available to assist with AML compliance. These systems typically offer features such as:

Leading AML software platforms often incorporate a combination of the above technologies, offering comprehensive solutions tailored to meet regulatory requirements and enhance operational efficiency.

Regtech (regulatory technology) focuses on leveraging technology to streamline compliance processes. This includes solutions for real-time monitoring, regulatory reporting, and data management, enabling organisations to meet AML obligations more efficiently.

The rise of cryptocurrencies poses unique challenges for AML compliance. Due to the anonymity and decentralisation associated with cryptocurrencies, it is essential for financial institutions to implement robust measures to monitor and report suspicious activities related to digital assets.

Digital identity solutions can enhance KYC processes by providing secure, verifiable identification methods. This is particularly beneficial for remote customer onboarding and ensuring compliance with AML regulations.

The integration of eKYC systems with blockchain technology can enhance the security and efficiency of customer verification processes. By using blockchain, institutions can access verified customer information in real-time, reducing the risk of identity fraud.

Banks are at the forefront of AML efforts due to their central role in the financial system. They are required to implement comprehensive AML programmes that include KYC procedures, transaction monitoring, and regular audits to ensure compliance with regulations.

Non-bank financial institutions, such as payment processors and money transfer services, are also subject to AML regulations. They must develop tailored compliance programmes that address their unique risks and regulatory requirements.

Real estate transactions are often exploited for money laundering. Therefore, estate agents must implement KYC procedures and monitor transactions closely to prevent the misuse of property for laundering illicit funds.

The insurance industry must assess the risk of money laundering in policy sales and claims processing. KYC and transaction monitoring procedures should be integrated into their operations to identify and report suspicious activities.

Casinos and gaming establishments face unique AML challenges due to the high volume of cash transactions. Effective KYC processes, transaction monitoring, and employee training are critical in preventing money laundering activities in this sector.

Charities and non-profit organisations must also implement AML measures to prevent misuse of funds. This includes verifying donors and ensuring transparency in financial transactions.

High-value dealers in art, antiques, and precious metals are often targeted for money laundering. They must establish KYC procedures and monitor transactions for suspicious activity, particularly in high-value sales.

A Remediation Action Plan is a strategic framework designed to address deficiencies identified in an institution’s AML programme. It outlines the steps necessary to rectify compliance issues and strengthen the overall AML framework.

Organisations must take immediate corrective actions to address any compliance gaps. This may involve enhancing KYC procedures, improving transaction monitoring systems, or providing additional training to staff.

Regularly updating AML policies is crucial to ensure alignment with the latest regulations and best practices. Institutions should conduct comprehensive reviews of their policies and procedures to identify necessary updates.

When regulatory audits identify deficiencies, institutions must respond promptly and effectively. This includes implementing corrective measures and maintaining open communication with regulators to demonstrate commitment to compliance.

To ensure effective AML remediation, organisations should consider the following best practices:

KYC and AML are essential components of financial integrity and security. By implementing robust processes and leveraging technology, organisations can mitigate risks, comply with regulations, and contribute to the global fight against money laundering and terrorism financing. As the landscape evolves, continuous improvement and adaptation will be critical to maintaining effective compliance programmes.

Neotas Platform covers 600Bn+ archived web pages, 1.8Bn+ court records, 198M+ corporate records, global social media platforms, and 40,000+ Media sources from over 100 countries to help you build a comprehensive picture of the team. It’s a world-first, searching beyond Google. Neotas’ diligence uncovers illicit activities, reducing financial and reputational risk.

Neotas is a leader in harnessing the combined power of open-source intelligence (OSINT), along with social media, and a wide range of traditional data sources using cutting edge technology to deliver comprehensive AML solutions. We help uncover hidden risks using a combination of technology and our team of over 100 trained research analysts to protect our customers from making risky investment or other business decisions.

Our automated AML monitoring continually tracks high-risk individuals and entities, providing immediate alerts on any significant changes or suspicious activities.

Neotas is a leading SaaS platform widely deployed by organisations for investigating suspected financial crime.

AML Case Studies:

AML Case Studies: AML Solutions:

AML Solutions:Manage Financial Compliance and Business Risk with Neotas AML Solutions.

Neotas is an Enhanced Due Diligence Platform that leverages AI to join the dots between Corporate Records, Adverse Media and Open Source Intelligence (OSINT).

Schedule a Call or Book a Demo of Neotas Anti-money laundering (AML) Solutions.

Download the AML Checklist

Download the AML ChecklistThe AML KYC process involves verifying the identity of clients to prevent money laundering and other illicit financial activities. It includes collecting and analysing customer information, assessing the risk of potential money laundering activities, and continuously monitoring transactions. This ensures compliance with regulatory requirements and protects financial institutions from being exploited for illegal activities.

AML rules are regulatory guidelines designed to combat money laundering and financial crimes. They require financial institutions to implement robust policies and procedures for identifying and reporting suspicious activities. Key components include customer identification, transaction monitoring, record-keeping, and employee training. These rules vary by jurisdiction but generally aim to create a transparent financial environment.

AML processes include several key steps:

AML refers to the set of laws, regulations, and procedures that prevent, detect, and report money laundering activities. Money laundering, on the other hand, is the act of concealing the origins of illegally obtained money to make it appear legitimate. In essence, AML is the framework designed to combat the crime of money laundering.

An AML tool is software or a system used by financial institutions to automate and streamline AML compliance processes. These tools typically include features for customer screening, transaction monitoring, risk assessment, and reporting of suspicious activities. They help institutions efficiently manage large volumes of data and enhance compliance with regulatory requirements.

The three stages of AML are:

An AML checklist is a comprehensive guide used by financial institutions to ensure compliance with AML regulations. It typically includes steps for customer identification, risk assessment, transaction monitoring, reporting obligations, and employee training. This checklist serves as a practical tool to confirm that all necessary actions are taken to mitigate risks associated with money laundering.

The four pillars of an AML policy are:

AML is primarily regulated by government authorities and financial regulatory bodies. In the UK, the Financial Conduct Authority (FCA) and the National Crime Agency (NCA) are key players in enforcing AML regulations. These bodies set guidelines, monitor compliance, and impose penalties for non-compliance.

AML documents refer to records required for compliance with AML regulations. These may include customer identification documents (such as passports or utility bills), transaction records, risk assessment reports, and records of suspicious activity reports submitted to authorities. Proper documentation is essential for demonstrating compliance during audits or investigations.

Yes, KYC is an integral part of AML. KYC refers specifically to the process of verifying the identity of clients and assessing their risk profiles. By implementing effective KYC measures, financial institutions can significantly enhance their AML efforts, as understanding the customer is crucial to identifying suspicious activities.

The five pillars of AML typically include:

AML works by establishing a framework of laws and regulations that require financial institutions to identify, assess, and report suspicious activities. Institutions must implement policies for customer identification, transaction monitoring, and record-keeping, which collectively help to deter and detect money laundering activities. By adhering to these regulations, organisations contribute to the overall integrity of the financial system.

Common tools used in AML include:

The first stage in AML is Placement, where illicit funds are introduced into the financial system. This could involve depositing cash in banks, purchasing assets, or making large cash transactions. The objective at this stage is to disguise the illegal origin of the funds before they undergo layering.

Client Due Diligence (CDD) is the process of verifying a client’s identity and assessing their risk profile as part of KYC. CDD involves collecting personal information, conducting background checks, and evaluating the purpose of the business relationship. Enhanced Due Diligence (EDD) is applied for higher-risk clients to obtain additional information.

The KYC life cycle includes the following stages:

Red flags in AML are indicators that suggest potential money laundering activities. Common red flags include:

Client Due Diligence (CDD) is the standard process of verifying customer identity and assessing risk. Enhanced Due Diligence (EDD) is applied to clients considered higher risk, requiring more comprehensive checks, such as detailed source of funds investigations, to mitigate the risk of money laundering or terrorist financing.

The consequences of non-compliance with AML regulations can be severe. Financial institutions may face significant fines, penalties, or sanctions imposed by regulatory authorities. Additionally, non-compliance can lead to reputational damage, loss of business, and increased scrutiny from regulators. In extreme cases, institutions may even lose their licenses to operate.

The key challenges in implementing an effective AML programme include:

The Money Laundering Reporting Officer (MLRO) is a designated individual within a financial institution responsible for overseeing the organisation’s AML compliance programme. The MLRO’s key responsibilities include:

The contribution of the MLRO to the effectiveness of an AML programme is significant due to their comprehensive oversight and strategic role. Key contributions include:

financial crime compliance

financial crimes compliance

what is financial crime compliance

financial crime and compliance

financial crime and compliance management

financial crime compliance jobs

financial crime compliance solutions

financial crimes compliance jobs

compliance and financial crime

cost of financial crime compliance

enterprise financial crimes compliance

fcc financial crime compliance

anti financial crime compliance

conduct financial crime and compliance

financial crime compliance analyst

financial crime compliance analyst salary

financial crime compliance certification

financial crime compliance course

financial crime compliance definition

financial crime compliance framework

financial crime compliance in banking

financial crime compliance meaning

financial crime compliance risk management

global financial crimes compliance

true cost of financial crime compliance global report

what is financial crimes compliance

Neotas Enhanced Due Diligence covers 600Bn+ Archived web pages, 1.8Bn+ court records, 198M+ Corporate records, Global Social Media platforms, and more than 40,000 Media sources from over 100 countries to help you screen & manage risks.

Index

Indexaml compliance checklist

aml compliance program

aml and bsa

aml ctf

aml and ctf

anti money laundering integration

fatf money laundering

bsa aml

money laundering transaction monitoring

aml transaction monitoring

anti money laundering transaction monitoring

aml checks

aml check

anti money laundering checks

aml checks uk

anti-money laundering check

money laundering checks

anti-money laundering checks

what is aml checks

money laundering check

what is an anti money laundering check

anti money laundering check

anti money laundering compliance

anti money laundering checks

aml and compliance

aml checks

anti-money laundering compliance

aml check

anti money laundering compliance

anti money laundering checks uk

what is an aml check

anti money laundering checks by banks

kyc checks

kyc compliance

kyc check

know your customer

know your customer checks

know your customer meaning

know your client

know your client regulations

aml kyc

what is anti money laundering

kyc requirements

aml money laundering

kyc regulations

anti money laundering regulations

aml regulations

money laundering regs

aml finance

aml compliance

aml regs

aml and compliance

know your customer compliance

kyc and compliance

money laundering laws

anti-money laundering compliance

types of anti money laundering

aml system

anti money laundering types

law for money laundering

anti money laundering

aml comply

kyc aml

aml in banking

aml requirements

aml procedures

anti money laundering requirements

anti money laundering in banking

anti money laundering procedures

kyc and aml compliance

kyc money laundering

aml reports

aml kyc process

anti money laundering and compliance

kyc aml compliance

kyc aml procedures

money laundering process

aml integration

aml risk assessment

banks and money laundering

money laundering risk

anti money laundering investigation

aml check meaning

what are aml checks

aml checks meaning

aml search

aml checker

anti money laundering search

aml check online

money laundering

cash laundering

laundering

anti money laundering checks for estate agents

anti money laundering audit

anti money laundering companies

bank money laundering

aml data

anti money laundering compliance program

aml check estate agents

money laundering checks for estate agents

anti money laundering finance

anti money laundering services

aml

aml audit

bsa banking

anti money laundering consultant

aml sanctions

aml insurance

aml sanctions screening

peps money laundering

anti money laundering checks

aml finance

aml and compliance

aml checks

aml compliance

anti-money laundering compliance

aml check

anti money laundering compliance

aml checks

aml check

anti money laundering checks

aml checks

money laundering checks

aml check meaning

anti-money laundering check

aml checks uk

anti-money laundering checks

what are aml checks

what is aml checks

aml checks meaning

money laundering check

what is an anti money laundering check

anti money laundering check

aml search

anti money laundering compliance

kyc

what is kyc verification

kyc compliance

kyc meaning

kyc verification

kyc identity verification

what is kyc

know your customer

know your client

kyc know

kyc definition

what are kyc

kyc documents

kyc process

what is know your customer

kyc aml

kyc know your client

kyc requirements

kyc what

know your customer requirements

kyc customer

kyc means

what is a kyc

what is kyc in banking

what does kyc mean

micromerchant

kyc software

kyc/aml

define kyc

kyc check

kyc services

kyc checks

kyc banking

bank know your customer

know your customer regulations

kyc document

kyc required

kyc regulations

meaning of know your customer

know your customer banking

kyc full form

kyc in banking

know your customer bank

know your customer rule

kyc meaning in banking

know your customer process

what does kyc stand for

know your customer news

know your client regulations

kyc information

kyc procedure

aml kyc

kyc and aml

kyc verification meaning

kyc due diligence

whats kyc

kyc know your customer

kyc law

kyc finance

aml kyc meaning

know your customer laws

aml and kyc

kyc requirements for banks

aml/kyc

aml check

kyc laws

corporate secrecy

kyc bank

how to launder cash

anti money laundering

aml

money laundering

cash laundering

laundering

bsa banking

law for money laundering

aml compliance

anti money laundering compliance

aml and compliance

anti money laundering and compliance

aml comply

aml checks

kyc aml

anti money laundering checks

anti money laundering regulations

aml finance

aml regulations

aml ctf

anti money laundering finance

aml and ctf

aml integration

aml regs

anti money laundering integration

bsa aml

aml and bsa

kyc compliance

aml in banking

know your customer compliance

anti money laundering in banking

money laundering regs

fatf money laundering

aml transaction monitoring

anti money laundering transaction monitoring

aml requirements

anti money laundering requirements

anti money laundering consultant

bank money laundering

banks and money laundering

aml audit

aml risk assessment

aml procedures

anti money laundering audit

anti money laundering procedures

aml reports

kyc aml compliance

kyc and aml compliance

anti money laundering services

anti money laundering companies

anti money laundering investigation

aml compliance program

aml kyc process

anti money laundering compliance program

kyc aml procedures

peps money laundering

anti money laundering checks for estate agents

aml insurance

aml sanctions

aml check estate agents

aml data

money laundering checks for estate agents

money laundering risk

aml checks uk

anti money laundering checks uk

money laundering checks

aml compliance checklist

aml sanctions screening

kyc money laundering

aml

aml audit

aml insurance

aml sanctions

aml sanctions screening

anti money laundering consultant

anti money laundering services

bsa banking

peps money laundering

aml and bsa

aml compliance checklist

aml compliance program

aml and ctf

aml ctf

anti money laundering integration

bsa aml

fatf money laundering

aml transaction monitoring

anti money laundering transaction monitoring

money laundering transaction monitoring

aml and compliance

aml check

aml checks

aml checks uk

aml compliance

aml comply

aml finance

aml in banking

aml kyc

aml kyc process

aml money laundering

aml procedures

aml regs

aml regulations

aml reports

aml requirements

aml system

anti money laundering

anti money laundering check

anti money laundering checks

anti money laundering checks by banks

anti money laundering checks uk

anti money laundering compliance

anti money laundering in banking

anti money laundering procedures

anti money laundering regulations

anti money laundering requirements

anti money laundering types

anti-money laundering check

anti-money laundering checks

anti-money laundering compliance

know your client KYC

know your client regulations

know your customer KYC

know your customer checks

know your customer compliance

know your customer meaning

kyc aml

kyc aml compliance

kyc aml procedures

kyc and aml compliance

kyc and compliance

kyc check

kyc checks

kyc compliance

kyc money laundering

kyc regulations

kyc requirements

law for money laundering

money laundering check

money laundering checks

money laundering laws

money laundering regs

types of anti money laundering

what is aml checks

what is an aml check

what is an anti money laundering check

what is anti money laundering

aml integration

money laundering process

aml risk assessment

anti money laundering investigation

banks and money laundering

money laundering risk

aml check estate agents

aml check meaning

aml check online

aml checker

aml checks meaning

aml data

aml search

anti money laundering audit

anti money laundering checks for estate agents

anti money laundering companies

anti money laundering compliance program

anti money laundering finance

anti money laundering search

bank money laundering

cash laundering

laundering

money laundering

money laundering checks for estate agents

what are aml checks

We leverage Open source intelligence (OSINT) to use publicly available data to provide organisations with hyper-accurate and fully auditable insights with no false positives.

Improve analyst efficiencies, including cost and time reduction of minimum 25% with zero false positives.

The FCA recommends open source Internet checks as best practice (FG 18/5). Manage and reduce risk by incorporating 100% of online sources into your processes.

Manage risk with hyper accurate ongoing monitoring. We will monitor 100% of publicly available online data to help identify relevant risks.

The Neotas Platform covers 600Bn+ archived web pages, 1.8Bn+ court records, 198M+ corporate records, global social media platforms, and 40,000+ media sources from over 100 countries to help you build a comprehensive risk assessment of individuals, entities, and their networks.

Neotas Platform covers 600Bn+ archived web pages, 1.8Bn+ court records, 198M+ corporate records, global social media platforms, and 40,000+ Media sources from over 100 countries to help you build a comprehensive picture of the team.

| Cookie | Duration | Description |

|---|---|---|

| AWSALBTG | 7 days | AWS Application Load Balancer Cookie. Load Balancing Cookie: Used to encode information about the selected target group. |

| AWSALBTGCORS | 7 days | AWS Classic Load Balancer Cookie: Used to map the session to the instance. This cookie is identical to the original ELB cookie except for the attribute &SameSite=None; |

| cookielawinfo-checkbox-advertisement | 1 year | Set by the GDPR Cookie Consent plugin, this cookie is used to record the user consent for the cookies in the "Advertisement" category . |

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| CookieLawInfoConsent | 1 year | Records the default button state of the corresponding category & the status of CCPA. It works only in coordination with the primary cookie. |

| debug | never | Cookie used to debug code and website issues |

| shown | session | Session cookie to control number of times a pop up is shown. |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| __cf_bm | 30 minutes | This cookie, set by Cloudflare, is used to support Cloudflare Bot Management. |

| AnalyticsSyncHistory | 1 month | Used to store information about the time a sync took place with the lms_analytics cookie |

| bcookie | 2 years | LinkedIn sets this cookie from LinkedIn share buttons and ad tags to recognize browser ID. |

| bscookie | 2 years | LinkedIn sets this cookie to store performed actions on the website. |

| lang | session | LinkedIn sets this cookie to remember a user's language setting. |

| lidc | 1 day | LinkedIn sets the lidc cookie to facilitate data center selection. |

| UserMatchHistory | 1 month | LinkedIn sets this cookie for LinkedIn Ads ID syncing. |

| Cookie | Duration | Description |

|---|---|---|

| li_gc | 2 years | Used to store consent of guests regarding the use of cookies for non-essential purposes |

| rl_anonymous_id | 1 year | Generates an unique anonymous Id to identify a user and attach to a subsequent event. |

| rl_user_id | 1 year | to store a unique user ID for the purpose of Marketing/Tracking |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | The _ga cookie, installed by Google Analytics, calculates visitor, session and campaign data and also keeps track of site usage for the site's analytics report. The cookie stores information anonymously and assigns a randomly generated number to recognize unique visitors. |

| _gat_gtag_UA_107495977_1 | 1 minute | Set by Google to distinguish users. |

| _gat_UA-107495977-1 | 1 minute | A variation of the _gat cookie set by Google Analytics and Google Tag Manager to allow website owners to track visitor behaviour and measure site performance. The pattern element in the name contains the unique identity number of the account or website it relates to. |

| _gcl_au | 3 months | Provided by Google Tag Manager to experiment advertisement efficiency of websites using their services. |

| _gid | 1 day | Installed by Google Analytics, _gid cookie stores information on how visitors use a website, while also creating an analytics report of the website's performance. Some of the data that are collected include the number of visitors, their source, and the pages they visit anonymously. |

| attribution_user_id | 1 year | This cookie is set by Typeform for usage statistics and is used in context with the website's pop-up questionnaires and messengering. |

| CONSENT | 2 years | YouTube sets this cookie via embedded youtube-videos and registers anonymous statistical data. |

| Cookie | Duration | Description |

|---|---|---|

| _fbp | 3 months | This cookie is set by Facebook to display advertisements when either on Facebook or on a digital platform powered by Facebook advertising, after visiting the website. |

| fr | 3 months | Facebook sets this cookie to show relevant advertisements to users by tracking user behaviour across the web, on sites that have Facebook pixel or Facebook social plugin. |

| IDE | 1 year 24 days | Google DoubleClick IDE cookies are used to store information about how the user uses the website to present them with relevant ads and according to the user profile. |

| test_cookie | 15 minutes | The test_cookie is set by doubleclick.net and is used to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | A cookie set by YouTube to measure bandwidth that determines whether the user gets the new or old player interface. |

| YSC | session | YSC cookie is set by Youtube and is used to track the views of embedded videos on Youtube pages. |

| yt-remote-connected-devices | never | YouTube sets this cookie to store the video preferences of the user using embedded YouTube video. |

| yt-remote-device-id | never | YouTube sets this cookie to store the video preferences of the user using embedded YouTube video. |

| yt.innertube::nextId | never | This cookie, set by YouTube, registers a unique ID to store data on what videos from YouTube the user has seen. |

| yt.innertube::requests | never | This cookie, set by YouTube, registers a unique ID to store data on what videos from YouTube the user has seen. |