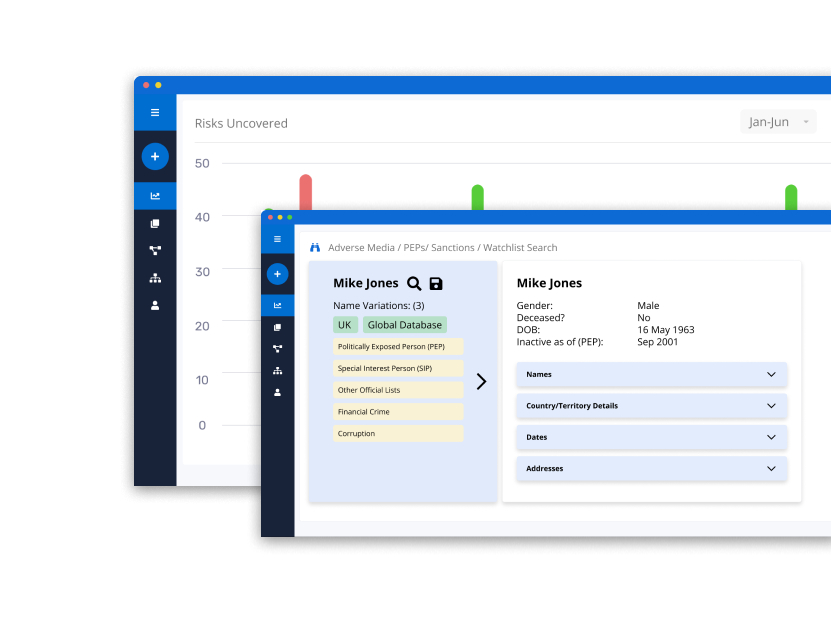

Delivering new customer insights faster than traditional processes, enhancing your due diligence. Strategic Insight, Informed Decisions

Revamp your Due Diligence process with Neotas’ Customer Due Diligence solutions. Harness advanced behavioural and reputational data for deeper insights and more effective risk mitigation. Elevate your compliance game!

Neotas outperforms existing processes, delivering rapid results for timely decision-making in critical due diligence scenarios, setting a new standard in efficiency.

Save valuable time and cost with Neotas, optimising resources for more productive and cost-effective due diligence processes.

Neotas leaves no stone unturned, analysing 100% of publicly available data to provide a thorough and comprehensive view for robust due diligence assessments.

Zero false positives, ensuring confidence in your due diligence outcomes and minimising the risk of overlooking critical information.

There is increasing regulatory pressure to know your customers better. We do this by using enhanced technology and open-source intelligence.

We help you remove your customer due diligence blindspots and bring more informed customer data to you, in an easy and compliant way.

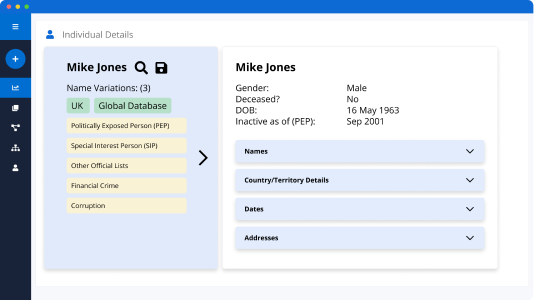

We help you build a clear and concise individual risk profile.

We rapidly interrogate the largest traditional databases in the world, as well as 100% of public online data.

No more wasting time sifting through irrelevant risk data.

Using the Neotas Platform, analyst investigation time is reduced by a minimum of 25%.

You receive concise, accurate findings that focus on relevant red flags only – all with zero false positives.

Risk exposure is ‘fluid’ and needs to be monitored thoroughly and consistently.

Our Ongoing Risk Monitoring helps reduce exposure by constantly evaluating real-time online data.

Set up alerts and be well placed to mitigate the newfound risk, providing ‘peace of mind’ for risk and compliance managers.

Neotas empowers you to proactively identify, assess, and mitigate risks tied to external partners. Our robust solutions ensure regulatory compliance, fortify data security, and maintain uninterrupted operations.

Improve analyst efficiencies, including cost and time reduction of minimum 25% with zero false positives.

The FCA recommends open source Internet checks as best practice (FG 18/5). Manage and reduce risk by incorporating 100% of online sources into your processes.

Manage risk with hyper accurate ongoing monitoring. We will monitor 100% of publicly available online data to help identify relevant risks.

Our clients can choose to use our advanced technology to interrogate vast data sources using their own methodologies. Our team of in-house expert analysts can also produce reports for you.

Customer Due Diligence (CDD) is a critical process that businesses and financial institutions undertake to verify and assess their customers’ identities, understand their financial activities, and evaluate the risks associated with serving them. It involves gathering information about customers to ensure they are who they claim to be and to detect any suspicious or potentially illegal activities.

CDD is a crucial component of anti-money laundering (AML) and Know Your Customer (KYC) regulations, which aim to prevent financial crimes like money laundering and terrorist financing. By conducting thorough customer due diligence, organizations can establish trust, mitigate risks, and maintain compliance with regulatory requirements. This process typically involves collecting identification documents, verifying customer information, and assessing their financial behavior and transactions. It enables businesses to make informed decisions about engaging with customers and helps protect against potential financial crimes.

A Customer Due Diligence (CDD) checklist is a crucial tool for businesses to ensure compliance and mitigate financial risks. It encompasses verifying customer identities, assessing their risk profiles, and monitoring for suspicious activities. Key components include identity and address verification, understanding business activities, confirming the source of funds, conducting risk assessments, and applying Enhanced Due Diligence (EDD) when necessary. Ongoing monitoring procedures and meticulous record-keeping further fortify the CDD process. By adhering to this checklist, businesses demonstrate a commitment to ethical and responsible practices while safeguarding against money laundering, fraud, and other financial crimes.

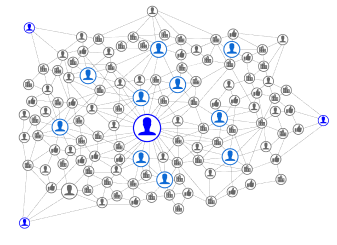

Neotas goes beyond current and traditional KYC checks by ‘spidering out’ across the Internet, aggregating and analysing vast amounts of data at speed. We bring you additional customer data, for example through social media networks, surface and deep web sources. We provide you with a single view of risk, with insights delivered in one single place. We help you remove your blindspots and build a clearer risk profile of customers, in an easy and compliant way.

Neotas adds valuable insight from unstructured and structured sources that are currently under-utilised. The regulators are increasingly stating the importance of using open source intelligence for customer due diligence (FG 18/5, FCA). Open sources include social media, surface web and deep web data and we are specialists in ‘joining the dots’ between disparate data sources, so that you have a complete risk profile of customers.

Absolutely. Our Platform can be used to monitor customer risk data on an ongoing basis, without false positives. This is particularly useful as the risk profile of customers can change over time and database checks provide ‘point in time’ information, whereas our Platform monitors risk in almost real-time and consistently.

We capture more information than traditional KYC, as we aggregate and analyse data from the largest traditional databases in the world, as well as 100% of publicly available online data. The Neotas Platform interrogates data at speed and ‘joins the dots’ between disparate data sources. All the information is made available to you at the click of a button, in one single place.

We interrogate vast amounts of information at speed and our ability to ‘connect the dots’ between disparate data sources enables us to identify risk, including fraud. We have discovered fraud amongst unconnected parties by, for instance, uncovering aliases used by individuals.

n the United Kingdom, regulatory bodies like the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA) set forth specific guidelines governing Customer Due Diligence. These guidelines are designed to ensure that businesses operating within the financial sector uphold the highest standards of integrity and transparency.

Key Customer Due Diligence Requirements

Adherence to Customer Due Diligence Requirements: Ensuring Compliance

Meeting these requirements is not merely a legal obligation; it is a commitment to ethical and responsible business practices. Non-compliance can have severe consequences, including legal penalties, damage to reputation, and potential loss of business. Therefore, businesses must establish robust internal processes and procedures to ensure strict adherence to Customer Due Diligence requirements.

The four main requirements for Customer Due Diligence are:

Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD) are both crucial processes used by businesses, particularly in the financial sector, to assess and manage risks associated with their customers. However, they differ in their depth and scope of scrutiny:

While both CDD and EDD aim to assess and manage risks associated with customers, EDD is a more intensive process applied to customers or transactions deemed to have a higher level of risk. It involves gathering additional information and conducting a more thorough analysis to ensure compliance with regulatory standards and to mitigate potential financial crimes.

There have been numerous instances where we’ve found instances of fraud where others have not found it. We pride ourselves on being able to uncover risks quickly and efficiently, which means that you can be rest assured you will solve the problems effectively.

We provide database checks alongside the power of open source intelligence, which means we interrogate and analyse open sources (publicly available data) at speed. The additional insights from open source intelligence helps you to make decisions more effectively. This gives you peace of mind that your blind spots are covered.

The Neotas Platform will help you conduct your investigations more effectively and efficiently, saving you at least 25% of your time. The Platform provides a richer and more complete profile of customers with greater:

We focus on the live data that exists outside of banks or financial institutions. This data comes in many forms, including social media, customer/employee reviews, adverse media, surface web and deep web sources, etc. We give you clear risk insights by analysing this data at speed and bringing it all together in one place.

Our Platform ‘joins the dots’ between disparate data sources, including your existing third party providers, which are integrated into one central hub. We provide you with a single view of all risks uncovered, helping you to make your processes more effective and efficient.

Ensure compliance, safeguard sensitive data, and uphold your reputation. Elevate your risk management approach with Neotas Customer Due Diligence Solution today!

customer due diligence

customer due diligence meaning

what is customer due diligence

customer due diligence checklist uk

customer due diligence checklist

customer due diligence money laundering

enhanced customer due diligence

worldpay customer due diligence

customer due diligence checks

customer due diligence for banks

aml customer due diligence

customer acquisition due diligence

customer due diligence process

customer due diligence solutions

simplified customer due diligence

what are the 4 customer due diligence requirements

what is customer due diligence in banking

when should you repeat due diligence on a customer

aml customer due diligence checklist

anti money laundering customer due diligence

cdd customer due diligence

customer due diligence analyst

customer due diligence analyst salary

customer due diligence and enhanced due diligence

customer due diligence and kyc

customer due diligence beneficial ownership

customer due diligence checklist for banks

customer due diligence checklist pdf

customer due diligence checklist template

customer due diligence definition

customer due diligence documents

customer due diligence example

customer due diligence fca

customer due diligence for banks pdf

customer due diligence form

customer due diligence hsbc

customer due diligence identification

customer due diligence in kyc

customer due diligence interview questions

customer due diligence job description

customer due diligence jobs

customer due diligence meaning in banking

customer due diligence measures

customer due diligence money laundering regulations 2017

customer due diligence nz

customer due diligence officer

customer due diligence policy

customer due diligence procedures

customer due diligence process flow

customer due diligence program

customer due diligence questionnaire

customer due diligence questions

customer due diligence regulations

customer due diligence report

customer due diligence requirements

customer due diligence requirements for financial institutions

customer due diligence rule

customer due diligence software

customer due diligence specialist

customer due diligence training

customer due diligence uk

customer due diligence vendor

customer due diligence 中文

customs due diligence

define customer due diligence

enhanced customer due diligence meaning

enhanced customer due diligence must be applied when dealing with

enhanced due diligence for high risk customers

enhanced due diligence high risk customer

enhanced due diligence is usually required for which customer

fatf customer due diligence

fca customer due diligence

fincen customer due diligence rule

high risk customer due diligence

hsbc customer due diligence

ica advanced certificate in practical customer due diligence

importance of customer due diligence

know your customer and due diligence

know your customer customer due diligence

know your customer due diligence

know your customer due diligence checklist

know your customer due diligence required

kyc customer due diligence

levels of customer due diligence

ongoing customer due diligence

pep customer due diligence

purpose of customer due diligence

sample customer due diligence form

standard customer due diligence

types of customer due diligence

what does customer due diligence mean

what is customer due diligence cdd

what is customer due diligence in kyc

what is enhanced customer due diligence

what is meant by customer due diligence

what is ongoing customer due diligence

what is the customer due diligence

what is the purpose behind conducting customer due diligence

what is the purpose of customer due diligence

when should customer due diligence be performed

what is customer due diligence

what are the 4 customer due diligence requirements

what is customer due diligence in banking

when should you repeat due diligence on a customer

what does customer due diligence mean

what is customer due diligence cdd

what is customer due diligence in kyc

what is enhanced customer due diligence

what is meant by customer due diligence

what is ongoing customer due diligence

what is the customer due diligence

what is the purpose behind conducting customer due diligence

what is the purpose of customer due diligence

when should customer due diligence be performed

why customer due diligence is important

why is customer due diligence important

what is cdd customer due diligence

what is customer due diligence mean

what is customer due diligence process

what is the definition of customer due diligence cdd

what records must be kept for customer due diligence

when must you undertake customer due diligence

when should a bank apply customer due diligence

when should bank apply customer due diligence

how to carry out customer due diligence

how to get customer due diligence nz

what are customer due diligence

what do you mean by customer due diligence

what does enhanced customer due diligence mean

what does know your customer kyc due diligence involve

what is called foundation in customer due diligence

what is customer acquisition due diligence

what is customer due diligence for bank

what is customer due diligence form

what is customer due diligence hsbc

what is customer due diligence nz

what is customer due diligence rule

what is customer due diligence uk

what is customer due diligence wiki

what is due diligence customer

what is enhanced customer due diligence ecdd

what is nab customer due diligence

what is reasonable customer due diligence

what is reasonable customer due diligence fraud

what is simplified customer due diligence

what is the customer due diligence rule

what is the definition of customer due diligence

when customer due diligence must be applied

when do you carry out customer due diligence

when is customer due diligence performed

when must you conduct customer due diligence

when should customer due diligence be applied

when to carry out customer due diligence

where are customer due diligence checks not required

where can i find customer due diligence

where can i get a customer due diligence form

where can i get customer due diligence form

The Neotas Platform covers 600Bn+ archived web pages, 1.8Bn+ court records, 198M+ corporate records, global social media platforms, and 40,000+ media sources from over 100 countries to help you build a comprehensive risk assessment of individuals, entities, and their networks.

Neotas Platform covers 600Bn+ archived web pages, 1.8Bn+ court records, 198M+ corporate records, global social media platforms, and 40,000+ Media sources from over 100 countries to help you build a comprehensive picture of the team.

| Cookie | Duration | Description |

|---|---|---|

| AWSALBTG | 7 days | AWS Application Load Balancer Cookie. Load Balancing Cookie: Used to encode information about the selected target group. |

| AWSALBTGCORS | 7 days | AWS Classic Load Balancer Cookie: Used to map the session to the instance. This cookie is identical to the original ELB cookie except for the attribute &SameSite=None; |

| cookielawinfo-checkbox-advertisement | 1 year | Set by the GDPR Cookie Consent plugin, this cookie is used to record the user consent for the cookies in the "Advertisement" category . |

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| CookieLawInfoConsent | 1 year | Records the default button state of the corresponding category & the status of CCPA. It works only in coordination with the primary cookie. |

| debug | never | Cookie used to debug code and website issues |

| shown | session | Session cookie to control number of times a pop up is shown. |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| __cf_bm | 30 minutes | This cookie, set by Cloudflare, is used to support Cloudflare Bot Management. |

| AnalyticsSyncHistory | 1 month | Used to store information about the time a sync took place with the lms_analytics cookie |

| bcookie | 2 years | LinkedIn sets this cookie from LinkedIn share buttons and ad tags to recognize browser ID. |

| bscookie | 2 years | LinkedIn sets this cookie to store performed actions on the website. |

| lang | session | LinkedIn sets this cookie to remember a user's language setting. |

| lidc | 1 day | LinkedIn sets the lidc cookie to facilitate data center selection. |

| UserMatchHistory | 1 month | LinkedIn sets this cookie for LinkedIn Ads ID syncing. |

| Cookie | Duration | Description |

|---|---|---|

| li_gc | 2 years | Used to store consent of guests regarding the use of cookies for non-essential purposes |

| rl_anonymous_id | 1 year | Generates an unique anonymous Id to identify a user and attach to a subsequent event. |

| rl_user_id | 1 year | to store a unique user ID for the purpose of Marketing/Tracking |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | The _ga cookie, installed by Google Analytics, calculates visitor, session and campaign data and also keeps track of site usage for the site's analytics report. The cookie stores information anonymously and assigns a randomly generated number to recognize unique visitors. |

| _gat_gtag_UA_107495977_1 | 1 minute | Set by Google to distinguish users. |

| _gat_UA-107495977-1 | 1 minute | A variation of the _gat cookie set by Google Analytics and Google Tag Manager to allow website owners to track visitor behaviour and measure site performance. The pattern element in the name contains the unique identity number of the account or website it relates to. |

| _gcl_au | 3 months | Provided by Google Tag Manager to experiment advertisement efficiency of websites using their services. |

| _gid | 1 day | Installed by Google Analytics, _gid cookie stores information on how visitors use a website, while also creating an analytics report of the website's performance. Some of the data that are collected include the number of visitors, their source, and the pages they visit anonymously. |

| attribution_user_id | 1 year | This cookie is set by Typeform for usage statistics and is used in context with the website's pop-up questionnaires and messengering. |

| CONSENT | 2 years | YouTube sets this cookie via embedded youtube-videos and registers anonymous statistical data. |

| Cookie | Duration | Description |

|---|---|---|

| _fbp | 3 months | This cookie is set by Facebook to display advertisements when either on Facebook or on a digital platform powered by Facebook advertising, after visiting the website. |

| fr | 3 months | Facebook sets this cookie to show relevant advertisements to users by tracking user behaviour across the web, on sites that have Facebook pixel or Facebook social plugin. |

| IDE | 1 year 24 days | Google DoubleClick IDE cookies are used to store information about how the user uses the website to present them with relevant ads and according to the user profile. |

| test_cookie | 15 minutes | The test_cookie is set by doubleclick.net and is used to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | A cookie set by YouTube to measure bandwidth that determines whether the user gets the new or old player interface. |

| YSC | session | YSC cookie is set by Youtube and is used to track the views of embedded videos on Youtube pages. |

| yt-remote-connected-devices | never | YouTube sets this cookie to store the video preferences of the user using embedded YouTube video. |

| yt-remote-device-id | never | YouTube sets this cookie to store the video preferences of the user using embedded YouTube video. |

| yt.innertube::nextId | never | This cookie, set by YouTube, registers a unique ID to store data on what videos from YouTube the user has seen. |

| yt.innertube::requests | never | This cookie, set by YouTube, registers a unique ID to store data on what videos from YouTube the user has seen. |