Customer Due Diligence Checklist

Understanding the Significance of Customer Due Diligence in Business Compliance – What is Customer Due Diligence? – The Customer Due Diligence Requirements

Customer Due Diligence Meaning: Customer Due Diligence (CDD) is a critical process in the realm of business, particularly in the financial sector. It serves as a cornerstone for maintaining regulatory compliance, safeguarding against financial crimes, and establishing trust between businesses and their customers.

This comprehensive examination of a customer’s identity, financial activities, and associated risks ensures that companies operate in accordance with legal and ethical standards.

What is Customer Due Diligence?

At its core, Customer Due Diligence is a methodical process used to verify and evaluate the identity of customers. It involves collecting pertinent information such as identification documents, residential addresses, and business activities. This information serves as a foundation upon which businesses build a secure and transparent relationship with their clientele.

In an ever-evolving global business landscape, the need for CDD cannot be overstated. It acts as a safeguard against illicit activities like money laundering, fraud, and terrorist financing. By understanding the source of funds and verifying the legitimacy of transactions, companies can maintain the integrity of their operations.

The Regulatory Landscape: Necessitating Customer Due Diligence

The regulatory environment in which businesses operate demands rigorous adherence to compliance measures. Laws and regulations, both at national and international levels, mandate businesses to conduct CDD. These regulations aim to curb financial crimes, protect the stability of financial institutions, and foster transparency within the business ecosystem.

Customer Due Diligence Requirements

Customer Due Diligence (CDD) requirements serve as the foundation upon which businesses build their compliance efforts. These stipulations, established by regulatory authorities, outline the necessary steps and documentation needed to conduct a thorough due diligence process. Adhering to these requirements is not only a legal obligation but also crucial in mitigating risks associated with money laundering, fraud, and other financial crimes.

In the United Kingdom, regulatory bodies like the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA) set forth specific guidelines governing CDD. These guidelines are designed to ensure that businesses operating within the financial sector uphold the highest standards of integrity and transparency.

Key Customer Due Diligence Requirements

- Identifying and Verifying Customer Identity: This is a fundamental requirement. Businesses must obtain and verify official identification documents, such as passports, national IDs, or driver’s licenses. This establishes the customer’s true identity and is essential in preventing identity theft and fraud.

- Assessing the Nature of Business Activities: Understanding the scope and nature of a customer’s business operations is imperative. This involves gaining insights into the industry they operate in, the products or services they provide, and their target market. This information aids in evaluating the legitimacy and legality of their business.

- Verifying the Source of Funds: It is incumbent upon businesses to ascertain the legitimacy of the funds used by customers. This requires verifying that the funds have been acquired through lawful means and are not linked to illicit activities like money laundering.

- Conducting Risk Assessments: Evaluating the level of risk associated with a customer or business relationship is paramount. Factors such as the customer’s location, industry, transaction patterns, and any connections to politically exposed persons (PEPs) are considered. This risk assessment guides businesses in determining the appropriate level of scrutiny.

- Applying Enhanced Due Diligence (EDD) When Necessary: In cases where higher risks are identified, Enhanced Due Diligence (EDD) must be implemented. This involves conducting a more thorough examination of the customer’s background, financial activities, and business relationships. It provides an additional layer of protection against potential financial crimes.

Adherence to Customer Due Diligence Requirements: Ensuring Compliance

Meeting these requirements is not merely a legal obligation; it is a commitment to ethical and responsible business practices. Non-compliance can have severe consequences, including legal penalties, damage to reputation, and potential loss of business. Therefore, businesses must establish robust internal processes and procedures to ensure strict adherence to Customer Due Diligence requirements.

Customer Due Diligence Checklist

A Customer Due Diligence (CDD) checklist is a structured tool that guides businesses through the process of verifying customer identities, assessing risks, and ensuring compliance with regulatory requirements. It serves as a roadmap, ensuring that all necessary steps are taken to conduct a thorough due diligence process.

Key Components of a Customer Due Diligence Checklist

- Identity Verification: This involves collecting and verifying official identification documents, such as passports, national IDs, or driver’s licenses. It is the foundation of the CDD process, establishing the authenticity of the customer.

- Address Verification: Ensuring the accuracy of the customer’s provided address is crucial. This may involve requesting utility bills, bank statements, or official documents confirming the current address.

- Understanding Business Activities: A comprehensive understanding of the customer’s business operations is essential. This includes knowledge of the industry, products or services provided, and target market. It aids in assessing the legitimacy and legality of their business.

- Source of Funds Verification: Verifying the source of a customer’s funds is pivotal in preventing money laundering. It involves confirming that the funds being used are legitimate and obtained through legal means.

- Risk Assessment: Evaluating the level of risk associated with a customer or business relationship is a critical facet of CDD. Factors such as location, industry, transaction patterns, and connections to politically exposed persons (PEPs) are considered.

- Enhanced Due Diligence (EDD) Criteria: In cases where higher risks are identified, the checklist should include criteria for implementing Enhanced Due Diligence. This involves conducting a more thorough examination of the customer’s background, financial activities, and business relationships.

- Ongoing Monitoring Procedures: The checklist should outline procedures for ongoing monitoring of customer activities to identify any unusual or suspicious behavior over time.

- Record-keeping Requirements: Proper documentation of the CDD process is essential. This includes retaining copies of identification documents, transaction records, and any communications related to the due diligence process.

In the landscape of modern business, CDD requirements and checklists serve as essential tools for upholding regulatory compliance and ethical standards. Adhering to these requirements and following a structured checklist not only protects businesses from legal repercussions but also reinforces trust and transparency within customer relationships. By consistently applying these practices, businesses demonstrate their commitment to responsible and conscientious operations in the global business ecosystem.

The Evolution of Customer Due Diligence

Customer Due Diligence (CDD) has undergone a significant evolution over the years, adapting to changing regulatory landscapes and technological advancements. Initially, CDD primarily focused on verifying customer identities and assessing their risk profiles. However, as financial crimes and global business complexities grew, so did the need for a more robust approach to due diligence.

In the early stages, CDD was a largely manual process, relying on paper-based documentation and in-person verification. This approach, while effective to a certain extent, was time-consuming and prone to human error. As financial institutions and businesses sought more efficient solutions, technology emerged as a game-changer.

The integration of advanced identity verification tools, data analytics, and artificial intelligence revolutionised the CDD process. Automated systems enabled businesses to conduct faster, more accurate due diligence, reducing the risk of identity fraud and enhancing compliance with regulatory standards.

Furthermore, the regulatory landscape itself has evolved, with authorities introducing more stringent requirements for customer identification and risk assessment. The advent of global anti-money laundering (AML) standards, such as the Financial Action Task Force (FATF) recommendations, has compelled businesses to adopt more sophisticated CDD measures.

Today, CDD is not confined solely to the financial sector. Its principles and practices have permeated various industries, including real estate, legal, gaming, and more. This evolution reflects a broader recognition of the importance of due diligence in mitigating risks associated with money laundering, fraud, and other financial crimes.

Challenges in Implementing Effective Customer Due Diligence

While the evolution of CDD has brought about many benefits, it has also introduced a new set of challenges for businesses. One such challenge is striking the right balance between compliance and customer experience. Businesses must ensure that CDD procedures are robust enough to meet regulatory standards, yet streamlined and user-friendly to avoid deterring potential customers.

Handling complex ownership structures poses another significant challenge. In cases involving corporate entities, identifying the ultimate beneficial owner(s) can be a complex process. Businesses must navigate through intricate webs of ownership and control, often across multiple jurisdictions.

Additionally, keeping up with rapidly changing regulations presents an ongoing challenge. Regulatory authorities regularly update their guidelines in response to emerging financial threats and geopolitical developments. Staying abreast of these changes and adjusting internal procedures accordingly requires a dedicated commitment to compliance.

Resource allocation is also a critical consideration. Implementing effective CDD measures necessitates investment in technology, staff training, and ongoing monitoring systems. Striking the right balance between cost-effective solutions and comprehensive due diligence practices is a continual challenge for businesses of all sizes.

About Neotas Customer Due Diligence

Neotas Platform covers 600Bn+ archived web pages, 1.8Bn+ court records, 198M+ corporate records, global social media platforms, and 40,000+ Media sources from over 100 countries to help you build a comprehensive picture of the team. It’s a world-first, searching beyond Google.

Neotas’ diligence uncovers illicit activities, reducing financial and reputational risk. Enhance business risk assessment and mitigation with Neotas Customer Due Diligence.

Customer Due Diligence Solutions:

- Customer Due Diligence

- Enhanced Due Diligence

- Management Due Diligence

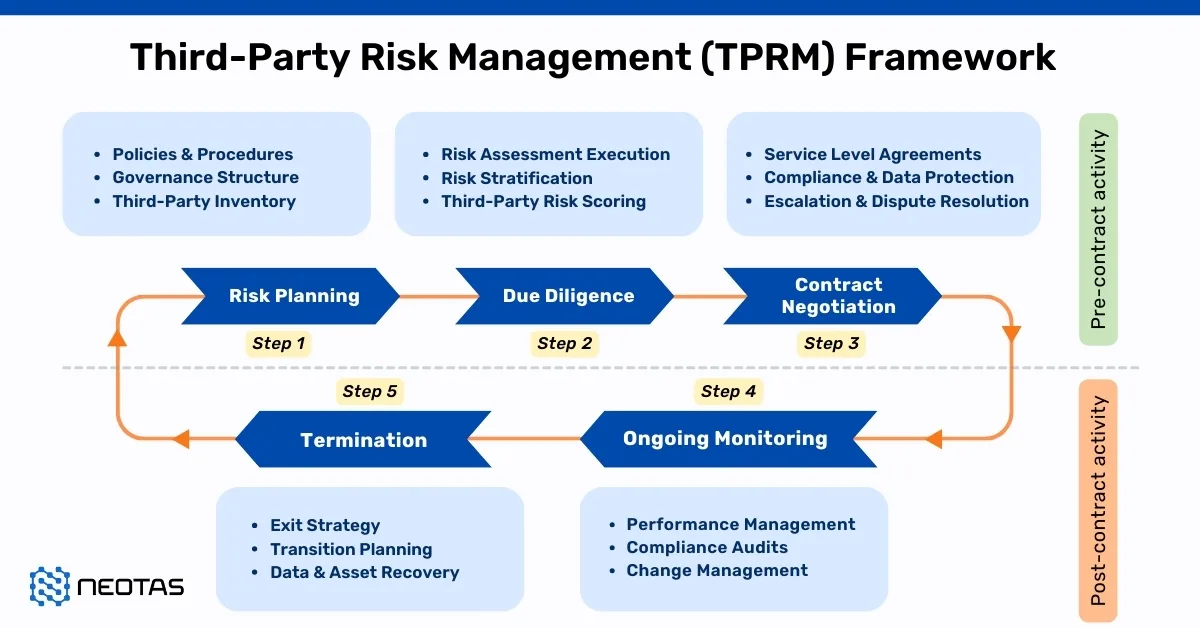

- Third Party Risk Management

- Open Source Intelligence (OSINT)

- Enhanced Due Diligence Checklist

- Customer Due Diligence Requirements

- Risk-Based Approach (RBA) to AML & KYC risk management

- Anti-Money Laundering (AML) Compliance and Checks

- Introducing the Neotas Enhanced Due Diligence Platform

Case Studies:

- Case Study: OSINT for EDD & AML Compliance

- Overcoming EDD Challenges on High Risk Customers

- Neotas Open Source Intelligence (OSINT) based AML Solution sees beneath the surface

- ESG Risks Uncovered In Investigation For Global Private Equity Firm

- Management Due Diligence Reveals Abusive CEO

- Ongoing Monitoring Protects Credit Against Subsidiary Threat

- AML Compliance and Fraud Detection – How to Spot a Money Launderer and Prevent It

- What is Customer Due Diligence in Banking and Financial Services?

FAQ on Customer Due Diligence (CDD)

What is Customer Due Diligence?

Customer Due Diligence (CDD) is a process used by businesses, particularly in the financial sector, to assess and verify the identity of their customers. It involves gathering relevant information about a customer’s identity, financial activities, and risk profile to ensure compliance with regulatory requirements and to mitigate potential risks such as money laundering and fraud.

Customer Due Diligence Meaning – Customer Due Diligence is a fundamental step in establishing a business relationship with a customer. It involves verifying the customer’s identity, understanding their source of funds, and assessing the level of risk associated with the business relationship. This process is crucial for regulatory compliance and safeguarding against financial crimes.

When is Customer Due Diligence Required?

Customer Due Diligence (CDD) is required whenever a business establishes a new relationship with a customer, whether it be an individual or an entity. It is also necessary when there are significant changes in the customer’s circumstances or if there are suspicions of money laundering or fraudulent activities.

What is a Customer Due Diligence Checklist?

A Customer Due Diligence checklist is a comprehensive list of steps and documents required to perform a thorough CDD process. It typically includes verifying the customer’s identity, assessing their risk profile, understanding the nature of the business relationship, and monitoring for any unusual or suspicious activities.

Technology and Expertise for an Effective Customer Due Diligence Process

Utilising advanced technology and expertise is crucial for an efficient and accurate Customer Due Diligence process. This includes access to robust identity verification tools, risk assessment algorithms, and a team with expertise in regulatory compliance and financial investigations.

What are the 4 Customer Due Diligence Requirements?

The four main requirements for CDD are:

- Identifying and verifying the customer’s identity

- Understanding the nature of the customer’s business and the source of funds

- Assessing the risk associated with the customer and the business relationship

- Monitoring and reporting any unusual or suspicious activities.

When should you repeat Customer Due Diligence on a customer?

CDD should be repeated on a customer whenever there are significant changes in their circumstances, such as a change in ownership, a substantial change in business activities, or if there are suspicions of money laundering or fraudulent behaviour.

What is AML Customer Due Diligence?

AML Customer Due Diligence refers to the process of conducting thorough due diligence on customers to prevent and detect potential money laundering activities. It is a crucial component of an effective anti-money laundering program.

CDD in the context of money laundering involves scrutinising customer information, financial transactions, and business activities to identify and report any suspicious or potentially illicit activities that may indicate money laundering.

How is Customer Due Diligence and KYC related?

Customer Due Diligence and Know Your Customer (KYC) are closely related processes. While CDD focuses on verifying and assessing the customer’s identity and risk profile, KYC goes further to include gathering information on the customer’s financial behaviour, source of funds, and overall financial history.

Customer Due Diligence Example: An example of Customer Due Diligence would be a bank requiring a customer to provide a government-issued identification document (such as a passport or driver’s license), proof of address, and additional documentation for businesses, like incorporation certificates and financial statements.

What is Simplified Customer Due Diligence?

Simplified Customer Due Diligence (S-CDD) is a streamlined version of the standard CDD process. It is applied in cases where the customer’s risk profile is low, and involves reduced documentation requirements. S-CDD is typically used for low-risk customers, such as certain retail clients.

What is the difference between Customer Due Diligence and Enhanced Due Diligence?

Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD) are both crucial processes used by businesses, particularly in the financial sector, to assess and manage risks associated with their customers. However, they differ in their depth and scope of scrutiny:

- Customer Due Diligence (CDD):

- Purpose: CDD is a standard process used to verify the identity of customers and assess their risk level. It involves collecting basic information about the customer to ensure compliance with regulatory requirements.

- Scope: CDD involves verifying the customer’s identity, understanding their source of funds, and assessing the level of risk associated with the business relationship.

- Application: CDD is applied to all customers during the onboarding process to establish a basic level of understanding and compliance.

- Enhanced Due Diligence (EDD):

- Purpose: EDD is a more comprehensive and detailed process applied to higher-risk customers or transactions. Its primary goal is to gather additional information and conduct a deeper analysis to better understand and mitigate potential risks.

- Scope: EDD goes beyond CDD by involving a more in-depth examination of the customer’s background, financial activities, and business relationships. It may include gathering information on beneficial ownership, source of wealth, and additional documentation.

- Application: EDD is triggered by factors indicating higher risk, such as dealing with politically exposed persons (PEPs), conducting transactions in high-risk jurisdictions, or engaging in complex and unusual transactions.

While both CDD and EDD aim to assess and manage risks associated with customers, EDD is a more intensive process applied to customers or transactions deemed to have a higher level of risk. It involves gathering additional information and conducting a more thorough analysis to ensure compliance with regulatory standards and to mitigate potential financial crimes.

What is Enhanced Customer Due Diligence?

Enhanced Customer Due Diligence is an intensified process used for high-risk customers or transactions. It involves a deeper investigation, often requiring more comprehensive documentation and additional scrutiny to ensure compliance with regulatory requirements.

What are Customer Due Diligence Checks?

Customer Due Diligence (CDD) checks are systematic procedures employed by businesses, particularly in the financial sector, to confirm the identity, background, and risk profile of customers. This entails verifying official identification documents, assessing the nature of business activities, and determining the legitimacy of the funds involved.

Additionally, CDD involves evaluating the level of risk associated with a customer or business relationship, considering factors like location, industry, and financial patterns. These checks are fundamental for regulatory compliance, aiding in the prevention of financial crimes such as money laundering, and ensuring the integrity of business operations and the broader financial system.

How does Customer Due Diligence Process Work?

The CDD process typically involves steps like verifying the customer’s identity, understanding their business activities, assessing risk, and conducting ongoing monitoring. It is designed to ensure regulatory compliance and safeguard against financial crimes.

When is Customer Due Diligence Required?

Customer Due Diligence is required whenever a business establishes a new relationship with a customer, when there are significant changes in the customer’s circumstances, or when there are suspicions of money laundering or fraudulent activities. This ensures ongoing compliance with regulatory standards.

Tags: Customer Due Diligence, Customer Due Diligence meaning, Customer Due Diligence requirements, Customer Due Diligence checklist, Customer Due Diligence UK, Customer Due Diligence money laundering, Customer Due Diligence checks, Customer Due Diligence process, Enhanced Customer Due Diligence, customer due diligence solutions, customer due diligence for banks, aml customer due diligence checklist

New Whitepaper and Checklist

New Whitepaper and Checklist