The Rising Importance of ESG Due Diligence in M&A Transactions – The ESG Due Diligence Checklist You Need for M&A Success

Environmental, Social, and Governance (ESG) factors are no longer optional considerations in mergers and acquisitions (M&A). Investors, buyers, and stakeholders now view ESG as fundamental to assessing a company’s long-term viability, resilience, and value. In an era where regulatory standards are tightening, consumer expectations are evolving, and social and environmental accountability is paramount, ESG due diligence offers a strategic advantage that goes beyond compliance.

We are pleased to present “The Rising Importance of ESG Due Diligence in M&A Transactions” – a comprehensive, actionable checklist designed to help M&A professionals, investors, and business leaders integrate ESG considerations seamlessly into their transaction processes. This checklist, developed in alignment with industry standards and best practices, provides a robust framework for understanding and assessing a target company’s ESG risks and opportunities.

1. ESG Is Essential for M&A Transactions

In recent years, ESG due diligence has transformed from a niche practice to a pivotal part of M&A processes. This change reflects a growing recognition that ESG factors influence both immediate transaction success and long-term corporate value. Understanding these dynamics empowers dealmakers to make more informed, sustainable decisions that benefit all stakeholders.

2. Compliance and Regulation Are Only the Beginning

Increasingly, global regulatory frameworks such as the EU’s Corporate Sustainability Reporting Directive (CSRD) and the EU Green Deal are setting a higher bar for ESG transparency and accountability. Beyond merely meeting these requirements, proactive ESG due diligence enhances a company’s reputation, minimises risks, and signals a commitment to sustainable growth.

3. Financial and Reputational Impact

Today’s M&A transactions aren’t just about finding financial synergy – they’re about understanding how environmental impact, social responsibility, and governance practices contribute to risk and valuation. Effective ESG due diligence identifies areas where a company might be vulnerable, protecting against reputational harm, regulatory penalties, and even failed transactions.

4. Value Creation Through ESG Integration

A forward-thinking ESG strategy can uncover value-adding opportunities that go beyond risk mitigation. Companies leading in ESG often demonstrate superior operational efficiencies, increased customer loyalty, and enhanced market differentiation. Identifying and supporting these opportunities drives value creation post-transaction.

This checklist has been designed to help M&A teams conduct thorough, structured, and efficient ESG due diligence. Here’s how it can be used:

1. Risk Mitigation

By identifying potential ESG risks, this checklist helps M&A professionals mitigate potential financial and reputational setbacks. The insights gained enable informed decision-making that protects the investment and safeguards long-term growth.

2. Value Creation Opportunities

ESG due diligence isn’t just about identifying risks – it’s about spotting opportunities for value creation. For example, a company with a strong commitment to social responsibility may attract loyal customers, enhancing revenue potential.

3. Alignment with Regulatory and Market Expectations

Companies increasingly face scrutiny from regulators, investors, and consumers alike. This checklist helps M&A teams stay compliant with evolving ESG standards, ensuring transparency and aligning with market demands for sustainable and ethical practices.

4. Continuous Improvement

The checklist facilitates ongoing improvement by learning from industry leaders, refining due diligence processes, and adapting to emerging ESG best practices. It provides a structured framework that can be updated as new insights or regulatory requirements emerge.

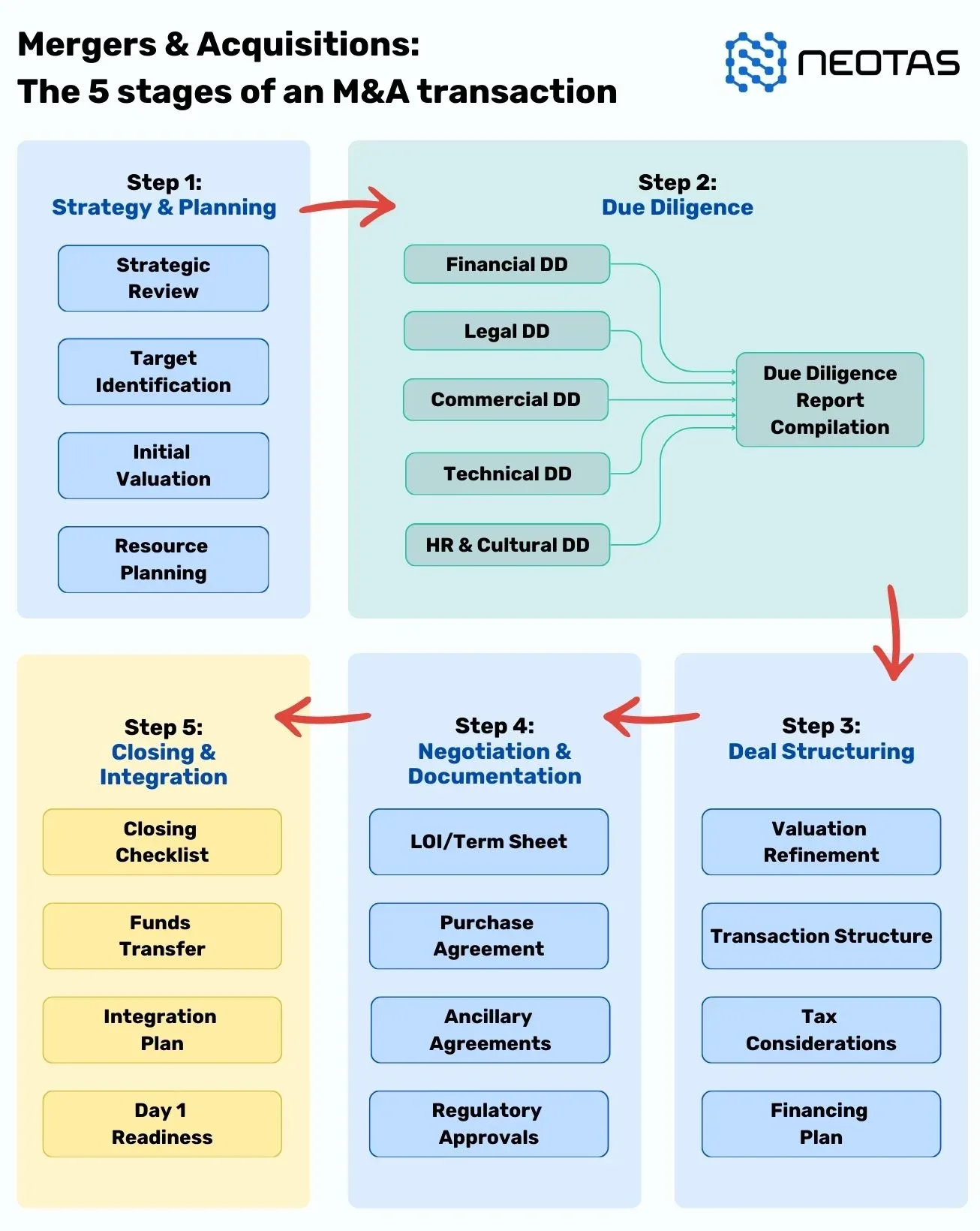

Mergers and Acquisitions (M&A) are transformative processes that can significantly alter the trajectory of companies, industries, and economies. The complexity of these transactions demands meticulous planning, strategic foresight, and rigorous execution. Whether the goal is to achieve growth, diversification, market entry, or cost synergies, understanding the five key stages of an M&A transaction is critical for all stakeholders involved.

This article provides a detailed breakdown of these stages, offering practical insights for business leaders, investors, and advisors navigating the intricate landscape of M&A.

At the outset, the parties involved must establish clear objectives for the transaction. This stage involves developing a comprehensive M&A strategy aligned with the organisation’s overarching goals.

Key Activities:

Challenges: Misaligned goals, lack of clarity in the strategic rationale, and poor due diligence frameworks can derail an M&A even before it begins.

This is the most critical stage, where the acquiring organisation evaluates the target company’s operational, financial, and legal standing. The focus here is on reducing risks and identifying potential challenges that could impact the deal.

Key Activities:

Challenges: Overlooking critical details during due diligence can lead to post-merger integration issues, unforeseen costs, or even regulatory hurdles.

Once the due diligence phase is complete, the deal moves into structuring and negotiation. The aim is to formalise an agreement that aligns the interests of both parties.

Key Activities:

Challenges: Protracted negotiations can strain relationships and erode deal value. Striking a balance between favourable terms and a cooperative spirit is essential.

The closing stage involves finalising all legal, financial, and operational components of the transaction. All necessary approvals must be secured, and the deal’s terms are executed.

Key Activities:

Challenges: Delays in approvals or financing can jeopardise the deal. Ensuring proper coordination among all parties is critical for a smooth closing.

The success of an M&A transaction is ultimately determined in the post-deal integration phase. This is where the promised synergies must be realised, and the two organisations are brought together under a unified strategy.

Key Activities:

Challenges: Poor integration planning can lead to loss of key talent, cultural clashes, and a failure to achieve projected synergies.

M&A transactions are transformative endeavours that require careful planning, diligent execution, and strategic foresight. By understanding and addressing the intricacies of the five key stages—Strategy and Planning, Target Evaluation and Due Diligence, Deal Structuring and Negotiation, Closing, and Integration—organisations can navigate the complexities of these transactions with greater confidence.

For business leaders embarking on this journey, the right preparation and professional guidance can make the difference between a transformative success and a costly misstep.

Image: ESG Due Diligence in M&A Transaction

Image: ESG Due Diligence in M&A Transaction

Investing in ESG isn’t just about compliance—it’s about driving long-term value, building resilience, and aligning with the future of responsible business. With Neotas’ ESG Due Diligence, you gain deeper insights, mitigate risks, and ensure your investments are aligned with sustainable growth.

Empower your decision-making process today and lead the way in shaping a more sustainable and responsible future.

For more information on how Neotas can support your ESG strategy, visit www.neotas.com or contact us at info@neotas.com. Connect with us on LinkedIn to stay updated on the latest industry insights and updates.

Read More on ESG Due Diligence:

Neotas Platform covers 600Bn+ archived web pages, 1.8Bn+ court records, 198M+ corporate records, global social media platforms, and 40,000+ Media sources from over 100 countries to help you build a comprehensive picture of the team. It’s a world-first, searching beyond Google. Neotas’ diligence uncovers illicit activities, reducing financial and reputational risk.

Neotas is a leader in harnessing the combined power of open-source intelligence (OSINT), along with social media, and a wide range of traditional data sources using cutting edge technology to deliver comprehensive AML solutions. We help uncover hidden risks using a combination of technology and our team of over 100 trained research analysts to protect our customers from making risky investment or other business decisions.

Don’t let hidden ESG risks derail your investment. Conduct a thorough ESG Due Diligence to identify potential compliance issues, reputational threats, and long-term sustainability challenges before finalising your M&A deal.

✔️ Mitigate financial & legal risks

✔️ Ensure regulatory compliance

✔️ Enhance investment value

✔️ Build a responsible & sustainable business

📌 Talk to Neotas ESG Due Diligence experts today! Get in touch to safeguard your transactions with a robust ESG risk assessment.

Neotas is an ESG Due Diligence Platform that leverages AI to join the dots between Corporate Records, Adverse Media and Open Source Intelligence (OSINT).

🗓️ Schedule a Call or Book a Demo of Neotas Anti-money laundering (AML) Solutions.

Make ESG due diligence a cornerstone of your M&A strategy. Equip your team with the insights, structure, and strategic advantage to navigate the complexities of modern transactions. The checklist is designed for M&A teams, investors, corporate strategists, and business leaders committed to embedding ESG into their operations and investment strategies.

This checklist is more than a guide – it’s a tool for building sustainable, resilient businesses that meet today’s demands and tomorrow’s expectations. Download “The Rising Importance of ESG Due Diligence in M&A Transactions” today and make ESG a priority in your transactions.

ESG Due Diligence is a process that identifies potential environmental, social, and governance risks within a business. This due diligence ensures that companies comply with sustainability regulations, uphold ethical business practices, and avoid ESG-related controversies.

Key Areas Assessed in ESG Due Diligence:

📌 Environmental – Carbon emissions, resource efficiency, waste management, and climate risk strategies.

📌 Social – Labour conditions, supply chain ethics, workplace diversity, and human rights policies.

📌 Governance – Board structure, corruption risks, executive compensation, and shareholder rights.

A robust ESG Due Diligence process helps companies mitigate risks, protect shareholder value, and drive sustainable business growth.

ESG Due Diligence in M&A is the structured process of evaluating a target company’s environmental, social, and governance (ESG) risks, compliance, and opportunities before a merger or acquisition.

Key Objectives of ESG Due Diligence in M&A:

✅ Identify material ESG risks that may impact valuation or legal compliance.

✅ Assess sustainability and corporate responsibility policies to align with investor expectations.

✅ Uncover governance weaknesses, such as unethical leadership, corruption risks, or lack of transparency.

✅ Ensure regulatory compliance with global and regional ESG laws, such as the EU Sustainable Finance Disclosure Regulation (SFDR) and the Corporate Sustainability Reporting Directive (CSRD).

An ESG Due Diligence checklist is a structured framework that guides investors, analysts, and compliance teams through the evaluation of ESG factors in an M&A deal.

📋 Key Components of an ESG Due Diligence Checklist:

1️⃣ Environmental Factors:

2️⃣ Social Factors:

3️⃣ Governance Factors:

A well-structured ESG Due Diligence checklist ensures thorough risk assessment and sustainable investment decisions.

Integrating ESG Due Diligence in M&A helps investors identify risks and opportunities that can influence financial performance, regulatory compliance, and brand reputation.

Top Reasons Why ESG Due Diligence is Crucial in M&A:

💰 Financial Impact: Companies with poor ESG records may face fines, lawsuits, and regulatory penalties, reducing their valuation.

🛡️ Reputation Protection: ESG scandals (e.g., human rights violations, environmental disasters) can cause brand damage and consumer backlash.

📈 Long-Term Value: Firms with strong ESG policies often outperform their peers in sustainability-focused markets.

⚖️ Regulatory Compliance: Governments worldwide are tightening ESG laws, making compliance a necessity for M&A deals.

Environmental Due Diligence in M&A refers to assessing a company’s environmental impact, legal compliance, and sustainability practices before an acquisition.

🔹 Key Focus Areas:

Failing to conduct proper environmental due diligence can expose buyers to costly lawsuits and regulatory fines.

ESG Indicators are measurable benchmarks used to evaluate a company’s ESG performance.

Key ESG Indicators:

📌 Environmental: Carbon intensity, renewable energy use, regulatory compliance.

📌 Social: Employee turnover, gender diversity, supply chain transparency.

📌 Governance: Board diversity, executive compensation, anti-corruption policies.

ESG indicators provide investors with quantifiable insights into a company’s sustainability performance.

The cost of ESG Due Diligence depends on:

Investing in ESG Due Diligence upfront can prevent costly fines and reputation damage later.

ESG Due Diligence in M&A is governed by various international regulations that require companies to disclose their sustainability risks and ESG performance.

✅ Key ESG Regulations to Consider:

Failure to comply with ESG regulations can result in heavy fines, legal liabilities, and reputational damage.

ESG Due Diligence in M&A is a multi-disciplinary effort involving various internal and external stakeholders.

Key Players Involved in ESG Due Diligence:

👥 M&A Legal Teams – Ensure regulatory compliance and ESG disclosures.

💰 Financial Analysts – Assess the financial risks of ESG liabilities.

🌱 ESG Consultants & Sustainability Experts – Evaluate the company’s environmental and social impact.

🏢 Board of Directors & Senior Management – Define the company’s ESG strategy.

📊 Third-Party Auditors – Conduct independent ESG assessments to verify data integrity.

A strong ESG Due Diligence team ensures all potential risks and opportunities are thoroughly examined.

ESG factors directly influence a company’s financial valuation in M&A transactions.

How ESG Performance Impacts Valuation:

✔️ Strong ESG Practices = Higher Valuation

❌ Poor ESG Records = Reduced Valuation & Risk Discounts

Investors are willing to pay a premium for businesses with strong ESG credentials due to reduced long-term risks.

Ignoring ESG Due Diligence can lead to:

Failure to conduct ESG Due Diligence can result in multi-million pound losses, legal disputes, and loss of investor confidence.

ESG Due Diligence in M&A helps uncover key risk areas that may impact the long-term sustainability of an acquisition.

Top ESG Risks to Consider:

Environmental Risks – Carbon emissions, climate liabilities, pollution penalties.

Social Risks – Human rights violations, labour exploitation, employee turnover.

Governance Risks – Fraud, corruption, poor leadership, board conflicts.

Identifying ESG risks early in M&A transactions helps businesses avoid post-acquisition losses.

Investors prefer businesses with strong ESG credentials because they pose lower risks and offer long-term value.

How ESG Due Diligence Increases Investment Appeal:

✅ Improves transparency – Investors trust companies that disclose ESG risks.

✅ Mitigates risks – Reduces financial and reputational exposure.

✅ Enhances resilience – Companies with strong ESG scores are better equipped to handle crises.

✅ Meets institutional investor criteria – Many investment funds require ESG compliance.

ESG Due Diligence makes businesses more attractive to sustainable investors and private equity firms.

ESG and financial due diligence go hand in hand to provide a comprehensive risk assessment in M&A.

Key Differences & Overlaps:

✔️ Financial Due Diligence focuses on:

✔️ ESG Due Diligence assesses:

Integrating ESG into financial due diligence ensures a well-rounded evaluation of a company’s long-term viability.

🔹 ESG Due Diligence = Forward-looking approach. It evaluates risks and opportunities before an investment or M&A transaction.

🔹 ESG Compliance Audits = Retrospective assessment. It ensures a company is following existing ESG regulations and standards.

While both processes are crucial, ESG Due Diligence in M&A is essential for identifying pre-transaction risks.

Private equity and venture capital (VC) firms increasingly prioritise ESG factors when making investment decisions.

📌 Why ESG Matters in Private Investments:

✅ Reduces investment risks associated with climate and governance issues.

✅ Attracts institutional investors who prefer ESG-aligned portfolios.

✅ Enhances exit value by improving long-term sustainability metrics.

Many PE and VC firms now require ESG Due Diligence before funding startups or acquiring businesses.

Major ESG Red Flags to Watch For:

❌ Unreported environmental violations (e.g., past pollution fines).

❌ Lack of board diversity and governance transparency.

❌ Poor supply chain management (e.g., child labour, unethical sourcing).

❌ Failure to disclose carbon emissions or sustainability targets.

Spotting ESG red flags early prevents post-acquisition liabilities and reputational damage.

The duration of ESG Due Diligence in M&A depends on factors such as deal size, industry, regulatory requirements, and data availability. While timelines vary, you can estimate the time required using these key factors:

🔹 Key Factors Affecting ESG Due Diligence Timeline

🔹 How to Estimate the Timeline?

1️⃣ Define the Scope – Is it a high-level review or a deep ESG risk assessment?

2️⃣ Assess Target Readiness – Are ESG disclosures available, or is data collection needed?

3️⃣ Account for Compliance Needs – More regulations = longer due diligence.

4️⃣ Plan for Delays – Legal approvals, stakeholder availability, and third-party audits can slow the process.

🔹 Estimating ESG Due Diligence Budget

💰 Costs vary based on:

🔹 Tips to Save Time & Costs

✅ Start early and prioritise material ESG risks.

✅ Use existing ESG reports where available.

✅ Leverage ESG technology for faster data analysis.

✅ Engage experienced ESG consultants to streamline the process.

💡 The more prepared the target company, the faster and more cost-efficient ESG Due Diligence will be.

Neotas Enhanced Due Diligence covers 600Bn+ Archived web pages, 1.8Bn+ court records, 198M+ Corporate records, Global Social Media platforms, and more than 40,000 Media sources from over 100 countries to help you screen & manage risks.

esg due diligence

esg supply chain due diligence

due diligence esg

esg due diligence checklist

esg due diligence services

esg due diligence framework

esg due diligence meaning

esg vendor due diligence

esg due diligence report

due diligence critères esg

esg due diligence private equity

esg due diligence methodology

esg due diligence process

esg due diligence support for private equity

what is esg due diligence

esg due diligence checklist pdf

esg due diligence audit

esg due diligence m&a

esg due diligence course

due diligence rse esg

esg due diligence checklist real estate

esg due diligence report pdf

esg due diligence and risk assessments

esg m&a due diligence

pwc esg due diligence

esg in due diligence

esg due diligence questionnaire

m&a and esg due diligence

esg due diligence definition

esg due diligence jobs

esg due diligence ey

hvad er esg due diligence

esg due diligence kpmg

kpmg esg due diligence survey 2023

global esg due diligence+ study 2024

esg investment operational due diligence

esg due diligence in m&a

esg due diligence real estate

esg due diligence deloitte

invest europe esg due diligence questionnaire

esg due diligence erneuerbare energien

esg-due-diligence

private equity esg due diligence

esg due diligence provider vectra

kpmg esg due diligence

kpmg esg due diligence survey

esg due diligence providers

esg due diligence immobilien

esg due diligence provider

deloitte esg due diligence

esg due diligence

esg supply chain due diligence

esg due diligence checklist

due diligence esg

esg due diligence report

esg due diligence jobs

esg due diligence meaning

what is esg due diligence

esg vendor due diligence

esg due diligence services

esg due diligence report pdf

esg due diligence questionnaire

esg due diligence framework

esg due diligence private equity

esg due diligence checklist pdf

kpmg esg due diligence survey

esg due diligence support for private equity

esg due diligence ey

ey esg due diligence

esg due diligence uk

esg due diligence audit

eu esg due diligence

esg m&a due diligence

esg due diligence report template

invest europe esg due diligence questionnaire

private equity esg due diligence

esg due diligence questionnaire template

esg due diligence kpmg

due diligence rse esg

esg due diligence erneuerbare energien

esg due diligence checklist pdf free

esg due diligence scope of work

esg due diligence deloitte

deloitte esg due diligence

esg due diligence methodology

pwc esg due diligence

esg due diligence provider

esg due diligence checklist excel download

m&a esg due diligence

esg due diligence checklist excel pdf

esg due diligence tool

esg due diligence questions

esg due diligence in m&a

due diligence critères esg

esg due diligence immobilien

esg due diligence m&a

esg investment operational due diligence

esg in due diligence

esg due diligence process

esg due diligence checklist pdf free download

esg due diligence checklist real estate

esg due diligence questionnaire example

esg due diligence checklist pdf download

esg due diligence questionnaire sample

esg due diligence real estate

esg due diligence checklist template

esg due diligence pwc

kpmg esg due diligence survey 2023

esg fund due diligence questionnaire

kpmg esg due diligence

esg due diligence checklist excel

esg due diligence providers

esg due diligence report sample

esg due diligence definition

esg due diligence checklist excel free download

esg due diligence course

over half of m&a dealmakers have cancelled deals on esg due diligence findings: kpmg survey

esg due diligence checklist excel free

esg due diligence in private equity

esg due diligence

esg diligence

due diligence esg

esg due dilligence

esg due diligence report

esg due diligence framework

esg due diligence private equity

financial due diligence checklist pwc

esg due diligence checklist

esg agenda meaning

esg due diligence questionnaire

environmental and social due diligence

esg supply chain due diligence

environmental and social due diligence

esg due diligence

esg process

esg due dilligence

esg diligence

due diligence esg

esg due diligence report

esg due diligence checklist

esg due diligence framework

esg proces

due diligence sustainability assessment

esg assessment assess your investments & supply chain

esg due diligence private equity

diligence process

esg due diligence questionnaire

due diligence risk

due deligence process

risk due diligence

due diligence risk assessment

due diligence processes

environmental due diligence checklist

due diligence process meaning

performing due diligence

conduct due diligence meaning

esg risk meaning

how to perform due diligence

importance of due diligence

diligent esg

due diligence program

esg testing

due diligence and risk management

due diligence efforts

due diligence risk management

due diligence importance

due diligence in risk management

due diligence policy and procedure

diligent insight

conduct diligence

due diligence is

perform due diligence

performed due diligence

risk assessment and due diligence

the esg

due diligence management

environmental social and governance risk

due diligence and risk assessment

esg investment risk

esg risk assessments

esg risks definition

esg due diligence

esg diligence

esg due dilligence

esg due diligence report

due diligence esg

esg due diligence framework

esg due diligence private equity

esg assessment assess your investments & supply chain

esg due diligence checklist

esg investment analysis

esg investment process

should investors be concerned with esg

esg due diligence questionnaire

a practical guide to esg integration for equity investing

investors esg

investors and esg

is esg an equity factor or just an investment guide

esg investing analysis

esg investment analysis tool

esg risk factors in a portfolio context

esg due diligence

esg diligence

esg due dilligence

esg due diligence report

due diligence esg

esg due diligence framework

esg due diligence private equity

esg assessment assess your investments & supply chain

esg due diligence checklist

esg investment analysis

esg investment process

should investors be concerned with esg

esg due diligence questionnaire

a practical guide to esg integration for equity investing

investors esg

investors and esg

is esg an equity factor or just an investment guide

esg investing analysis

esg investment analysis tool

esg risk factors in a portfolio context

esg due diligence

esg diligence

due diligence esg

esg due dilligence

esg due diligence report

esg due diligence framework

specialized due diligence

due diligence study

esg in m&a

esg m&a

esg premium

for financial institutions esg is only about mitigating risks

what is specialized due diligence

bcg esg

esg in m&a training

esg deals

esg due diligence

esg due diligence report

esg due diligence framework

esg diligence

esg due diligence checklist

due diligence esg

esg due dilligence

kpmg due diligence checklist

esg due diligence questionnaire

vendor due diligence questionnaire pdf

esg due diligence

fti consulting esg

due diligence esg

esg due dilligence

esg diligence

esg due diligence report

esg due diligence private equity

due diligence sustainability assessment

esg due diligence framework

for financial institutions esg is only about mitigating risks

esg due diligence questionnaire

energy management due diligence assessment consulting

esg due diligence

esg due diligence report

esg diligence

esg due dilligence

due diligence esg

esg due diligence questionnaire

esg verification

esg due diligence checklist

esg due diligence framework

esg supply chain due diligence

esg supply chain assessment

esg due diligence

esg supplier

esg due diligence checklist

esg due dilligence

esg due diligence report

supplier esg assessment

esg diligence

due diligence on suppliers

due diligence esg

due diligence supplier

esg assessment assess your investments & supply chain

esg due diligence questionnaire

supplier due diligence checklist

esg compliance checklist

esg due diligence framework

supply chain due diligence checklist

esg testing

due diligence sustainability assessment

esg assessments

supplier due diligence process

esg vendors

vendor compliance checklist

supplier due diligence

esg and value chain reporting software

esg screening tool

energy management due diligence assessment

energy management due diligence assessment solutions

energy management due diligence assessment services

supplier due diligence report

supplier due dilligence

ilpa ddq

ilpa due diligence questionnaire

esg due diligence

esg diligence

esg due diligence private equity

esg ddq

esg due diligence framework

esg due diligence checklist

esg due dilligence

gp esg

esg investment decisions

esg due diligence questionnaire

esg due diligence report

private equity due diligence framework

due diligence esg

ilpa esg

investment due diligence

ilpa ddq template

due diligence investment

due diligence partners

private equity due diligence process

esg idp

investment due dilligence

is esg an equity factor or just an investment guide

due diligence for investors

ilpa esg assessment framework

pre investment due diligence

esg due diligence

esg diligence

due diligence esg

esg due dilligence

esg due diligence framework

esg due diligence report

environmental and social due diligence

esg due diligence checklist

esg due diligence checklist

esg ddq

esg questionnaire

esg due diligence questionnaire

due diligence questionnaire

private equity due diligence checklist pdf

esg due diligence

ddq private equity

esg questions

esg survey questions

private equity due diligence questionnaire

esg due dilligence

due diligence questionnaire example

a blank is invested by managers

esg diligence

ddq template

due diligence questionnaire pdf

due diligence questionnaire template

due diligence questionnaire for investment managers

ddq questionnaire

ddq example

portfolio management system due diligence questionnaire

esg due diligence report

esg due diligence private equity

portfolio esg

due diligence questionnaires

due diligence questionnaire for hedge funds

due diligence esg

hedge fund due diligence questionnaire

vendor due diligence questionnaire pdf

iso 14001 is a system that manages a firm’s impact on blank______.

private equity investment due diligence checklist

private equity due diligence checklist

ddq finance

what is ddq in finance

due diligence questions to ask when investing in a business

list of esg private equity funds

enhanced due diligence questionnaire

what is a due diligence questionnaire

investor portfolio companies template

ilpa due diligence questionnaire

esg checklist

private equity and esg

private equity investment checklist

hedge fund ddq

due diligence investment

esg screening tool

examples of esg companies

private equity operational due diligence pdf

equity esg

esg due diligence

esg due diligence report

esg due diligence framework

esg diligence

esg due diligence checklist

due diligence esg

esg due dilligence

kpmg due diligence checklist

esg due diligence questionnaire

vendor due diligence questionnaire pdf

esg due diligence checklist

esg due diligence report

environmental due diligence checklist

esg due diligence questionnaire

esg compliance checklist

due diligence esg

esg checklist

due diligence sustainability assessment

esg supply chain due diligence

environmental and social due diligence

esg due diligence

esg process

esg due dilligence

esg diligence

due diligence esg

esg due diligence report

esg due diligence checklist

esg due diligence framework

esg proces

due diligence sustainability assessment

esg assessment assess your investments & supply chain

esg due diligence private equity

diligence process

esg due diligence questionnaire

due diligence risk

due deligence process

risk due diligence

due diligence risk assessment

due diligence processes

environmental due diligence checklist

due diligence process meaning

performing due diligence

conduct due diligence meaning

esg risk meaning

how to perform due diligence

importance of due diligence

diligent esg

due diligence program

esg testing

due diligence and risk management

due diligence efforts

due diligence risk management

due diligence importance

due diligence in risk management

due diligence policy and procedure

diligent insight

conduct diligence

due diligence is

perform due diligence

performed due diligence

risk assessment and due diligence

the esg

due diligence management

environmental social and governance risk

due diligence and risk assessment

esg investment risk

esg risk assessments

esg risks definition

esg due diligence checklist

esg due diligence

esg due dilligence

esg due diligence questionnaire

esg due diligence report

esg diligence

due diligence esg

esg due diligence framework

due diligence blog

esg due diligence checklist

esg due diligence

esg due dilligence

esg due diligence questionnaire

esg due diligence report

esg diligence

due diligence esg

esg due diligence framework

due diligence blog

esg investing

what is esg investing

esg investing trends

missouri esg investing rule blocked

esg investing stocks

esg investing meaning

esg investing funds

esg investing definition

esg impact investing

esg sri investing

certificate in esg investing

esg and impact investing

sustainable investing esg

best platforms for esg investing

cfa esg investing

thematic investing esg

esg investing private equity

esg and sustainable investing

what is esg in investing

esg sustainable investing

esg investing companies

esg based investing

esg in investing

thematic esg investing

esg investing defined

cfa certificate in esg investing

esg vs impact investing

esg focused investing

define esg investing

esg investing vs impact investing

blackrock esg investing

esg investing platforms

does esg investing outperform

esg investing means

does esg investing work

investing esg

esg investing principles

types of esg investing

impact investing vs esg

what does esg stand for in investing

esg socially responsible investing

what does esg investing stand for

esg investing strategy

esg investing for insurance portfolios

esg investing news

esg investing stock

investing in esg

esg investing jobs

esg investing australia

esg and responsible investing

esg and investing

the growing trend of esg investing bloomberg

future of esg investing

what is esg investing?

esg investing growth

esg investing strategies

impact investing esg

esg investing examples

what is sustainable investing esg

difference between esg and impact investing

investing in esg funds

esg investing solutions

sri investing vs esg

esg factors in investing

esg real estate investing

what is esg impact investing

environmental social and governance esg investing

growth in esg investing

definition esg investing

is esg investing good

definition of esg investing

advantages of esg investing

why is esg investing important

benefits of esg investing

esg investing explained

esg investing real estate

esg investing cfa

esg investing analysis

esg investing options

socially responsible investing vs esg

esg investing firms

esg investing online course

what does esg investing mean

esg and sri investing

anti esg investing

esg investing climate change

esg investing certificate

esg investing performance

top platforms for esg-focused investing

how does esg investing work

esg investing fidelity

pros and cons of esg investing

esg investing certification

esg investing for insurance

growth of esg investing

esg responsible investing

esg investing statistics

what does esg mean in investing

esg investing and analysis

esg investing

esg reporting software

esg reporting software market

best esg reporting software

sustainability esg reporting software

esg reporting software companies

oil & gas esg reporting software

esg reporting and sustainability software

esg reporting frameworks software

esg reporting software uk

esg and value chain reporting software

esg reporting software cost

best esg reporting software in india

esg reporting software for real estate

investor esg reporting software

esg management and reporting software

esg reporting software market size

esg reporting software gartner

software esg reporting

top esg reporting software

free esg reporting software

cloud-based esg reporting software

top esg reporting software in india

automated esg reporting software

esg reporting software australia

market guide for esg management and reporting software

esg reporting frameworks

esg reporting standards and frameworks

list of esg reporting frameworks

how sasb integrates with esg reporting frameworks

esg reporting frameworks software

esg reporting frameworks and initiatives

esg reporting frameworks and standards

comparison of esg reporting frameworks

esg reporting frameworks comparison

big three esg reporting frameworks

different esg reporting frameworks

which of the four esg reporting frameworks is the most widely used?

how many esg reporting frameworks are there

what are esg reporting frameworks

most popular esg reporting frameworks

nareit guide to esg reporting frameworks

big 3 esg reporting frameworks

reporting frameworks for esg

what are the frameworks for esg reporting?

global esg reporting frameworks

there are many esg reporting frameworks. which organization’s framework has been around the longest?

evolution of esg reporting frameworks

esg reporting frameworks are aligned to

2023 gartner® market guide for esg management and reporting software

green quadrant: esg reporting and data management software

microsoft esg reporting software

esg reporting software sustainiq

esg reporting software solutions

esg reporting software in india

software for esg reporting

sustainability & esg reporting software

esg reporting software comparison

global esg reporting software market

emerging tech: sustainability and esg software providers focus on simplifying esg reporting

software für esg reporting

sustainability accounting software for esg reporting.

esg reporting software, companies

esg reporting

esg reporting requirements

esg reporting solution

esg reporting software

what is esg reporting

esg reporting standards

esg sustainability reporting

esg reporting tools

esg reporting framework

esg reporting frameworks

esg reporting platform

esg reporting services

esg reporting uk

california esg reporting requirements

esg reporting software market

sec esg reporting requirements

esg reporting examples

corporate esg reporting

esg reporting dashboard

esg reporting companies

esg reporting certification

sec esg reporting

is esg reporting mandatory

esg reporting tool

esg data reporting

esg reporting meaning

esg reporting solutions

esg reporting courses

esg reporting partners

california esg reporting

esg reporting regulations

esg corporate reporting

how to do esg reporting

esg reporting process

esg reporting consultant

reporting esg

best esg reporting software

esg reporting platforms

esg reporting pflicht

esg reporting training

sustainability esg reporting software

is esg reporting mandatory in usa

esg reporting template

benefits of esg reporting

esg data management & reporting

esg reporting standards and frameworks

esg reporting australia

esg and sustainability reporting

workiva esg reporting

esg reporting jobs

esg reporting metrics

what is esg reporting standards

sustainability esg reporting

esg reporting and sustainability performance management

uk esg reporting requirements

sustainability and esg reporting

what is esg reporting and why is it important

best esg reporting tools

esg financial reporting

esg reporting data

esg reporting and disclosure

data center esg reporting

esg reporting requirements us

esg reporting challenges

csr vs esg reporting

list of esg reporting frameworks

esg vs sustainability reporting

esg reporting service

esg reporting technology

esg reporting trends

esg reporting consultants

supply chain esg reporting

why is esg reporting important

esg-reporting

esg reporting standard

esg reporting outsourcing

esg reporting requirements sec

esg reporting guide

difference between esg and sustainability reporting

best esg reporting

challenges of esg reporting

esg sec reporting

esg reporting software companies

esg investment reporting

oil & gas esg reporting software

global esg reporting standards

esg reporting and sustainability software

esg financial reporting requirements

senior manager esg reporting salary

difference between esg reporting and sustainability reporting

esg compliance reporting

similarities between sustainability and esg reporting

how sasb integrates with esg reporting frameworks

sustainability reporting esg

esg performance reporting

csrd esg reporting

ai in esg reporting

sfdr esg reporting

esg reporting österreich

esg reporting course

We leverage Open source intelligence (OSINT) to use publicly available data to provide organisations with hyper-accurate and fully auditable insights with no false positives.

Improve analyst efficiencies, including cost and time reduction of minimum 25% with zero false positives.

The FCA recommends open source Internet checks as best practice (FG 18/5). Manage and reduce risk by incorporating 100% of online sources into your processes.

Manage risk with hyper accurate ongoing monitoring. We will monitor 100% of publicly available online data to help identify relevant risks.

The Neotas Platform covers 600Bn+ archived web pages, 1.8Bn+ court records, 198M+ corporate records, global social media platforms, and 40,000+ media sources from over 100 countries to help you build a comprehensive risk assessment of individuals, entities, and their networks.

Neotas Platform covers 600Bn+ archived web pages, 1.8Bn+ court records, 198M+ corporate records, global social media platforms, and 40,000+ Media sources from over 100 countries to help you build a comprehensive picture of the team.

| Cookie | Duration | Description |

|---|---|---|

| AWSALBTG | 7 days | AWS Application Load Balancer Cookie. Load Balancing Cookie: Used to encode information about the selected target group. |

| AWSALBTGCORS | 7 days | AWS Classic Load Balancer Cookie: Used to map the session to the instance. This cookie is identical to the original ELB cookie except for the attribute &SameSite=None; |

| cookielawinfo-checkbox-advertisement | 1 year | Set by the GDPR Cookie Consent plugin, this cookie is used to record the user consent for the cookies in the "Advertisement" category . |

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| CookieLawInfoConsent | 1 year | Records the default button state of the corresponding category & the status of CCPA. It works only in coordination with the primary cookie. |

| debug | never | Cookie used to debug code and website issues |

| shown | session | Session cookie to control number of times a pop up is shown. |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| __cf_bm | 30 minutes | This cookie, set by Cloudflare, is used to support Cloudflare Bot Management. |

| AnalyticsSyncHistory | 1 month | Used to store information about the time a sync took place with the lms_analytics cookie |

| bcookie | 2 years | LinkedIn sets this cookie from LinkedIn share buttons and ad tags to recognize browser ID. |

| bscookie | 2 years | LinkedIn sets this cookie to store performed actions on the website. |

| lang | session | LinkedIn sets this cookie to remember a user's language setting. |

| lidc | 1 day | LinkedIn sets the lidc cookie to facilitate data center selection. |

| UserMatchHistory | 1 month | LinkedIn sets this cookie for LinkedIn Ads ID syncing. |

| Cookie | Duration | Description |

|---|---|---|

| li_gc | 2 years | Used to store consent of guests regarding the use of cookies for non-essential purposes |

| rl_anonymous_id | 1 year | Generates an unique anonymous Id to identify a user and attach to a subsequent event. |

| rl_user_id | 1 year | to store a unique user ID for the purpose of Marketing/Tracking |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | The _ga cookie, installed by Google Analytics, calculates visitor, session and campaign data and also keeps track of site usage for the site's analytics report. The cookie stores information anonymously and assigns a randomly generated number to recognize unique visitors. |

| _gat_gtag_UA_107495977_1 | 1 minute | Set by Google to distinguish users. |

| _gat_UA-107495977-1 | 1 minute | A variation of the _gat cookie set by Google Analytics and Google Tag Manager to allow website owners to track visitor behaviour and measure site performance. The pattern element in the name contains the unique identity number of the account or website it relates to. |

| _gcl_au | 3 months | Provided by Google Tag Manager to experiment advertisement efficiency of websites using their services. |

| _gid | 1 day | Installed by Google Analytics, _gid cookie stores information on how visitors use a website, while also creating an analytics report of the website's performance. Some of the data that are collected include the number of visitors, their source, and the pages they visit anonymously. |

| attribution_user_id | 1 year | This cookie is set by Typeform for usage statistics and is used in context with the website's pop-up questionnaires and messengering. |

| CONSENT | 2 years | YouTube sets this cookie via embedded youtube-videos and registers anonymous statistical data. |

| Cookie | Duration | Description |

|---|---|---|

| _fbp | 3 months | This cookie is set by Facebook to display advertisements when either on Facebook or on a digital platform powered by Facebook advertising, after visiting the website. |

| fr | 3 months | Facebook sets this cookie to show relevant advertisements to users by tracking user behaviour across the web, on sites that have Facebook pixel or Facebook social plugin. |

| IDE | 1 year 24 days | Google DoubleClick IDE cookies are used to store information about how the user uses the website to present them with relevant ads and according to the user profile. |

| test_cookie | 15 minutes | The test_cookie is set by doubleclick.net and is used to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | A cookie set by YouTube to measure bandwidth that determines whether the user gets the new or old player interface. |

| YSC | session | YSC cookie is set by Youtube and is used to track the views of embedded videos on Youtube pages. |

| yt-remote-connected-devices | never | YouTube sets this cookie to store the video preferences of the user using embedded YouTube video. |

| yt-remote-device-id | never | YouTube sets this cookie to store the video preferences of the user using embedded YouTube video. |

| yt.innertube::nextId | never | This cookie, set by YouTube, registers a unique ID to store data on what videos from YouTube the user has seen. |

| yt.innertube::requests | never | This cookie, set by YouTube, registers a unique ID to store data on what videos from YouTube the user has seen. |