Enhanced Due Diligence for High Risk Customers

By Michael Harris MCMI, Head of Financial Crime Risk, Neotas

There is growing concern that disinformation and so-called “reputation laundering” campaigns could be used by high-risk customers to illegitimately pass enhanced due diligence checks.

Additionally, such campaigns could undermine the introduction of sanctions on high-risk individuals, as well as impede financial crime compliance teams in their assessment of customer risk.

Disinformation Campaigns

Disinformation campaigns typically seek to positively distort the reputation of a high-risk individual seeking to hide an unsavoury past.

They are orchestrated by PR firms, lawyers and accountants, who disseminate and build complex networks of false information, making it difficult for banks and other institutions to track the origins of their success or their sources of wealth.

The rebranding of a high-risk customer’s reputation can be so successful that without a sufficiently diligent approach, they are able to pass enhanced due diligence checks.

Customer Due Diligence (CDD) Complications

When initial risk assessment findings show that a potential client is a wealthy individual then this usually leads to a need for enhanced due diligence. If the customer is a politically exposed person (PEP) or from a higher risk jurisdiction known for corruption then the need for more stringent checks intensifies.

In recent times, important parts of customer due diligence (CDD) onboarding checks have been made more difficult than ever.

Banks conducting Sources of Wealth (SOW) and adverse media checks must continually battle against recent trends which have made this type of due diligence work even more challenging:

- Data Privacy Laws such as GDPR have complicated matters – particularly ‘the right to be forgotten’, whereby an individual has the right to request information about them held on file be removed, where there is no longer a legitimate use.

This can even extend to information about them on the internet which has been indexed by one of the search engines, which they can request to be removed based on the provider’s removal criteria. - Image and business re-engineering – sometimes referred to as “reputation laundering”. The reengineering of public personas to legitimise a high-risk individual’s business affairs. Reputations are “washed” clean, with any negative media buried under a barrage of manufactured positivity.

Follow The Money

In the due diligence community there is a phrase which basically says, ‘check how the person made their first million’. In other words, what are the origins of the current wealth portfolio?

Money laundering techniques for the layering of dirty money from corruption, trafficking, organised crime or any other illegal activity are renowned for disguising the original sources of money through a myriad of schemes.

A common tool is to create very complex corporate structures (with the help of a complicit lawyer) through which money can be transferred from company to company, making the trail practically unauditable (with the help of a complicit accountant). Use of trusts, offshore and shell companies, nominee shareholders and directors (proxies) are all tools of the trade.

This is how so many oligarchs and other Ultra HNWIs (High Net Worth Individuals) can easily buy high-end property and other luxury assets, as conducting due diligence on companies set up for this purpose where no beneficial owner can be found is very difficult.

In response, the UK Government, in its economic crime bill, announced the creation of a Register of Beneficial Owners of Overseas Entities, in theory compelling the UBO (Ultimate Beneficial Owner) to be found and registered.

Manufacture The Reputation

Once it is extremely difficult to link the current wealth portfolio and assets with any original corruption, the oligarch/UHNWI can set about “buying a seat at the table”.

Typically, this involves investment into western cultural and entertainment industries including universities, the arts and sport, influencing governments and manufacturing a positive reputation (with the help of PR agencies and image consultants).

A major criticism of the recent purchase of Newcastle United Football Club by the Saudi Arabian Public Investment Fund is their very close association with the Saudi state. Critics have labelled the move an act of “sportwashing”, where a sporting institution will be used to help clean up the reputation of an owner or investor.

Enhanced Due Diligence for High Risk Customers – Recent Cases

An interesting recent case in point is how Russian-born oligarch Alisher Usmanov is attempting to get himself and his two sisters removed from the EU sanctions list.

Usmanov, who has a personal wealth of $20bn, made his money from metal and mining operations and has previously faced allegations of sportswashing due to his associations with Premier League football clubs Arsenal and Everton.

Following his placement on EU sanctions lists in March, a statement from Usmanov claimed that ownership of their assets is fully transparent and legitimate, while the Credit Suisse data that the EU’s case is built on is “fake and incorrect”.

Documents relating to his application to be taken off the sanctions list have not been made public. His history is a classic case of image and business reengineering over a period of many years.

New Guidance For Overcoming “Fake News” In EDD

The Wolfsberg Group recently issued new guidance on adverse media screening, which can help guide banks and financial institutions into managing high risk customers.

The guide gives detailed advice on carrying out negative news screening (adverse media) for financial institutions, highlighting the pitfalls and dangers of the sources of information used for these checks, as well as advice on how to check their legitimacy.

They call out the problem of “disinformation” or false/fake news and insist that only by carefully evaluating the sources can this be mitigated.

Download Our Report: The Risk-Based Approach: How Open Source Intelligence (OSINT) Is Transforming Enhanced Due Diligence And Investigations In AML Compliance

Using Open Source Intelligence

Given the level of complexity used in the schemes to launder money and manufacture reputations, appropriate levels of due diligence should be aided by advanced technology.

Open source intelligence tools like the Neotas Platform will build a complete picture of a high-risk individual and can help in identifying sources of wealth, analysing the legitimacy of news sources and mapping out a complete network picture.

Investigations using the Neotas Platform are not limited time or international jurisdictions, and can be processed in multiple languages – enabling a more thorough analysis of a high-risk individual with a globalised background.

Although reputations may have been reengineered, not every track will have been covered. There will be a remaining footprint out there tying the individual to their sources and origins of wealth and original associates, a footprint that can only be uncovered using enhanced technology.

As the analyst starts digging, the truth will start to emerge.

To find out more about the Neotas Platform, Customer Due Diligence or open source intelligence, schedule a call with our team here.

At Neotas, we remain committed to excellence in Enhanced Due Diligence. Let’s continue to drive excellence in due diligence.

Thank you for your continued support and engagement with Neotas. Should you have any questions or require further information, please do not hesitate to reach out.

About Neotas Enhanced Due Diligence

Neotas Platform covers 600Bn+ archived web pages, 1.8Bn+ court records, 198M+ corporate records, global social media platforms, and 40,000+ Media sources from over 100 countries to help you build a comprehensive picture of the team. It’s a world-first, searching beyond Google. Neotas’ diligence uncovers illicit activities, reducing financial and reputational risk.

Enhanced Due Diligence Solutions:

- Enhanced Due Diligence

- Management Due Diligence

- Customer Due Diligence

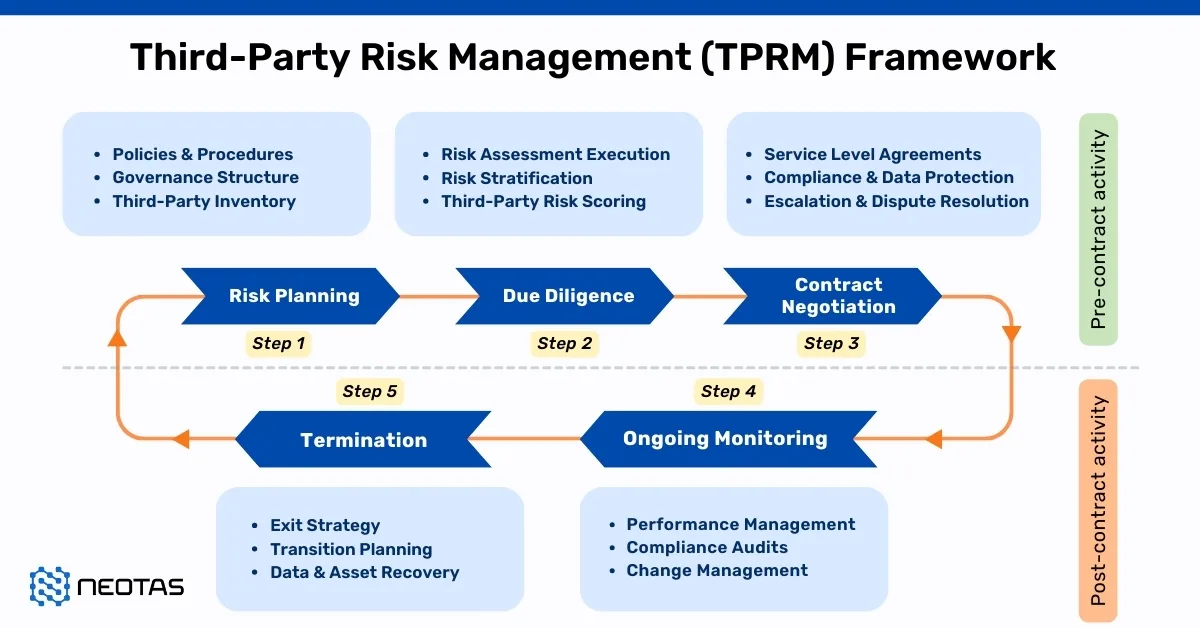

- Third Party Risk Management

- Open Source Intelligence (OSINT)

- Introducing the Neotas Enhanced Due Diligence Platform

Enhanced Due Diligence Case Studies:

- Case Study: OSINT for EDD & AML Compliance

- Overcoming EDD Challenges on High Risk Customers

- Neotas Open Source Intelligence (OSINT) based AML Solution sees beneath the surface

- ESG Risks Uncovered In Investigation For Global Private Equity Firm

- Management Due Diligence Reveals Abusive CEO

- Ongoing Monitoring Protects Credit Against Subsidiary Threat

- AML Compliance and Fraud Detection – How to Spot a Money Launderer and Prevent It

New Whitepaper and Checklist

New Whitepaper and Checklist