Smarter Risk Insights, Faster Decisions

Transform your risk management strategy with our AI-powered intelligence platform. We turn complex data into crystal-clear insights, so you can make faster, smarter decisions.

Ready to gain a competitive edge?

Enhanced Due Diligence Platform

Industry-Leading Risk Intelligence,

Tailored to Your Business Case

At Neotas, we believe that clarity is power. By combining cutting-edge AI with global insights, we help organisations like yours navigate risk with confidence. From third-party assessments to customer onboarding, our solutions provide deep, actionable intelligence that transforms the way you work.

Third-Party Risk Management (TPRM)

Managing third-party risks is critical in today’s global business environment. Our TPRM solution provides deep-dive insights into financial, reputational, and compliance risks—empowering businesses to secure their supply chains and make informed decisions.

Global Screening & Continuous Monitoring

Detect emerging risks across vendors, suppliers, and partners in real-time.

Regulatory Readiness and Compliance Alignment

Stay compliant with FCA, SEC, AML, ESG, and industry-specific regulations.

Sector-Specific Risk Insights

Tailored intelligence for financial services, manufacturing, and technology industries.

Early Warning System

Get proactive alerts before risks escalate into costly disruptions.

KYC & Customer Risk Solutions

We streamline customer onboarding, due diligence, and risk monitoring in one intelligent platform—reducing costs while enhancing compliance efficiency. The Neotas platform ensures compliance with global regulations while accelerating onboarding and reducing manual effort.

Unified KYC/AML Platform

Onboard, verify, and monitor customers in a single seamless workflow.

Comprehensive Risk Coverage

Identify sanctions, PEPs, adverse media, and corporate structures instantly.

Advanced OSINT Capabilities

Deep web and social media analysis to uncover hidden risks.

Automated Case Management

Full audit trails ensure regulatory-ready documentation.

Global Multilingual Support

Conduct risk assessments across 30+ languages.

Seamless API Integration

Easily connects with existing systems for a frictionless compliance process.

Enhanced Due Diligence (EDD)

Standard background checks don’t go far enough. Our EDD reports provide deeper intelligence, revealing risks that traditional screening often misses. EDD empowers businesses with the intelligence needed to mitigate high-risk engagements and strengthen compliance.

Detect High-Risk Entities

Screen PEPs, sanctions, and financial crime associations.

Map Hidden Risk Networks

Leverage OSINT and deep web intelligence for deeper risk insights.

Verify Corporate Beneficiaries

Assess ownership, directorships, and financial health with precision.

Assess Integrity & Reputation

Identify adverse media, fraud risks, and credibility gaps.

Multi-Jurisdiction Compliance

Conduct multilingual risk checks across global jurisdictions.

Regulator-Ready Reports

Generate clear, actionable reports for compliance and due diligence.

Investigations & Forensic Risk Analysis

Our investigative tools empower businesses to detect and mitigate fraud, financial crime, and cybersecurity threats with unmatched precision. By connecting fragmented data points, we provide businesses with a complete and actionable risk intelligence framework—empowering them to make smarter, faster decisions.

Corporate Intelligence & Crisis Management

Proactively monitor threats, reputational risks, and operational vulnerabilities.

Forensic Investigations

Leverage advanced AI to analyse dark web data, social networks, and undisclosed risk indicators.

Data Correlation & Pattern Recognition

Identify hidden relationships between individuals, companies, and financial networks.

Enhanced Due Diligence & Risk Profiling

Uncover undisclosed associations, fraudulent activities, and compliance gaps.

Visual Risk Mapping

Graph-based analytics provide a clear, real-time view of complex risk networks.

AI-Powered Risk Processing

Investigate in multiple global languages to ensure jurisdictional compliance.

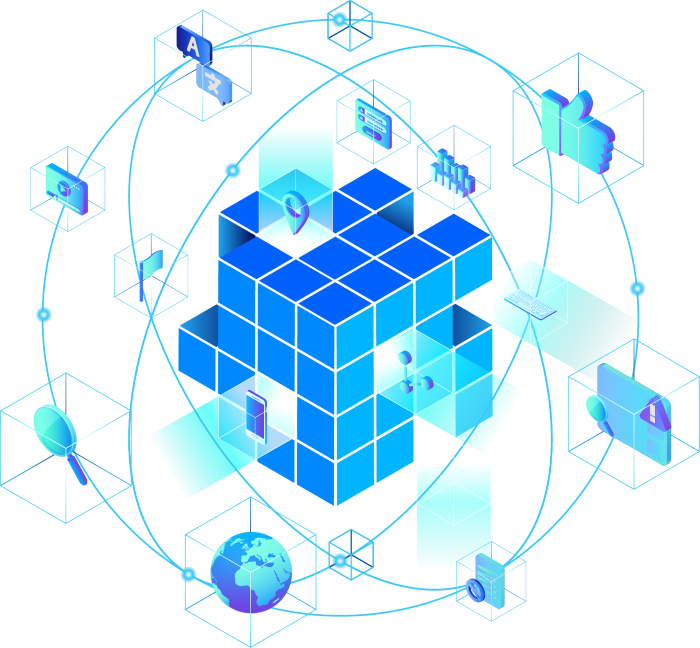

Uncover Complex Risks & Connect the Dots with AI-Driven Analysis

Unlock the Power of AI-Driven Intelligence

to Mitigate Risk & Prevent Financial Crime

AI-Powered Intelligence

Detect hidden risks with cutting-edge technology that others fail to see.

Global Data Coverage

Access industry-specific intelligence tailored to every jurisdiction.

Continuous Monitoring

Stay one step ahead with real-time alerts and proactive risk management.

Unmatched Risk Intelligence Across All Industries

An advanced Due Diligence Platform that leverages AI to join the dots between Social Media, Corporate Records, Adverse Media and Open Source Intelligence (OSINT).

Data-driven decisions that save time, money, and safeguard your reputation.

At Neotas, we believe that clarity is power. By combining cutting-edge AI with global insights, we help organisations like yours navigate risk with confidence. From third-party assessments to customer onboarding, our solutions provide deep, actionable intelligence that transforms the way you work.

Clarity, Speed and Precision

The Neotas Advantage: Secure, Scalable, and Smart

Make risk management a competitive advantage – We leverage Open source intelligence (OSINT) to use publicly available data to provide organisations with hyper-accurate and fully auditable insights with no false positives.

Real-Time, Actionable Intelligence

Our platform offers the most advanced insights, so you can respond to risks immediately.

Comprehensive Global Coverage

With insights spanning over 200 jurisdictions, your business is never in the dark.

Scalable Solutions

Whether you manage a small portfolio or a global enterprise, our platform adapts to your needs

Book A Demo

Mitigate Business Risk with Neotas Platform

Case Studies

Our clients can choose to use our advanced technology to interrogate vast data sources using their own methodologies. Our team of in-house expert analysts can also produce reports for you.

Resources

Learn from industry experts and gain the insights needed to make data-driven decisions.

What Our Clients Say

Discover How To Connect The Dots.

Try Neotas Due Diligence Platform Today! All due diligence information at your fingertips, without the hassle! Our advanced technology delivers new insights while managing all risk data in a single centralised hub.

Frequently Asked Questions

Enhanced Due Diligence (EDD) involves a higher level of scrutiny and investigation into potentially higher-risk business relationships or transactions. EDD goes beyond standard due diligence to require a deeper understanding of the parties involved, their source of funds, and their overall business operations. Its aim is to identify and mitigate potential risks associated with money laundering, terrorist financing, or other illicit activities.

Read more about Enhanced Due Diligence Checklist and EDD for High Risk Customers.

CDD stands for Customer Due Diligence, which is the standard process of verifying the identity of a customer and assessing their risk level before establishing a business relationship. CDD involves collecting basic identifying information, such as name, address, and date of birth, as well as verifying this information using reliable and independent sources.

Read more about Customer Due Diligence Requirements.

Our reports provide clearly flagged risks using a traffic light system (red/amber/green), with detailed evidence, a network association visual map, an audit trail and a list of all sources used. We also provide a narrative and context to all the risks flagged.

The risks we consider in our enhanced due diligence reporting are:

- Lifestyle/Wealth Mismatch

- Disqualified/Insolvent Entities

- Fraudulent Activity

Investment of Concern/Risk - Tax Evasion/Avoidance Concerns

- Terrorism Financing Concerns

- Money Laundering Concerns

- Links to criminal activities

- Financial Irregularities

- Multiple Identities/Aliases

- Political Exposure

- Regulatory Actions/Notices

- Court Records

- Risks associated with significant individuals

Google searches only cover 4-6% of the entire internet. The Neotas Platform provides a richer and more complete profile of customers, companies and individuals with greater:

Coverage: We cover traditional third party databases, the entire internet (surface, deep and dark web)

Depth: We automatically gather and analyse data using AI and machine learning, pulling information which others do not. This provides unique insights into behavioural attributes, reputation, connections (that are not in any databases).

Speed and ease of use: Our Platform can conduct ‘built-in’ investigations in seconds as opposed to days and hours. The Neotas Platform is also easy to use.

Management Due Diligence (MDD) is a process used in mergers and acquisitions (M&A) to evaluate the capabilities and experience of a company’s management team. MDD involves a thorough review of the management team’s backgrounds, skills, and track record, as well as an assessment of their ability to execute the company’s business strategy, to inform the M&A decision-making process.

Investment Due Diligence is a process that involves evaluating the potential risks and benefits of a particular investment opportunity. The process typically includes reviewing financial statements, conducting market research, analyzing business operations, and assessing the management team. The goal of Investment Due Diligence is to inform investment decisions and mitigate potential risks.

ESG Due Diligence is a process that evaluates the environmental, social, and governance factors associated with a particular investment opportunity. The process typically includes assessing a company’s impact on the environment, its social and labor practices, and its governance structure. The goal of ESG Due Diligence is to inform investment decisions and identify any potential risks associated with these factors.

ESG Due Diligence questionnaire is a tool used by investors, asset managers, and other stakeholders to assess the environmental, social, and governance (ESG) performance of a company. The questionnaire typically includes a series of questions related to a company’s ESG practices, policies, and performance, and is used to gather information that can be used to inform investment decisions and identify potential ESG risks.

The questions in an ESG due diligence questionnaire may cover a wide range of topics, including a company’s environmental impact, labor practices, human rights policies, executive compensation, and board diversity, among others. The questionnaire may be customized to reflect the specific interests and priorities of the investor or stakeholder.

The goal of an ESG due diligence questionnaire is to provide a comprehensive understanding of a company’s ESG performance, identify any potential risks, and inform investment decisions. The results of the questionnaire can be used to evaluate the company’s suitability for investment, to engage in dialogue with the company on ESG issues, and to inform ongoing monitoring and reporting on ESG performance.

A due diligence checklist is a tool used to ensure that all relevant information and documents are collected and reviewed during the due diligence process in various contexts such as mergers and acquisitions, real estate transactions, and investments. The checklist usually consists of a list of items that need to be reviewed, such as financial statements, legal documents, regulatory compliance, and intellectual property. The checklist helps to identify potential risks or issues associated with the transaction or investment and provides a systematic and thorough approach to due diligence, ensuring all parties have access to the same information for informed decision-making.

TPRM, or Third-Party Risk Management, is a framework used by organisations to assess, monitor, and manage risks associated with their external partners or vendors. This includes evaluating potential risks like data breaches, regulatory compliance, and operational failures that could arise from working with third-party providers. The TPRM standard ensures that businesses maintain security and compliance while relying on external services. In today’s interconnected world, it’s essential for organisations to ensure their partners uphold the same high standards, reducing vulnerabilities and protecting both company assets and reputation from external threats.

Enhanced Due Diligence Platform

Enhanced Due Diligence Checks

enhanced due diligence checklist

enhanced due diligence requirements

what is enhanced due diligence

enhanced customer due diligence

enhanced due diligence aml

enhanced due diligence checklist uk

enhanced due diligence examples

enhanced due diligence is usually required for

enhanced due diligence meaning

what is enhanced due diligence uk

when is enhanced due diligence required

aml enhanced due diligence

aml enhanced due diligence requirements

coinbase enhanced due diligence

customer due diligence and enhanced due diligence

Enhanced Due Diligence Platform

Enhanced Due Diligence software

define enhanced due diligence

definition of enhanced due diligence

difference between due diligence and enhanced due diligence

enhanced client due diligence

enhanced due diligence analyst

enhanced due diligence analyst salary

enhanced due diligence attributes

enhanced due diligence banking

enhanced due diligence bsa

enhanced due diligence checklist template

enhanced due diligence checks

enhanced due diligence definition

enhanced due diligence edd

enhanced due diligence fatf

enhanced due diligence fca

Enhanced Due Diligence Platform

Enhanced Due Diligence tool

enhanced due diligence for high risk customers

enhanced due diligence for peps

enhanced due diligence form

enhanced due diligence high risk customer

enhanced due diligence is required to be done when

enhanced due diligence is usually required for which customer

enhanced due diligence jobs

enhanced due diligence kyc

enhanced due diligence means you should

enhanced due diligence measures

enhanced due diligence money laundering

enhanced due diligence money laundering regulations

enhanced due diligence pep

enhanced due diligence procedures

enhanced due diligence process

Enhanced Due Diligence Platform

Enhanced Due Diligence checklist

enhanced due diligence questionnaire

enhanced due diligence report

enhanced due diligence report sample

enhanced due diligence software

enhanced due diligence sra

enhanced due diligence template

enhanced due diligence training

enhanced due diligence uk

examples of enhanced due diligence

fatf enhanced due diligence

how to conduct enhanced due diligence

how to perform enhanced due diligence

money laundering enhanced due diligence

pep enhanced due diligence

politically exposed person enhanced due diligence