Enhanced Due Diligence Checklist

Enhanced Due Diligence (EDD) is a critical process for identifying and mitigating risks associated with high-risk customers and transactions. It goes beyond standard due diligence, ensuring businesses comply with anti-money laundering (AML) regulations and prevent financial crimes.

This guide provides a structured Enhanced Due Diligence Checklist to help businesses conduct thorough assessments efficiently.

What is an Enhanced Due Diligence Checklist?

An Enhanced Due Diligence Checklist is a structured document that outlines the key steps and information required when assessing high-risk individuals, businesses, or transactions. It helps organisations ensure that they are not inadvertently facilitating financial crime, corruption, or money laundering.

The EDD checklist covers key areas such as customer identification, risk assessment, source of funds verification, transaction monitoring, and ongoing compliance measures.

By following an EDD checklist, businesses and financial institutions can systematically navigate through the various elements involved in the due diligence process, ultimately enhancing the effectiveness and integrity of risk assessments.

Enhanced Due Diligence (EDD) emerges as a critical extension of this process. It involves a deeper level of scrutiny, predominantly reserved for higher-risk clientele. The primary objectives encompass the mitigation of associated risks and the assurance of regulatory compliance.

When is Enhanced Due Diligence Required?

Enhanced Due Diligence is necessary in situations where there is a higher level of risk. These include:

- High-value transactions: Large or complex financial activities that require scrutiny.

- Politically Exposed Persons (PEPs): Individuals with prominent public roles who may be at higher risk of corruption.

- Customers in high-risk jurisdictions: Countries with weak AML regulations or a history of financial crime.

- Unusual transaction patterns: Frequent, large, or inconsistent transactions that do not align with a customer’s profile.

- Customers with opaque ownership structures: Businesses with complex ownership, shell companies, or offshore accounts.

- Negative media associations: Clients who have been publicly linked to criminal activity or corruption.

The Enhanced Due Diligence checklist serves as a streamlined roadmap through the due diligence process. By offering a systematic approach, it enhances efficiency and reduces the likelihood of errors or omissions. This organised method proves especially crucial when dealing with intricate transactions or partnerships that involve multifaceted considerations.

This structured approach is pivotal in enhancing the accuracy and integrity of risk assessments. Furthermore, the checklist aids in identifying and mitigating potential risks associated with higher-risk clients or transactions, ultimately ensuring compliance with regulations and safeguarding against legal, financial, and reputational risks.

Within the EDD framework, comprehensive risk assessment is paramount. This process entails an in-depth analysis of various aspects including the nature of the business, source of funds, transaction history, and potential political exposure. By employing the checklist, businesses can systematically navigate through these critical elements, leaving no room for oversight.

EDD Checklist Components

Here’s a checklist for Enhanced Due Diligence (EDD) that businesses and financial institutions can use to ensure they are conducting a thorough assessment of higher-risk customers:

- Customer Information:

- This involves collecting comprehensive information about the customer, which may include their legal name, any aliases they use, date of birth (for individuals) or date of establishment (for businesses), nationality or jurisdiction of incorporation, residential or business address, and contact information like phone numbers and email addresses.

- Nature of Business or Activity:

- Understanding the customer’s business or individual financial activities is crucial. This includes a detailed description of what the customer does and the sector or industry they operate in.

- Source of Funds:

- This step focuses on understanding where the customer’s funds come from. It involves collecting evidence to ensure that the income or revenue streams are legitimate and not derived from illegal activities.

- Beneficial Ownership:

- Beneficial owners are individuals who have significant ownership or control over the customer entity. It’s important to identify and verify these individuals to understand who ultimately benefits from the business or financial activities.

- Transaction History and Patterns:

- This involves examining the customer’s transaction history in detail. This includes information on the types, amounts, frequency, and purpose of transactions. Any unusual or suspicious activities should be flagged for further investigation.

- Geographic Risk Assessment:

- This step evaluates the risks associated with the customer’s geographic location. Certain jurisdictions may have a higher risk of money laundering or financial crime, so this assessment helps in understanding and mitigating those risks.

- Politically Exposed Persons (PEPs):

- Politically Exposed Persons are individuals who hold public positions or have held them in the recent past. This could include government officials, heads of state, or individuals with political influence. Identifying PEPs helps assess potential risks associated with political connections.

- Sanctions and Watchlists:

- Screening against government-issued sanctions lists, terrorist watchlists, and other relevant databases is essential to ensure that the customer or any associated parties are not involved in prohibited activities.

- Regulatory Compliance:

- Verification of compliance with applicable laws and regulations, particularly those related to anti-money laundering (AML) and counter-terrorist financing (CTF) requirements. Ensuring compliance is critical for avoiding legal repercussions.

- Reputation and Media Review:

- Reviewing media sources and public information about the customer helps assess their reputation. This can uncover any adverse publicity or potential issues that may need further investigation.

- High-Risk Indicators:

- Identifying red flags or high-risk indicators is crucial. This could include things like unusually large or frequent transactions, or business activities that don’t align with the industry norm.

- Customer Relationship History:

- Understanding any prior or existing business relationships the customer maintains, especially with other financial institutions, provides context and can reveal potential risks.

- Third-Party Documentation:

- Collecting and verifying relevant third-party documents, such as references, certifications, or legal opinions, helps corroborate the information provided by the customer.

- Enhanced Monitoring and Reporting:

- Establishing protocols for enhanced monitoring of the customer’s activities ensures ongoing assessment and timely reporting of any suspicious behavior to regulatory authorities.

- Documentation and Record Keeping:

- Comprehensive documentation of all EDD steps taken is essential. Keeping records is not only good practice but also necessary for regulatory compliance and auditing purposes.

By following this detailed Enhanced Due Diligence checklist, businesses and financial institutions can conduct a thorough Enhanced Due Diligence process, enabling them to make well-informed decisions about higher-risk customers while staying compliant with regulatory requirements. It’s important to note that the specific requirements and processes may vary based on jurisdiction and industry. Staying up-to-date with relevant regulatory guidelines is crucial.

Enhanced Due Diligence Checklist Template

1. Conduct a Risk-Based Assessment

- Define risk assessment parameters (e.g., customer type, business sector, country of operation).

- Assign a risk rating (low, medium, high) to the customer or transaction.

- Allocate resources proportionally—higher-risk cases require deeper scrutiny.

2. Collect & Verify Customer Information

- Full legal name and aliases

- Date of birth (individuals) / incorporation (businesses)

- Nationality or jurisdiction of incorporation

- Residential or business address

- Contact details (phone and email)

- Company registration and corporate structure (if applicable)

3. Understand the Nature of Business & Activities

- Describe the customer’s business model and typical transactions.

- Assess if the industry is high-risk (e.g., gambling, cryptocurrency, precious metals).

- Identify ultimate beneficiaries and controlling individuals.

4. Verify Source of Funds & Wealth

- Identify and document the origin of funds.

- Ensure funds are consistent with declared income or revenue streams.

- Cross-check against public records, tax filings, and bank statements.

5. Assess Transaction History & Patterns

- Analyse past transactions for consistency with expected behaviour.

- Identify large, irregular, or high-frequency transactions.

- Flag any transactions linked to high-risk jurisdictions.

6. Conduct a Geographic Risk Assessment

- Assess whether the customer operates in a high-risk country.

- Check against sanctions lists (UK, EU, UN, US OFAC, etc.).

- Consider regional AML compliance and regulatory variations.

7. Screen for Politically Exposed Persons (PEPs)

- Identify if the individual holds a prominent political or public role.

- Extend screening to family members and close associates.

- Assess potential corruption risks and relationships.

8. Cross-Check Against Sanctions & Watchlists

- Screen customer details against government-issued sanctions lists.

- Monitor against terrorist watchlists and financial crime databases.

- Ensure compliance with the UK Financial Conduct Authority (FCA) guidelines.

9. Conduct Reputational & Media Reviews

- Investigate adverse media reports, lawsuits, or regulatory penalties.

- Use reliable sources such as press releases, financial reports, and global databases.

- Assess the credibility and impact of any negative findings.

10. Identify High-Risk Indicators

- Unexplained large transactions or multiple accounts under similar names.

- Use of intermediaries or shell companies to obscure ownership.

- Frequent cash transactions or movement of funds to offshore accounts.

11. Establish Enhanced Monitoring & Reporting Measures

- Set up real-time monitoring of transactions.

- Establish thresholds and alerts for suspicious activities.

- Regularly update customer risk profiles.

- Report suspicious activities to regulatory bodies (e.g., FCA, HMRC, NCA).

12. Maintain Thorough Documentation & Records

- Maintain detailed records of all due diligence steps.

- Ensure compliance with UK data protection laws (GDPR).

- Store customer files securely for regulatory audits.

Download Enhanced Due Diligence Template

Factors to Consider When Carrying Out Enhanced Due Diligence

A. Customer Factors:

- Analysing the Customer’s Profile and Background:

- This involves a detailed examination of the customer’s background, including their personal or business history, financial standing, and any previous relationships with the entity conducting due diligence. It helps in understanding the context and potential risks associated with the customer.

- Identifying Unusual or High-Risk Customer Behaviors:

- This step involves the detection of any behaviors or activities that deviate from the norm or raise red flags. Unusual transaction patterns, significant changes in financial behavior, or other suspicious activities may indicate potential risks.

- Evaluating the Nature of the Business Relationship:

- Understanding the type and purpose of the business relationship is crucial. This includes identifying the scope of transactions, the roles of the parties involved, and the overall objectives. It helps in tailoring the due diligence process to the specific nature of the relationship.

B. Geographical Factors:

- Assessing the Risk Associated with Specific Geographical Locations:

- Different regions may pose varying levels of risk due to factors like local regulations, economic stability, and prevalence of financial crime. Conducting a thorough assessment of the risk associated with specific geographical locations helps in implementing appropriate due diligence measures.

- Understanding Regional Compliance and Regulatory Variations:

- Regulations and compliance requirements can significantly differ from one region to another. It’s imperative to be well-versed in the specific compliance standards of each area where business operations are conducted. This ensures that due diligence efforts align with local regulatory frameworks.

- Adapting EDD Strategies for Different Geographic Areas:

- Given the diversity of risks associated with different regions, tailoring EDD strategies to suit the specific characteristics of each geographical area is crucial. This may involve customising the depth and scope of due diligence based on the perceived level of risk.

C. External Factors:

- Incorporating External Data Sources for Comprehensive EDD:

- Accessing external data sources, such as public records, industry reports, and financial databases, enhances the depth of due diligence. This additional information provides a more comprehensive view of the customer’s background and potential risks.

- Utilising Third-Party Services in the Due Diligence Process:

- Engaging specialised third-party services, like background check agencies or investigative firms, can provide expert insights and resources to conduct a thorough due diligence process. These services often have access to extensive databases and expertise in risk assessment.

- Staying Updated on External Factors Impacting the Business:

- Monitoring external factors such as economic trends, regulatory changes, and geopolitical events is essential. These factors can have a significant impact on the risk profile of a customer or business entity. Staying informed ensures that due diligence efforts remain relevant and effective.

How to use the Enhanced Due Diligence Checklist?

Enhanced Due Diligence Checklist Step 1: Start with a Risk-Based Approach

- Defining Risk Assessment Parameters for EDD:

- This involves establishing clear criteria and factors for assessing the risk associated with a particular customer or transaction. It may include factors like business type, transaction size, geographic location, and previous history.

- Allocating Resources Based on Risk Levels:

- Once the risk levels are determined, resources, both in terms of personnel and technology, can be allocated proportionally. Higher-risk cases may require more extensive due diligence efforts.

- Aligning EDD Efforts with Organisational Risk Tolerance:

- It’s crucial to ensure that the level of due diligence undertaken aligns with the organisation’s risk appetite and compliance policies. This helps in maintaining consistency and coherence in risk management.

Enhanced Due Diligence Checklist Step 2: Source for Recognising Information

- Identifying Reliable Sources for Gathering Information:

- This step involves identifying reputable and trustworthy sources of information. These sources could include government records, public databases, industry reports, and credible third-party services.

- Validating Information from Various Channels:

- It’s important to cross-verify information obtained from different sources to ensure accuracy and reliability. Consistency in information across multiple channels strengthens its validity.

- Ensuring Accuracy and Completeness of Data:

- Rigorous checks should be in place to verify that the information collected is both accurate and complete. Inaccurate or incomplete data can lead to flawed assessments.

Enhanced Due Diligence Checklist Step 3: Analyse the Source of Funds and Ultimate Beneficial Ownership (UBO)

- Tracing the Source of Funds for Transparency:

- Understanding where the funds originate provides transparency in financial transactions. This step involves thorough investigation to ensure funds are derived from legitimate sources.

- Determining Ultimate Beneficial Owners for Accountability:

- Identifying the individuals who ultimately benefit from the business or transaction is crucial for accountability. This includes identifying those with significant ownership or control.

- Uncovering Complex Ownership Structures:

- In cases of complex business structures, it’s important to unravel intricate ownership hierarchies to ascertain the ultimate beneficial owners and their interests.

Enhanced Due Diligence Checklist Step 4: Ongoing Transactions Monitoring

- Implementing Continuous Monitoring for Suspicious Activity:

- Continuous monitoring involves real-time or periodic assessment of transactions to detect any unusual or suspicious activity that may indicate potential risks.

- Establishing Thresholds and Alerts for Unusual Transactions:

- Setting predefined thresholds for certain transaction parameters (e.g., large amounts, frequent transactions) helps in flagging potentially risky activities for further investigation.

- Adapting EDD Measures as Transactions Evolve:

- As the nature and volume of transactions evolve, EDD measures should also adapt accordingly. This ensures that due diligence efforts remain relevant and effective.

Enhanced Due Diligence Checklist Step 5: Adverse Media and Negative Check

- Identifying Negative Information and Adverse Media:

- This step involves actively seeking out any negative or adverse information related to the customer or business. This could include news articles, legal records, or any publicised controversies.

- Assessing the Impact of Negative Findings on EDD:

- Once negative information is identified, it’s important to assess its relevance and potential impact on the due diligence process. This helps in determining the level of risk associated with the customer or transaction.

- Mitigating Risks Arising from Adverse Media:

- If negative information is found, steps should be taken to mitigate associated risks. This could involve implementing additional due diligence measures or even deciding not to proceed with the transaction.

Enhanced Due Diligence Checklist Step 6: Conduct an On-site Visit

- Conducting Physical Verification for High-Risk Entities:

- For entities deemed high-risk, conducting an on-site visit provides a firsthand opportunity to physically verify the existence and operations of the business. This helps in confirming the legitimacy of the entity.

- Gathering First-Hand Information for Thorough EDD:

- On-site visits allow for direct interaction with key personnel, giving insights that may not be attainable through remote investigations. It provides an opportunity to ask questions and gather information in real-time.

- Documenting On-Site Visit Findings:

- It’s imperative to document all findings from the on-site visit. This includes observations, interviews, and any relevant documents obtained. These records serve as valuable evidence for the due diligence process.

Enhanced Due Diligence Checklist Step 7: Draft Your Report and Develop Ongoing Monitoring Strategy

- Compiling Comprehensive Reports for Documentation:

- A thorough and well-organised report should be compiled, summarising all the findings from the due diligence process. This report serves as an official record and documentation of the assessment.

- Outlining Ongoing Monitoring Strategies for Sustained Due Diligence:

- Establishing a strategy for ongoing monitoring ensures that risks continue to be assessed even after the initial due diligence process. This could involve periodic reviews, continuous transaction monitoring, and regular reassessments of risk levels.

- Ensuring Compliance with Reporting Requirements:

- Depending on the industry and jurisdiction, there may be specific reporting requirements for the results of the due diligence process. Ensuring compliance with these requirements is essential.

By meticulously following these steps, businesses and financial institutions can conduct a thorough and effective Enhanced Due Diligence process. This structured approach helps in identifying and mitigating potential risks associated with higher-risk customers or transactions, ultimately ensuring compliance and safeguarding against legal, financial, and reputational risks.

When do I need Enhanced Due Diligence Checklist?

Enhanced Due Diligence checklist is typically warranted in situations involving higher risks or specific triggering events. Understanding when to implement EDD is crucial for businesses and financial institutions to maintain compliance and mitigate potential risks. Here are the key considerations for determining when Enhanced Due Diligence is necessary:

1. Identifying Trigger Events Requiring EDD Implementation:

- High-Risk Customers: Enhanced Due Diligence is essential for customers or entities classified as high-risk due to factors like complex ownership structures, political exposure, or involvement in industries prone to money laundering or financial crime.

- Unusual or Large Transactions: When transactions are unusually large, frequent, or exhibit patterns deviating from the norm, it may trigger the need for Enhanced Due Diligence to ensure the legitimacy of the funds involved.

- Change in Customer Behavior: Significant changes in a customer’s financial behavior, such as sudden increases in transaction volumes or unfamiliar types of transactions, may necessitate EDD.

- Geographic Risk: Transactions involving countries or regions with higher risks of financial crime, economic instability, or regulatory non-compliance may warrant EDD.

2. Regulatory Mandates for EDD in Specific Industries:

- Financial Institutions: Many jurisdictions, under anti-money laundering (AML) and counter-terrorist financing (CTF) regulations, require financial institutions to conduct EDD on higher-risk customers. This includes banks, credit unions, and other regulated financial entities.

- Legal and Accounting Firms: These entities may need to implement EDD, especially if they handle financial transactions for clients or provide services in areas prone to higher risks.

- Real Estate and Property Transactions: In certain jurisdictions, real estate professionals are mandated to conduct EDD, particularly for high-value transactions, to mitigate the risk of money laundering through property.

3. Key Considerations for Determining EDD Necessity:

- Nature of Business Activities: Businesses operating in industries vulnerable to financial crimes, such as casinos, precious metal dealers, and money service businesses, are often subject to EDD requirements.

- Politically Exposed Persons (PEPs): Transactions involving PEPs, or their close associates, may require EDD due to the potentially higher risks associated with politically exposed individuals.

- Legal and Regulatory Environment: The legal framework of the jurisdiction in which the business operates plays a significant role. Regulations may stipulate specific circumstances that necessitate EDD.

- Organisational Risk Tolerance: Each organisation may have its own risk tolerance level. Some may choose to apply EDD more broadly, while others may reserve it for cases with the highest perceived risk.

- Periodic Review of Customer Profiles: Regular reviews of customer profiles can trigger the need for EDD if there are changes or activities that raise concerns.

Enhanced Due Diligence is crucial in situations involving higher risks or specific triggering events. Identifying these events and understanding regulatory mandates for Enhanced Due Diligence is essential for businesses and financial institutions to effectively implement thorough due diligence processes.

Additionally, considering key factors such as the nature of business activities and organisational risk tolerance aids in determining when Enhanced Due Diligence is necessary to safeguard against potential risks and maintain regulatory compliance.

About Neotas Enhanced Due Diligence

Neotas Platform covers 600Bn+ archived web pages, 1.8Bn+ court records, 198M+ corporate records, global social media platforms, and 40,000+ Media sources from over 100 countries to help you build a comprehensive picture of the team. It’s a world-first, searching beyond Google. Neotas’ diligence uncovers illicit activities, reducing financial and reputational risk.

Due Diligence Solutions:

- Enhanced Due Diligence

- Management Due Diligence

- Customer Due Diligence

- Simplified Due Diligence

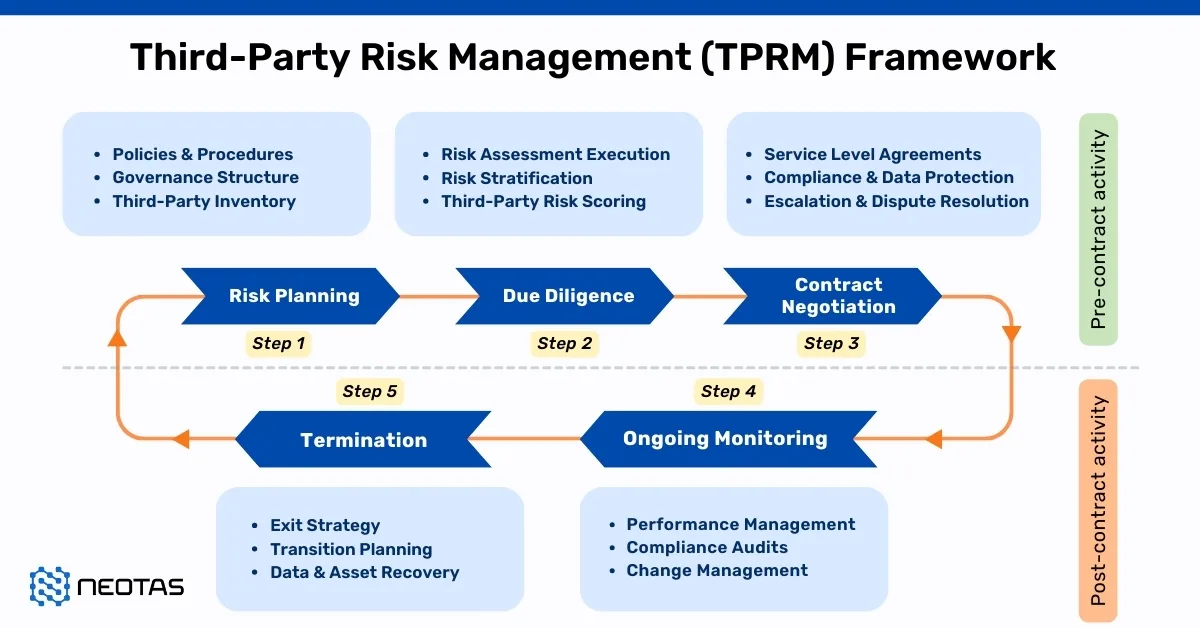

- Third Party Risk Management

- Open Source Intelligence (OSINT)

- Introducing the Neotas Enhanced Due Diligence Platform

Due Diligence Case Studies:

- Case Study: OSINT for EDD & AML Compliance

- Overcoming EDD Challenges on High Risk Customers

- Neotas Open Source Intelligence (OSINT) based AML Solution sees beneath the surface

- ESG Risks Uncovered In Investigation For Global Private Equity Firm

- Management Due Diligence Reveals Abusive CEO

- Ongoing Monitoring Protects Credit Against Subsidiary Threat

- AML Compliance and Fraud Detection – How to Spot a Money Launderer and Prevent It

- OSINT Framework, OSINT Tools, OSINT Techniques, and how to use OSINT framework.

- Open Source Intelligence (OSINT) in the Fight Against Financial Crime

- Reduce & Manage Business Risk with Neotas Open Source Intelligence (OSINT) Solutions

- Using OSINT for Sources of Wealth Checks

- Open Source Intelligence (OSINT) based AML Solution sees beneath the surface

- Enhancing ESG Risk Management Framework with Neotas’ OSINT Integration

- How Open Source Intelligence (OSINT) is transforming enhanced due diligence and investigations in AML compliance

- Detecting Modern Slavery In Your Supply Chain using Open-source Intelligence

- Creating an effective framework for managing risk with suppliers and third parties using open-source intelligence (OSINT)

- Using Open Source Intelligence For Enhanced Due Diligence

Manage Financial Compliance and Business Risk with Enhanced Due Diligence and OSINT.

Neotas is an Enhanced Due Diligence Platform that leverages AI to join the dots between Corporate Records, Adverse Media and Open Source Intelligence (OSINT).

Schedule a Call or Book a Demo of Neotas Enhanced Due Diligence Platform.

FAQs on Enhanced Due Diligence Checklists

1. What are Enhanced Due Diligence (EDD) Checks?

- Enhanced Due Diligence (EDD) checks refer to advanced and comprehensive procedures conducted by businesses and financial institutions to assess higher-risk customers or transactions. They go beyond standard due diligence to ensure compliance with regulations and mitigate potential risks.

2. What is an Enhanced Due Diligence Checklist?

- An Enhanced Due Diligence checklist is a structured document outlining specific steps and information required for a thorough assessment of higher-risk customers or transactions. It serves as a comprehensive guide to ensure that no critical aspect is overlooked during the due diligence process.

3. How does EDD relate to Anti-Money Laundering (AML)?

- Enhanced Due Diligence (EDD) is a critical component of Anti-Money Laundering (AML) efforts. It involves conducting in-depth assessments of higher-risk customers or transactions to identify and mitigate potential risks associated with money laundering and other financial crimes.

4. What should be included in an Enhanced Due Diligence Checklist for AML purposes?

- An Enhanced Due Diligence checklist for Anti-Money Laundering (AML) purposes should include steps such as customer verification, source of funds verification, beneficial ownership assessment, transaction monitoring, PEP screening, risk assessment, and documentation of findings.

5. When is Enhanced Customer Due Diligence (CDD) necessary?

- Enhanced Customer Due Diligence (CDD) is necessary in situations involving higher risks, such as dealing with politically exposed persons (PEPs), clients with criminal ties, cash-intensive businesses, online platforms with non-face-to-face interactions, businesses in high-risk countries, private banking clients, unexplained business relationships, and complex business structures. It helps ensure thorough assessments and compliance with regulations.

6. How does an Enhanced Due Diligence Checklist differ from standard Due Diligence procedures?

- An Enhanced Due Diligence checklist goes beyond standard due diligence by focusing on higher-risk customers or transactions. It involves more detailed and comprehensive assessments to identify and mitigate potential risks associated with money laundering, financial crimes, and other illicit activities.

7. When should an Enhanced Due Diligence Checklist be used?

- An Enhanced Due Diligence checklist should be used in situations where there is a higher level of risk involved, such as dealing with customers or transactions that have complex structures, substantial financial transactions, or associations with higher-risk jurisdictions. It ensures that thorough due diligence measures are applied to mitigate potential risks and ensure regulatory compliance.

8. How does EDD relate to Anti-bribery and Corruption (ABC) ?

- Enhanced due diligence is a critical component of an anti-bribery and corruption (ABC) compliance programme. It involves conducting due diligence in-depth checks on higher risk third party relationships such as suppliers, distributors, agents, intermediaries where the company needs to ensure that there is no exposure to bribery and corruption risks through its business partners. Enhanced due diligence is a critical part of any Know your Supplier (KYS) and Third Party Risk Management (TPRM) programme

9. How does EDD relate to managing ESG risks such as Modern Slavery laws?

- As laws and regulations increase in the area of Environmental, Social and Governance (ESG) risk such as modern slavery, human rights abuse, conflict minerals, greenwashing, environmental and wildlife crime , enhanced due diligence(EDD) checks are required to ensure the company is not exposed to such risks in its supply chain or other third parties.Tags: Due Diligence Checklist, EDD Checklist, Enhanced Due Diligence Checklist, Enhanced Due Diligence Checklist for Banks, Enhanced Due Diligence Checklist UK, Enhanced Due Diligence Checklist PDF, Enhanced Due Diligence Checklist Template, Customer Due Diligence Checklist, Enhanced Customer Due Diligence Checklist, Enhanced Due Diligence Checklist AML, Enhanced Due Diligence Checklist for High Risk Customers, What is Enhanced Due Diligence Checklist?

New Whitepaper and Checklist

New Whitepaper and Checklist