Due Diligence

In the intricate world of business, the term “Due Diligence” echoes like a guiding principle, a practice that stands as a beacon of prudence and precision. This comprehensive guide aims to illuminate the essence of due diligence, encompassing its meaning, significance, and diverse applications across various contexts.

What is Due Diligence?

Due diligence represents a thorough process of systematically gathering, verifying, and analysing information to inform decision-making before proceeding with a business transaction. This approach is fundamental in assessing the viability, risks, and opportunities associated with potential deals, ensuring informed and strategic choices in the business landscape. It’s most commonly used in business transactions.

Due Diligence Meaning

In essence, due diligence represents the diligence and care one exercises before entering into a business agreement or making a significant investment. It’s about being diligent and thorough in your investigations, probing into the details to uncover hidden risks and opportunities.

Why is Due Diligence Required?

The need for due diligence is rooted in risk management and informed decision-making. It’s required to:

- Mitigate Risks: By identifying potential pitfalls, legal complications, financial vulnerabilities, and operational challenges, due diligence allows businesses to proactively address and mitigate these risks.

- Ensure Transparency: Due diligence promotes transparency and accountability. It demonstrates a commitment to ethical conduct and provides stakeholders with a clear view of business operations and compliance with regulations.

- Enhance Negotiating Power: Armed with a well-prepared due diligence report, businesses can enter negotiations with confidence, leveraging the information to secure favourable terms and agreements.

Due Diligence in Different Contexts

The practice of due diligence transcends industry boundaries, finding application in various contexts:

Mergers and Acquisitions

In the context of mergers and acquisitions (M&A), due diligence involves a comprehensive assessment of a target company. It’s about scrutinising every facet of the company to understand its financial health, operational efficiency, legal compliance, and strategic alignment. M&A due diligence is a critical step that empowers acquirers to make informed investment decisions and plan for successful integration.

Financial Transactions

Financial transactions, such as investments and loans, require a thorough financial due diligence process. It involves analysing financial statements, assessing financial risks, and identifying opportunities for growth. Financial due diligence ensures that investors and lenders have a clear understanding of the financial stability and performance of the target entity.

Legal Compliance

Legal due diligence is essential to ensure compliance with legal and regulatory requirements. It involves a comprehensive review of legal contracts, agreements, and obligations. It helps businesses identify any legal issues, potential liabilities, or non-compliance areas that need to be addressed.

Global Perspectives on Due Diligence

Due diligence is not confined to a specific region or jurisdiction. In today’s globalised business landscape, it has a global perspective. Businesses engage in due diligence to navigate the complexities of international markets, assess cross-border risks, and ensure compliance with diverse regulatory frameworks.

In this comprehensive guide, we will delve deeper into each of these facets of due diligence, shedding light on their importance, methodologies, and best practices. Whether you’re a business leader, investor, or simply someone eager to understand the due diligence process, this guide will equip you with the knowledge and insights needed to navigate the intricate terrain of the business world with confidence.

Due Diligence Process

A Step-by-Step guide to Conducting Due Diligence:

This guide unveils the step-by-step process of conducting due diligence, equipping you with the knowledge to navigate this essential practice.

Pre-Due Diligence Phase

- Initial Assessment and Planning

- Begin by defining the scope and objectives of the due diligence process.

- Establish clear goals and outcomes to guide the assessment.

- Assembling the Due Diligence Team

- Form a diverse team with expertise in finance, law, operations, technology, and other relevant areas.

- Ensure each team member brings a unique perspective to the assessment.

- Understanding the Target’s Business Model

- Dive deep into the target company’s business model and operations.

- Gain a comprehensive understanding of how the company generates revenue and delivers value.

Financial Due Diligence

- Analysing Financial Statements

- Scrutinise financial statements, including balance sheets, income statements, and cash flow statements.

- Identify key financial metrics and trends.

- Assessing Financial Health and Stability

- Evaluate the company’s financial stability and solvency.

- Determine its ability to meet financial obligations.

- Identifying Financial Risks and Liabilities

- Uncover potential financial risks, such as debt obligations, contingent liabilities, and credit risks.

- Assess the impact of these risks on the business.

Legal Due Diligence

- Reviewing Legal Structures and Compliance

- Examine the company’s legal structure, ownership, and compliance with regulatory requirements.

- Identify any legal issues or non-compliance areas.

- Intellectual Property and Contracts Examination

- Assess intellectual property assets, including patents, trademarks, and copyrights.

- Review contracts and agreements to understand obligations and commitments.

- Litigation and Legal Disputes Assessment

- Investigate any ongoing or historical litigation or legal disputes involving the company.

- Evaluate the potential impact of legal risks on the business.

Operational Due Diligence

- Evaluating Business Operations

- Analyse the core business operations, including production processes and supply chain management.

- Assess operational efficiency and scalability.

- Supply Chain and Infrastructure Analysis

- Review the supply chain structure, dependencies, and risks.

- Evaluate infrastructure and technology capabilities.

- Employee and Management Review

- Assess the organisational structure and key personnel.

- Review talent management strategies and employment policies.

Commercial Due Diligence

- Market Analysis and Competitive Position

- Analyse the target company’s position in the market and industry.

- Study market trends and competitive dynamics.

- Customer and Sales Channel Evaluation

- Examine customer profiles and preferences.

- Evaluate the effectiveness of sales and distribution channels.

- Brand and Marketing Strategy Review

- Assess the company’s brand positioning and marketing strategies.

- Analyse brand value and recognition.

Technical and IT Due Diligence

- Assessing IT Systems and Infrastructure

- Evaluate the company’s IT systems, infrastructure, and technology stack.

- Identify potential IT risks and vulnerabilities.

- Cybersecurity and Data Protection Analysis

- Scrutinise cybersecurity measures and data protection protocols.

- Ensure compliance with data privacy regulations.

- Technology Roadmap and Innovation Capacity

- Explore the company’s technology roadmap and innovation initiatives.

- Assess its capacity for technological adaptation and growth.

Environmental and Social Governance (ESG) Due Diligence

- Environmental Impact Assessment

- Evaluate the company’s environmental practices and sustainability initiatives.

- Ensure compliance with environmental regulations.

- Social Responsibility and Governance Practices

- Examine social responsibility initiatives, community engagement, and corporate governance.

- Assess adherence to ethical standards.

Risk Management and Contingency Planning

- Identifying and Mitigating Key Risks

- Identify and categorise key risks that could impact the business.

- Develop strategies and action plans to mitigate these risks.

- Scenario Analysis and Contingency Strategies

- Conduct scenario analysis to anticipate potential future challenges.

- Develop contingency strategies and plans to address different scenarios.

Reporting and Decision-Making

- Compiling and Presenting Findings

- Organise and document all findings in a clear and structured manner.

- Create a comprehensive due diligence report for stakeholders.

- Making Informed Decisions Based on Due Diligence

- Empower decision-makers with the insights and recommendations derived from the due diligence process.

- Use the findings to make informed choices regarding investments, mergers, acquisitions, or other business decisions.

Post-Due Diligence Integration and Follow-up

- Integration Planning and Execution

- Develop integration plans for successful post-merger or acquisition integration.

- Ensure a seamless transition based on due diligence insights.

- Ongoing Monitoring and Assessment

- Implement systems for continuous monitoring and risk management.

- Regularly review and update the due diligence findings as circumstances change.

This step-by-step guide to conducting due diligence serves as a comprehensive roadmap for businesses, investors, and decision-makers. It empowers them to navigate complex business transactions with confidence, ensuring that every decision is based on thorough analysis and informed insights.

Due Diligence Checklist

This comprehensive due diligence checklist outlines the critical areas to scrutinise when conducting a thorough assessment of a potential investment or business venture.

Financial Review

- Financial Statements and Reports

- Analyse the company’s financial statements, including balance sheets, income statements, and cash flow statements.

- Examine trends in revenue, expenses, and profitability over time.

- Tax Records and Compliance

- Review tax returns and records to assess compliance with tax regulations.

- Identify any outstanding tax liabilities or disputes.

- Debt and Equity Structures

- Understand the company’s capital structure, including debt obligations and equity ownership.

- Evaluate the impact of debt on the company’s financial health.

Legal Assessment

- Corporate Documents and Legal Structure

- Examine corporate documents, including articles of incorporation and bylaws.

- Verify the legal structure of the entity and its compliance with relevant laws.

- Contracts and Agreements

- Review all contracts and agreements, including client contracts, supplier agreements, and partnerships.

- Identify any contract-related risks or obligations.

- Litigation History and Ongoing Legal Issues

- Investigate the company’s litigation history, including past lawsuits and legal disputes.

- Assess the status of any ongoing legal matters and their potential impact.

Operational Analysis

- Business Operations and Processes

- Understand the core business operations and production processes.

- Evaluate operational efficiency and scalability.

- Supply Chain and Vendor Relationships

- Review the supply chain structure and dependencies.

- Assess the strength of vendor relationships and potential risks.

- Asset Inventory and Condition

- Take inventory of all assets, including physical assets and intellectual property.

- Evaluate the condition and value of assets.

Commercial Evaluation

- Market Analysis and Competition

- Analyse the target market and competitive landscape.

- Identify market trends and the company’s position within the industry.

- Customer Base and Satisfaction Levels

- Review the customer base and their satisfaction levels.

- Assess customer retention rates and feedback.

- Sales and Marketing Strategies

- Evaluate the effectiveness of sales and marketing strategies.

- Understand the company’s branding and marketing approach.

Human Resources Inspection

- Employee Records and Contracts

- Review employee records, including contracts, job descriptions, and performance evaluations.

- Ensure compliance with employment laws and regulations.

- Organisational Structure

- Understand the organisational hierarchy and reporting structure.

- Assess the alignment of the organisational structure with business goals.

- Employee Benefits and Liabilities

- Examine employee benefit programs and associated liabilities.

- Ensure compliance with pension and benefit laws.

IT and Technology Assessment

- IT Systems and Cybersecurity Measures

- Assess the company’s IT systems, infrastructure, and cybersecurity protocols.

- Identify potential vulnerabilities and data protection measures.

- Intellectual Property and Patents

- Verify intellectual property assets, including patents, trademarks, and copyrights.

- Ensure the protection and ownership of key intellectual property.

- Technology Development and Innovation

- Explore the company’s technology roadmap and innovation initiatives.

- Assess its capacity for technological adaptation and growth.

Environmental and Regulatory Compliance

- Environmental Impact and Sustainability Practices

- Evaluate the company’s environmental impact and sustainability initiatives.

- Ensure compliance with environmental regulations and certifications.

- Regulatory Compliance and Certifications

- Review regulatory compliance records and certifications relevant to the industry.

- Assess adherence to industry-specific regulations.

- Health and Safety Records

- Investigate health and safety records and practices within the organisation.

- Ensure a safe and compliant work environment.

Strategic Fit and Future Potential

- Alignment with Strategic Goals

- Assess the alignment of the investment or venture with your strategic objectives.

- Ensure that the opportunity complements your long-term goals.

- Growth Potential and Scalability

- Evaluate the growth potential of the business, including market expansion opportunities.

- Assess scalability in response to increasing demand.

- Risks and Opportunities for Future Development

- Identify key risks that may impact future development.

- Explore potential opportunities for innovation and growth.

This due diligence checklist serves as a comprehensive guide for conducting a thorough assessment of a potential business venture. By meticulously examining each of these critical areas, you can make informed decisions that align with your strategic goals and risk tolerance.

Due Diligence Questionnaire

This due diligence questionnaire serves as your compass, guiding you through the critical aspects of assessing a potential investment or business venture and conduct the due diligence. Please adapt the checklist to fit the specific nuances of your business scenario, as this is not an exhaustive list.

Company Overview

- Company History and Background

- Provide a brief history of the company, including its founding, growth milestones, and significant events.

- Highlight the company’s evolution within its industry.

- Description of Products or Services

- Outline the products or services offered by the company.

- Explain how these offerings meet market needs and contribute to the company’s success.

- Organisational Structure and Key Personnel

- Provide an overview of the company’s organisational structure, including divisions, departments, and reporting lines.

- Identify key personnel, their roles, and their contributions to the company’s operations.

Financial Information

- Financial Statements and Reports

- Share recent financial statements, including balance sheets, income statements, and cash flow statements.

- Highlight key financial metrics and trends.

- Details of Debt and Equity

- Describe the company’s capital structure, including outstanding debt, equity ownership, and financing arrangements.

- Explain the impact of debt on the company’s financial health.

- Revenue Streams and Profitability

- Break down revenue streams by product, service, or market segment.

- Discuss profitability, profit margins, and factors influencing financial performance.

Legal Compliance

- Legal Structure of the Company

- Explain the legal structure of the company, including its registration, ownership, and governance.

- Ensure alignment with relevant laws and regulations.

- Any Current or Past Litigation

- Disclose any ongoing or historical litigation or legal disputes involving the company.

- Assess the potential impact of legal matters on the business.

- Compliance with Relevant Laws and Regulations

- Provide evidence of compliance with industry-specific regulations and legal requirements.

- Highlight any regulatory certifications or licenses.

Operational Processes

- Overview of Operational Processes

- Describe the core operational processes within the company, from production to distribution.

- Highlight any unique or innovative processes.

- Supply Chain and Vendor Details

- Explain the structure of the supply chain, including key vendors and suppliers.

- Assess the resilience of the supply chain and potential risks.

- Production Capacities and Efficiencies

- Share insights into production capacities, including volume and efficiency metrics.

- Discuss strategies for enhancing operational efficiency.

Market and Competitive Landscape

- Market Size and Growth Potential

- Analyse the size of the target market and its growth prospects.

- Identify factors driving market expansion.

- Competitive Analysis

- Provide a competitive landscape analysis, including key competitors and their market share.

- Highlight the company’s competitive advantages.

- Customer Demographics and Behavior

- Describe customer demographics, preferences, and buying behavior.

- Share insights into customer retention and satisfaction.

Human Resources

- Employee Headcount and Turnover

- Report the current employee headcount and turnover rates.

- Identify trends in workforce management.

- Key Management and Skills

- Highlight key management personnel and their roles.

- Assess the skills and expertise of the leadership team.

- Employment Policies and Benefits

- Share details of employment policies, including benefits, compensation, and performance evaluations.

- Ensure compliance with employment laws.

Technology and Intellectual Property

- Description of IT Infrastructure

- Explain the company’s IT infrastructure, including hardware, software, and data management.

- Assess technology capabilities and needs.

- Details of Patents or Proprietary Technology

- Provide information on patents, trademarks, copyrights, and other intellectual property assets.

- Ensure protection and ownership of critical intellectual property.

- Cybersecurity Measures

- Describe cybersecurity measures in place to protect data and systems.

- Assess vulnerabilities and data protection protocols.

Environmental and Social Responsibility

- Environmental Impact and Sustainability Practices

- Detail the company’s environmental practices and sustainability initiatives.

- Highlight efforts to reduce environmental impact.

- Social Responsibility Initiatives

- Share social responsibility initiatives, including community engagement and philanthropy.

- Discuss corporate governance practices.

- Community Engagement

- Describe the company’s involvement in the community.

- Highlight partnerships or initiatives that benefit society.

Strategic Fit and Future Plans

- Alignment with Strategic Goals

- Assess how the investment aligns with your strategic objectives and long-term goals.

- Ensure synergy with your existing portfolio.

- Future Business Plans and Projections

- Share the company’s future business plans and growth projections.

- Discuss strategies for achieving expansion and development.

- Risk Assessment and Mitigation Strategies

- Identify key risks associated with the investment or venture.

- Explain mitigation strategies and contingency plans.

This due diligence questionnaire equips you with the tools to navigate complex investment decisions. By addressing each critical aspect, you ensure that your evaluation is thorough, informed, and aligned with your strategic objectives.

Due Diligence Report

Making informed decisions is paramount. Whether you’re contemplating an investment, considering a merger or acquisition, or simply evaluating the health of your own company, due diligence plays a pivotal role. A comprehensive Due Diligence Report is not just a document; it’s a strategic tool that can make or break a business venture. In this article, we’ll delve into the significance of a Due Diligence Report and provide insights into how to prepare one effectively.

Understanding the Importance of Due Diligence Report

- Risk Mitigation:

A Due Diligence Report is your shield against unforeseen risks. It identifies potential pitfalls, legal issues, financial vulnerabilities, and operational challenges. By uncovering these risks early, you can take proactive measures to mitigate them, safeguarding your investments and assets.

- Informed Decision-Making:

In the business world, decisions should be based on concrete data and thorough analysis. A well-prepared Due Diligence Report provides decision-makers with a comprehensive view of the situation. It empowers them to make choices that align with the company’s objectives and minimise undesirable outcomes.

- Transparency and Accountability:

Transparency is a cornerstone of good corporate governance. A Due Diligence Report demonstrates your commitment to transparency and ethical conduct. It provides stakeholders, including investors and regulatory bodies, with a clear picture of your business operations and compliance with regulations.

- Negotiating Power:

In negotiations, knowledge is power. When you possess a robust Due Diligence Report, you enter negotiations with confidence. You can leverage the information it contains to secure favourable terms, whether in mergers, acquisitions, or contractual agreements.

Preparing a Comprehensive Due Diligence Report

- Clearly Define Objectives:

Before embarking on the due diligence process, establish clear objectives. What are you seeking to achieve? Whether it’s evaluating a potential investment or preparing for a merger, having well-defined goals guides the entire process.

- Assemble a Competent Team:

Due diligence is a multidisciplinary task. Ensure you have a team with expertise in areas such as finance, law, operations, and technology. Each team member should bring a unique perspective to the assessment.

- Gather Data Methodically:

Begin by collecting all relevant data and documents. This includes financial statements, legal contracts, operational reports, and more. The data-gathering process should be meticulous and systematic.

- Conduct In-Depth Analysis:

Once the data is collected, conduct a thorough analysis. Evaluate financial health, legal compliance, operational efficiency, and potential risks. Use analytical tools and methodologies to derive meaningful insights.

- Document Findings Clearly:

Document your findings in a clear and organised manner. A well-structured report ensures that stakeholders can easily access and understand the information. Include an executive summary for a quick overview.

- Provide Actionable Recommendations:

Don’t stop at presenting findings. Offer actionable recommendations based on your assessment. These recommendations should guide decision-makers on the next steps to take.

- Continuous Monitoring:

Due diligence is not a one-time task. It’s an ongoing process. Implement a system for continuous monitoring and risk management. Regularly review and update your Due Diligence Report as circumstances change.

- Engage Legal Counsel:

Legal expertise is critical, especially in matters of compliance and contractual obligations. Engage legal counsel to review and provide guidance on the report’s legal aspects.

- Ensure Ethical Conduct:

Ethical conduct is non-negotiable. Ensure that your Due Diligence Report adheres to ethical standards and respects confidentiality. Avoid conflicts of interest and maintain the integrity of the process.

In conclusion, a comprehensive Due Diligence Report is more than a due diligence checklist; it’s a strategic asset that guides your business towards success while mitigating risks. By understanding its importance and following a meticulous preparation process, you empower your organisation to make well-informed decisions and navigate the complex terrain of the business world with confidence.

Focus areas for a Due Diligence report

The focus areas for a Due Diligence report can include, but are not limited to the following; however, it’s essential to customise them according to the specific use case.

- Executive Summary

Objectives and Key Findings

- Start with a clear understanding of the objectives behind due diligence.

- Summarise the key discoveries that have emerged during this meticulous exploration.

Conclusions and Recommendations

- Distill the essence of your findings into clear, actionable recommendations.

- Provide guidance on the next steps based on your assessment.

- Company Profile

The Essence of the Company

- Paint a vivid picture of the company under scrutiny, outlining its core operations and industry presence.

- Dive into the company’s mission, vision, and the values that define its identity.

Tracing the Path: Historical Background

- Trace the company’s journey from its inception to its current state.

- Highlight milestones, pivotal events, and key achievements that have shaped its trajectory.

- Financial Analysis

Gauging Financial Health

- Summarise the financial performance of the company over a defined period.

- Evaluate the company’s financial stability and overall health.

Delving Deeper: Financial Statements

- Take a magnifying glass to the financial statements, dissecting balance sheets, income statements, and cash flow statements.

- Identify crucial financial metrics and trace trends that offer insights into the company’s fiscal well-being.

Navigating Financial Waters: Risks and Opportunities

- Expose financial risks that lurk beneath the surface and might pose a threat.

- Explore opportunities that could propel the company towards growth and improvement.

- Legal Compliance

The Legal Landscape

- Provide an overview of the company’s legal structure, ownership, and subsidiary relationships.

- Emphasise the importance of compliance with UK legal regulations.

Legal Compliance and Challenges

- Highlight the company’s adherence to legal obligations.

- Uncover any legal challenges or areas where compliance may be at risk.

Legal Battlefields: Litigation and Risks

- Unveil any ongoing or historical legal disputes involving the company.

- Assess the potential impact of legal risks on the business.

- Operational Review

Inside the Engine Room: Business Operations

- Conduct a thorough analysis of the company’s core business operations.

- Evaluate operational efficiency, scalability, and alignment with strategic objectives.

Navigating the Supply Chain

- Take a deep dive into supply chain management and production processes.

- Identify key suppliers and dependencies that keep the business engine running.

Efficiency and Pitfalls: Operational Insights

- Assess operational efficiencies and uncover areas that may require improvement.

- Pinpoint operational risks that could jeopardise performance.

- Market Analysis

The Marketplace and Industry

- Provide an overview of the market in which the company operates, shedding light on industry dynamics.

- Examine trends that impact the company’s positioning in the market.

The Arena of Competition

- Analyse the competitive landscape, spotlighting key competitors and their strengths and weaknesses.

- Offer insights into what sets the company apart and the challenges it faces.

Customer and Market Pulse

- Explore customer preferences and emerging market trends that could sway the company’s fortunes.

- Identify opportunities for market expansion and growth.

- Human Resources Assessment

The Organisational Blueprint

- Decode the company’s organisational structure, mapping out key departments and reporting lines.

- Highlight the organisational framework that supports its operations.

Guardians of Talent: Key Personnel

- Spotlight key personnel within the company and the pivotal roles they play.

- Evaluate talent management strategies and the company’s approach to nurturing its human capital.

Cultivating Culture: Employment Policies

- Unearth the company’s employment policies, including recruitment and retention strategies.

- Delve into the corporate culture and values that shape its identity.

- Technology and Intellectual Property

Navigating the Digital Realm

- Assess the company’s IT infrastructure and cybersecurity measures, emphasising their significance in the digital age.

- Shed light on intellectual property assets, including patents and trademarks.

The Technological Frontier

- Examine the company’s technological capabilities and innovations.

- Identify areas for technological enhancement and improvement.

- Environmental and Social Governance (ESG)

Gauging Environmental Impact

- Evaluate the company’s environmental practices and their alignment with sustainability goals.

- Ensure compliance with environmental regulations and standards.

The Responsibility Mandate

- Explore social responsibility initiatives, including community engagement and philanthropy.

- Scrutinise corporate governance practices and adherence to ethical standards.

- Risk Management and Mitigation

Identifying Risks

- List and categorise key risks that loom on the horizon.

- Weigh the potential impact of these risks on the company.

Strategies for a Safe Passage

- Offer recommendations and strategies to mitigate identified risks.

- Provide a roadmap for risk reduction and management.

- Conclusion

The Big Picture

- Summarise the comprehensive assessment of the company’s health and performance.

- Conclude with an overview of its readiness to face future opportunities and challenges.

Guiding the Way Forward

- Offer final, actionable recommendations that encapsulate the essence of the due diligence process.

- Guide decision-makers on the path to informed and strategic choices.

Types of Due Diligence

Due diligence is a critical process undertaken by businesses, investors, and legal entities to evaluate various aspects of a potential investment, business, or transaction. This meticulous examination ensures informed decisions, risk identification, and compliance with applicable laws and regulations. In this comprehensive guide, we delve into several essential types of due diligence, each serving a distinct purpose in the realm of modern commerce within the UK.

- Customer Due Diligence (CDD): Customer due diligence involves the process of verifying the identity of customers to prevent financial crimes such as fraud and money laundering. In the UK, it is a crucial step for businesses, especially financial institutions, to comply with anti-money laundering (AML) regulations. CDD includes verifying customer identities, assessing their risk profiles, and monitoring their transactions to ensure compliance with regulatory requirements.

- Enhanced Due Diligence (EDD): Enhanced due diligence is an extended and more comprehensive form of due diligence. It is typically applied to high-risk customers or transactions. In the UK, EDD entails a deeper investigation into the background, activities, and financial transactions of individuals or entities that pose higher AML or terrorism financing risks. EDD helps businesses make informed decisions and mitigate potential risks associated with such customers or transactions.

- Commercial Due Diligence (CDD): Commercial due diligence involves the analysis of market dynamics, competition, and growth potential in a specific industry or market segment. In the UK, businesses often conduct CDD before entering into mergers and acquisitions (M&A) or strategic partnerships to assess the commercial viability of a potential investment. CDD provides insights into market trends, customer preferences, and competitive landscape, helping businesses make informed market entry or expansion decisions.

- Financial Due Diligence (FDD): Financial due diligence is a critical aspect of evaluating a company’s financial health and stability. In the UK, FDD includes a thorough examination of financial statements, cash flow analysis, and assessment of financial risks. It helps investors, lenders, and acquirers understand a company’s financial position, debt obligations, and revenue streams, enabling them to make well-informed financial decisions.

- Vendor Due Diligence (VDD): Vendor due diligence focuses on assessing the vendors or suppliers that a company engages with. In the UK, VDD is essential for managing supply chain risks and ensuring the reliability and compliance of suppliers. It involves evaluating vendor contracts, financial stability, and operational capabilities. VDD helps businesses identify potential risks and dependencies in their supply chain, promoting effective supplier management.

- Simplified Due Diligence (SDD): Simplified due diligence is a streamlined approach used in lower-risk situations, where the regulatory burden is reduced. In the UK, SDD is applied when the customer or transaction is deemed low risk. It involves simplified identity verification and transaction monitoring procedures. SDD allows businesses to allocate resources more efficiently while still complying with AML regulations.

- Operational Due Diligence (ODD): Operational due diligence assesses the operational aspects of a company. In the UK, ODD includes evaluating business processes, supply chain management, and operational efficiencies. It aims to identify operational risks and vulnerabilities that may impact the overall performance and resilience of the business. ODD is particularly relevant in industries where operational excellence is crucial, such as manufacturing and logistics.

- Supplier Due Diligence: Supplier due diligence focuses on assessing and managing relationships with suppliers. In the UK, businesses rely on supplier due diligence to ensure the reliability and compliance of their suppliers. It includes vendor background checks, financial stability assessments, and contractual reviews. Supplier due diligence helps mitigate supply chain risks and strengthen supplier partnerships.

- Technical Due Diligence: Technical due diligence involves a comprehensive review of a company’s technical infrastructure and capabilities. In the UK, this type of due diligence is crucial in technology-driven industries such as IT and telecommunications. It includes assessing IT systems, cybersecurity measures, and intellectual property portfolios. Technical due diligence helps investors and acquirers understand a company’s technological assets and potential vulnerabilities.

- ESG Due Diligence: Environmental, social, and governance (ESG) due diligence focuses on evaluating a company’s sustainability practices and their impact on the environment and society. In the UK, ESG due diligence has gained significance as businesses strive to align with ESG principles and meet regulatory requirements. It includes assessing environmental impact, social responsibility initiatives, and corporate governance practices. ESG due diligence helps businesses demonstrate their commitment to responsible and sustainable business practices.

- Legal Due Diligence: Legal due diligence is a critical aspect of assessing a company’s legal compliance and potential legal risks. In the UK, it involves reviewing legal structures, contracts, and agreements. It aims to identify any ongoing litigation, legal disputes, or regulatory non-compliance issues that may impact the business. Legal due diligence is fundamental in ensuring that a business operates within the bounds of the law and can make informed legal decisions.

- Human Rights Due Diligence: Human rights due diligence focuses on evaluating a company’s impact on human rights, both within its operations and supply chain. In the UK, businesses are increasingly aware of their responsibilities regarding human rights, and this type of due diligence helps identify and address human rights risks. It includes assessing labor practices, ethical sourcing, and community engagement. Human rights due diligence aligns with the principles of corporate social responsibility and ethical business conduct.

- Mergers and Acquisitions Due Diligence (M&A Due Diligence): M&A due diligence is a comprehensive assessment conducted during mergers and acquisitions in the UK. It encompasses various aspects, including financial, legal, operational, and commercial due diligence. M&A due diligence aims to uncover potential risks, synergies, and opportunities associated with the target company. It is a critical step in M&A transactions, enabling acquirers to make informed investment decisions and plan for a successful integration.

- Environmental Due Diligence: Environmental due diligence is essential for assessing the environmental impact and sustainability practices of a company. In the UK, this type of due diligence includes evaluating the company’s compliance with environmental regulations, assessing potential environmental liabilities, and identifying opportunities for sustainable practices. It is particularly relevant in industries with significant environmental considerations, such as manufacturing and energy.

- EU Due Diligence Directive: The EU Due Diligence Directive refers to the European Union’s regulations that require certain sectors, such as minerals and metals, to conduct due diligence on their supply chains to prevent the use of conflict minerals. In the UK, compliance with this directive is crucial for businesses operating in these sectors. It involves supply chain transparency, risk assessment, and reporting to ensure responsible sourcing.

- Third-Party Due Diligence: Third-party due diligence involves assessing and managing risks associated with third-party relationships, including suppliers, distributors, and business partners. In the UK, businesses rely on third-party due diligence to ensure the integrity and compliance of their partners. It includes background checks, risk assessments, and ongoing monitoring to mitigate potential risks and maintain trust in business relationships.

- Consumer Due Diligence: Consumer due diligence focuses on ensuring that a company complies with consumer protection regulations in the UK. It includes reviews of advertising practices, product quality, and customer service. Consumer due diligence is essential for businesses to build and maintain consumer trust and avoid legal issues related to consumer rights.

- Digital Due Diligence: Digital due diligence assesses a company’s digital assets, online presence, and cybersecurity measures. In the UK, this type of due diligence is critical as businesses increasingly rely on digital technologies. It includes evaluating website security, data protection measures, and digital marketing strategies. Digital due diligence helps identify vulnerabilities and opportunities in the digital landscape.

- KYC (Know Your Customer) Due Diligence: KYC due diligence involves verifying the identities of customers and ensuring compliance with regulatory requirements in the UK. It is particularly important for financial institutions and businesses in regulated sectors. KYC due diligence includes identity verification, risk assessments, and ongoing monitoring to prevent fraud and money laundering.

- Private Equity Due Diligence: Private equity due diligence is tailored to the specific needs of private equity investors in the UK. It encompasses financial, operational, and strategic assessments of potential investments. Private equity due diligence aims to identify value drivers, risks, and growth opportunities to make informed investment decisions.

- Supply Chain Due Diligence: Supply chain due diligence evaluates the entire supply chain of a company, focusing on risk management and compliance. In the UK, businesses conduct supply chain due diligence to ensure ethical sourcing, manage dependencies, and address potential disruptions. It includes supplier assessments, risk mapping, and contingency planning to enhance supply chain resilience.

- Technology Due Diligence: Technology due diligence assesses a company’s technology infrastructure, intellectual property, and IT capabilities. In the UK, it is crucial for technology-driven industries. Technology due diligence includes cybersecurity assessments, intellectual property evaluations, and technology roadmap analysis. It helps investors and acquirers understand the technological assets and potential vulnerabilities of a business.

- Company Due Diligence: Company due diligence provides an overall assessment of a company’s financial health, operational efficiency, legal compliance, and strategic alignment. In the UK, it is a fundamental step in various business transactions, including mergers, acquisitions, and investments. Company due diligence aims to uncover risks, strengths, and areas for improvement, enabling stakeholders to make informed decisions.

- Compliance Due Diligence: Compliance due diligence focuses on ensuring that a company adheres to legal and regulatory requirements in the UK. It includes a comprehensive review of regulatory compliance, reporting obligations, and adherence to industry standards. Compliance due diligence helps businesses identify and address any regulatory gaps or non-compliance issues.

- Corporate Due Diligence: Corporate due diligence encompasses a holistic evaluation of a corporation’s financial performance, operational efficiency, legal compliance, and strategic alignment. In the UK, corporate due diligence is essential for assessing the overall health and viability of a corporation. It provides insights into financial stability, competitive positioning, and risk management.

Due Diligence Levels: 1, 2, and 3

Due diligence is a multifaceted process that can vary in depth and scope. Different levels of due diligence are applied based on the nature and significance of a transaction or investment. Let’s unravel the distinctions between Level 1, Level 2, and Level 3 due diligence:

Level 1 Due Diligence:

Overview: Level 1 due diligence is the initial and high-level assessment of a potential opportunity. It serves as a preliminary evaluation to determine whether further investigation is warranted.

Focus: At this level, the focus is on gathering basic information, assessing the initial feasibility of a deal, and identifying any obvious red flags or deal-breakers.

Key Activities:

- Collecting readily available information.

- Conducting initial financial analysis.

- Identifying potential risks and issues.

- Assessing the alignment of the opportunity with strategic goals.

Purpose: Level 1 due diligence helps stakeholders decide whether to invest more time, effort, and resources into a deeper investigation (Level 2 or 3) or whether to proceed with caution or abandon the opportunity.

Level 2 Due Diligence:

Overview: Level 2 due diligence represents a deeper and more comprehensive phase of the due diligence process. It involves a detailed examination of various aspects of the opportunity.

Focus: This level delves into in-depth analysis, verification of information, and comprehensive risk assessment. It aims to uncover hidden issues or risks that may not be evident in Level

Key Activities:

- Extensive investigation and research.

- Cross-checking and verifying data.

- Detailed financial, legal, operational, and strategic analysis.

- Thorough risk assessment.

Purpose: Level 2 due diligence provides a comprehensive understanding of the opportunity, identifies potential challenges, and informs decision-makers about whether to proceed, renegotiate terms, or abandon the opportunity.

Level 3 Due Diligence:

Overview: Level 3 due diligence is the highest level of scrutiny and is typically reserved for complex, high-value transactions or investments. It involves exhaustive examination and specialised expertise.

Focus: At this level, every detail is examined, and specialised professionals may be involved to assess technical, industry-specific, or regulatory aspects. It aims to leave no stone unturned.

Key Activities:

- Highly specialised investigations.

- In-depth analysis of technical, industry-specific, or regulatory aspects.

- Extensive due diligence reports and assessments.

- Complex risk modeling and mitigation strategies.

Purpose: Level 3 due diligence is conducted to ensure the highest level of confidence in decision-making for substantial investments or transactions. It provides a comprehensive understanding of all facets of the opportunity.

The choice of due diligence level depends on factors such as the complexity, value, and criticality of the opportunity. Level 1 provides an initial assessment, Level 2 offers comprehensive analysis, and Level 3 delves into exhaustive scrutiny. Tailoring due diligence to the specific context is essential for informed decision-making.

FAQs on Due Diligence

What Does It Mean to Do Your Due Diligence?

Doing your due diligence means conducting a thorough and comprehensive investigation or research process before making a significant decision or investment. It involves gathering all relevant information and assessing the potential risks and benefits to make informed choices.

What Is a Due Diligence Checklist?

A due diligence checklist is a structured document that outlines the key areas and criteria to be examined during the due diligence process. It serves as a systematic guide to ensure that no critical aspect is overlooked when assessing a business, investment, or venture.

What Is the Meaning of Due Diligence Process?

The due diligence process refers to the methodical and systematic examination of all relevant aspects of a potential business transaction, investment, or partnership. It aims to assess risks, opportunities, and compliance with regulations to make informed decisions.

What Is the Role of Due Diligence?

The role of due diligence is to provide decision-makers with a comprehensive understanding of the subject under consideration. It helps identify potential risks, opportunities, and areas of concern, enabling informed choices that align with strategic objectives.

What Is a Synonym for Due Diligence?

A synonym for due diligence is “thoroughness.” It reflects the commitment to conducting a meticulous and comprehensive examination before making a decision.

Is Due Diligence a Good Thing?

Yes, due diligence is a crucial and positive practice. It ensures that decisions are well-informed and based on a thorough assessment of all relevant factors. It helps mitigate risks and enhances the likelihood of successful outcomes.

Who Performs Due Diligence?

Due diligence can be performed by various parties, including investors, buyers, lenders, legal professionals, financial experts, and consultants. The specific individuals or teams involved depend on the nature of the transaction or decision.

What Are the 4 P’s of Due Diligence?

The 4 P’s of due diligence are often referred to as the core elements to be examined:

- People: Assess key personnel, management, and their qualifications.

- Processes: Examine operational processes, systems, and workflows.

- Products/Services: Evaluate the products or services offered by the entity.

- Profits/Financials: Analyse financial statements, profitability, and financial health.

What Is Standard Due Diligence?

Standard due diligence refers to the customary or typical process of examining a business or investment. It includes a comprehensive assessment of financials, legal compliance, operational aspects, and market factors.

How Do You Prepare Due Diligence?

Preparing due diligence involves gathering relevant documents, forming a due diligence team, and defining the scope and objectives of the assessment. It also includes creating a due diligence checklist and establishing a timeline for the process.

What Is Due Diligence in AML?

In the context of Anti-Money Laundering (AML) regulations, due diligence refers to the process of verifying the identity of customers, assessing their risk levels, and monitoring their financial transactions to detect and prevent money laundering activities.

What Is the Power of Due Diligence?

The power of due diligence lies in its ability to provide decision-makers with the information and insights needed to make well-informed choices. It reduces uncertainty, mitigates risks, and enhances the likelihood of successful outcomes.

What Are the 3 Kinds of Diligence?

The three kinds of diligence often referred to are:

- Financial Diligence: Focuses on assessing financial statements, cash flows, and economic viability.

- Legal Diligence: Involves reviewing legal documents, contracts, and compliance with laws and regulations.

- Operational Diligence: Examines business operations, supply chains, and operational efficiency.

Who Should Pay for Due Diligence?

The party responsible for paying for due diligence varies based on the transaction or agreement. It is typically negotiated between the parties involved, with the buyer or investor often covering the costs.

What Are the Benefits of Diligence?

The benefits of diligence include:

- Informed Decision-Making

- Risk Mitigation

- Enhanced Transparency

- Compliance with Regulations

- Increased Confidence in Investments or Transactions

- Improved Negotiation Position

How Many Types of Diligence Are There?

There are several types of diligence, including financial diligence, legal diligence, operational diligence, market diligence, and more. The specific type of diligence conducted depends on the nature of the assessment or transaction.

What Happens After Due Diligence?

After due diligence is completed, decision-makers use the findings and insights to make informed choices. They may proceed with the transaction, renegotiate terms, request additional information, or decide not to proceed based on the assessment.

About Neotas Enhanced Due Diligence

Neotas Platform covers 600Bn+ archived web pages, 1.8Bn+ court records, 198M+ corporate records, global social media platforms, and 40,000+ Media sources from over 100 countries to help you build a comprehensive picture of the team. It’s a world-first, searching beyond Google. Neotas’ diligence uncovers illicit activities, reducing financial and reputational risk.

Enhanced Due Diligence Solutions:

- Enhanced Due Diligence

- Management Due Diligence

- Customer Due Diligence

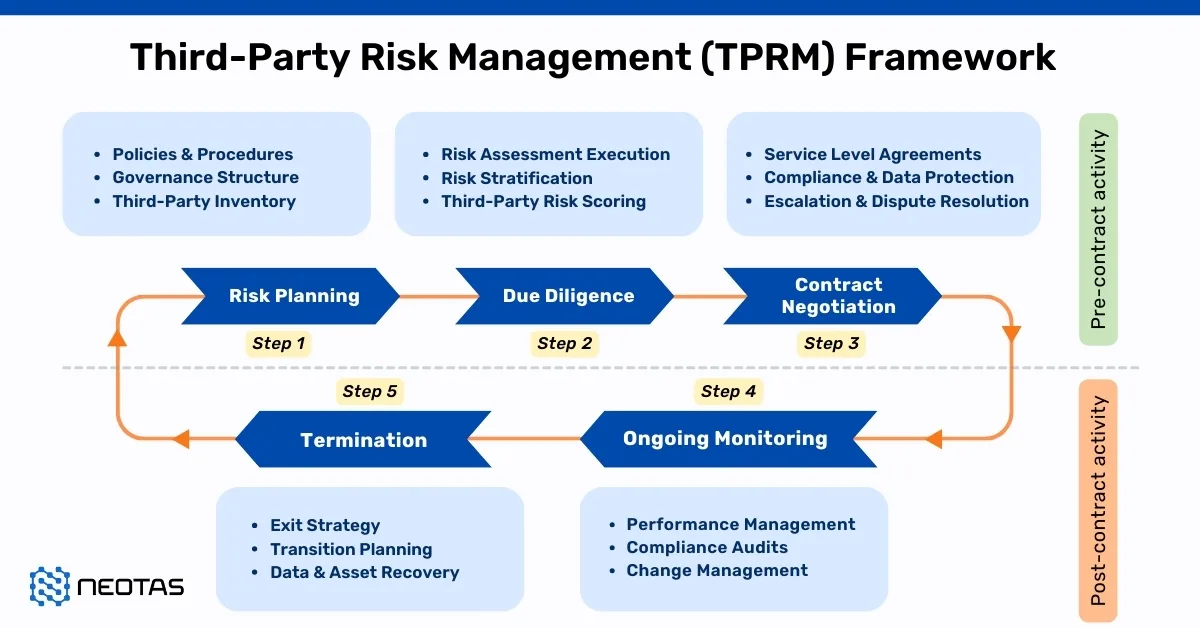

- Third Party Risk Management

- Open Source Intelligence (OSINT)

- Introducing the Neotas Enhanced Due Diligence Platform

Enhanced Due Diligence Case Studies:

- Case Study: OSINT for EDD & AML Compliance

- Overcoming EDD Challenges on High Risk Customers

- Neotas Open Source Intelligence (OSINT) based AML Solution sees beneath the surface

- ESG Risks Uncovered In Investigation For Global Private Equity Firm

- Management Due Diligence Reveals Abusive CEO

- Ongoing Monitoring Protects Credit Against Subsidiary Threat

- AML Compliance and Fraud Detection – How to Spot a Money Launderer and Prevent It

New Whitepaper and Checklist

New Whitepaper and Checklist