Striking the Right Balance: Insights from the Customer Due Diligence Webinar

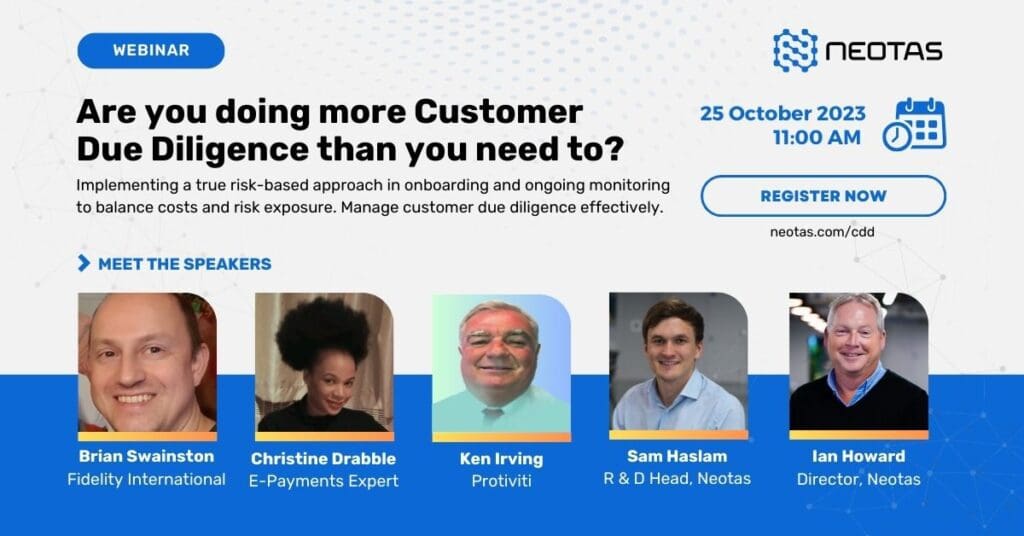

Are You Doing More Customer Due Diligence Than You Need To? Implementing a true risk-based approach in onboarding and ongoing monitoring to balance costs and risk exposure to manage customer due diligence effectively.

Introduction:

In a recent webinar held on October 25, 2023, focused on Customer Due Diligence (CDD), industry experts gathered to discuss the critical balance between thorough compliance efforts and operational efficiency. Moderated by Ian Howard, the panel delved into the evolving landscape of CDD in the financial and professional services sectors. With regulators intensifying requirements, the conversation centered around whether companies are finding the sweet spot in their CDD practices.

Our Expert Panelists:

In this live webinar on Customer Due Diligence (CDD), we were privileged to be joined by a panel of distinguished experts, each offering a unique perspective from their extensive experience in the financial and professional services sectors:

- Brian Swainston, Fidelity International: With a career spanning nearly three decades in financial services, Brian brings a wealth of knowledge to the discussion, particularly in the realm of asset management and operational controls.

- Christine Drabble, E-Payments Expert: A seasoned professional in the ePayments sector, Christine’s eight years of experience have positioned her as a leading authority on compliance and anti-financial crime within this dynamic sement of the Fintech sector.

- Ken Irving, Protiviti: As a consultant and former practioner with a decade-long tenure in financial crime compliance, Ken offers invaluable insights into the evolving landscape of KYC and AML models from his extensive experience across global financial institutions.

- Sam Haslam, R&D Head at Neotas: Drawing from his role as the Head of Research and Development at Neotas, Sam provides a forward-looking perspective on how technological advancements are shaping the landscape of CDD.

- Ian Howard, Director at Neotas: Our moderator, Ian, brings a wealth of expertise in the realm of compliance and financial crime prevention.

Together, these experts guided us through an enriching discussion on the challenges and opportunities surrounding Customer Due Diligence in the rapidly evolving financial landscape of today. Their collective knowledge promised to shed light on critical strategies for navigating the intricate terrain of compliance and operational efficiency.

Key Insights from the Customer Due Diligence Webinar

- Striking the Balance:

The consensus among the panelists was clear: organisations must strike an optimal balance between compliance costs and effectiveness in their CDD strategies. Christine Drabble, UK Head of Compliance and MLR, stressed the importance of this equilibrium, stating, “The challenge lies in harmonising compliance expenditure with efficiency, especially in a landscape with escalating regulatory expectations.”

Ken Irving, a seasoned consultant in financial crime compliance, reaffirmed, adding, “This equilibrium is pivotal. It calls for a strategic approach that aligns CDD processes with potential financial crime risks.”

- Leveraging Technological Advancements:

A pivotal aspect of the discussion revolved around how industry leaders are harnessing the power of technology, open-source intelligence, and data analytics to gain an edge in CDD. Brian Swainston, with extensive experience in financial services, highlighted the transformative potential of technology, stating, “The adoption of cutting-edge technology is not merely an operational enhancement; it reinforces compliance efforts, creating a dual benefit.”

Ken Irving further emphasised, “The transition towards technological integration is a pressing matter. It allows firms to streamline their AML controls without compromising their effectiveness. The goal is to do more with less.”

- Navigating the Regulatory Landscape:

As Christine Drabble aptly put it, “Regulators and policymakers, including the FCA and the Financial Action Task Force, are intensifying requirements. This underscores the necessity for a discerning approach in aligning CDD practices with potential financial crime risks.”

The panel emphasised the need for organisations to remain vigilant and adaptable in the face of evolving regulatory mandates. Ken Irving echoed this sentiment, stating, “Staying abreast of regulatory shifts is non-negotiable. It ensures that organisations remain not only compliant but also well-prepared for emerging challenges.”

- Industry-Specific Expertise:

Each speaker brought a unique perspective to the table, underscoring the importance of sector-specific knowledge in tailoring CDD practices. Christine Drabble’s extensive experience in the ePayments sector provided a valuable lens into this critical aspect. She remarked, “Sector-specific knowledge is invaluable. It enables organisations to navigate the intricacies of compliance within their specific industry.”

Watch the Customer Due Diligence Webinar Recording:#

Conclusion:

The CDD webinar provided deep insights into the multifaceted world of compliance in the financial and professional services sectors. Striking the right balance between compliance costs and effectiveness, harnessing technology, staying attuned to regulatory shifts, and leveraging industry-specific expertise emerged as the cornerstone principles. As the industry navigates this dynamic business environment, informed decision-making and the integration of innovative solutions will be paramount in ensuring robust CDD practices and tackling rising levels of financial crime.

At Neotas, we remain committed to excellence in Customer Due Diligence. Let’s continue to drive excellence in due diligence.

Thank you for your continued support and engagement with Neotas. Should you have any questions or require further information, please do not hesitate to reach out.

More On Customer Due Diligence

New Whitepaper and Checklist

New Whitepaper and Checklist