All you need to know about Third-Party Risk Management, TPRM Framework and a step by step practical guide to implement the TPRM Framework.

Third-party risk management (TPRM) is a structured approach that organisations use to identify, assess, mitigate, and continuously monitor risks associated with their external vendors, suppliers, contractors, and partners. As businesses increasingly rely on third parties to streamline operations, enhance efficiency, and reduce costs, managing associated risks becomes critical to safeguarding sensitive data, ensuring regulatory compliance, and maintaining business continuity.

A Third-Party Risk Management (TPRM) Framework is a structured, systematic approach that organisations use to identify, assess, mitigate, and monitor risks associated with third-party relationships. These third parties can include vendors, suppliers, contractors, service providers, and other external entities that interact with an organisation’s operations, data, or systems.

Given the increasing reliance on third-party services in today’s business landscape, a TPRM framework is essential to protect against financial, operational, cybersecurity, compliance, and reputational risks that may arise from these external partnerships.

A well-defined Third-Party Risk Management framework provides businesses with a systematic approach to mitigating potential risks introduced by third-party relationships.

Organisations depend on third parties for critical services such as cloud computing, data processing, supply chain logistics, and customer support. However, these relationships introduce inherent risks that can impact security, compliance, and business continuity.

A well-defined TPRM framework helps organisations:

A robust TPRM framework ensures that third-party risks are proactively managed rather than addressed reactively, reducing the likelihood of costly incidents such as data breaches, compliance violations, or financial losses.

An effective third-party risk management framework should be structured around key risk management principles to ensure thorough oversight. The following are its fundamental components:

By integrating these core elements, businesses can proactively manage third-party risks and ensure compliance with regulatory obligations.

A TPRM framework is essential for organisations across all industries, particularly those handling sensitive data, financial transactions, or critical infrastructure. It is especially crucial for:

Any business that engages with third-party service providers—whether for IT services, cloud hosting, supply chain management, or payroll processing—must have a robust third-party risk management framework in place.

Organisations that implement a strong TPRM framework can experience several advantages, including:

1. Enhanced Security and Data Protection

By enforcing stringent security measures, businesses can minimise vulnerabilities introduced by third-party vendors.

2. Regulatory Compliance Assurance

A structured framework ensures adherence to industry regulations such as GDPR, ISO 27001, NIST, and SOC 2, reducing legal liabilities.

3. Operational Resilience

An effective TPRM framework reduces the likelihood of operational disruptions caused by vendor failures.

4. Improved Decision-Making

With clear risk assessment metrics, organisations can make informed decisions regarding vendor selection and management.

5. Reputational Safeguarding

Maintaining a strong risk management culture reduces reputational damage from third-party misconduct.

Despite its benefits, implementing a TPRM framework presents challenges that organisations must address:

1. Managing Complex Supply Chains

With globalisation, organisations often engage with a vast network of third parties, making risk oversight complex.

2. Data Security and Privacy Risks

Third parties may have access to sensitive data, increasing the risk of cyber threats. Ensuring they comply with data protection laws is crucial.

3. Regulatory Variability

Different regions and industries have unique compliance requirements, making it difficult to standardise TPRM processes.

4. Resource Constraints

Many organisations lack dedicated teams and technology to monitor third-party risks effectively.

Overcoming these challenges requires strategic investments in technology, process automation, and governance frameworks.

1. Establish Governance and Accountability

2. Develop Comprehensive Risk Policies

3. Implement Risk Assessment Tools

4. Conduct Ongoing Due Diligence

5. Automate Risk Monitoring with Technology

6. Regularly Update and Review the TPRM Framework

To ensure regulatory adherence, businesses must comply with global third-party risk management standards, such as:

1. ISO 27001

A leading standard for information security management systems.

2. NIST (National Institute of Standards and Technology) Framework

A widely recognised framework for improving cybersecurity risk management.

3. GDPR (General Data Protection Regulation)

Applicable to organisations handling EU citizens’ data, enforcing strict third-party data processing controls.

4. SOC 2 (System and Organisation Controls 2)

A framework ensuring third parties maintain strong security and privacy practices.

Understanding and integrating these regulations into a TPRM framework can prevent legal and financial repercussions.

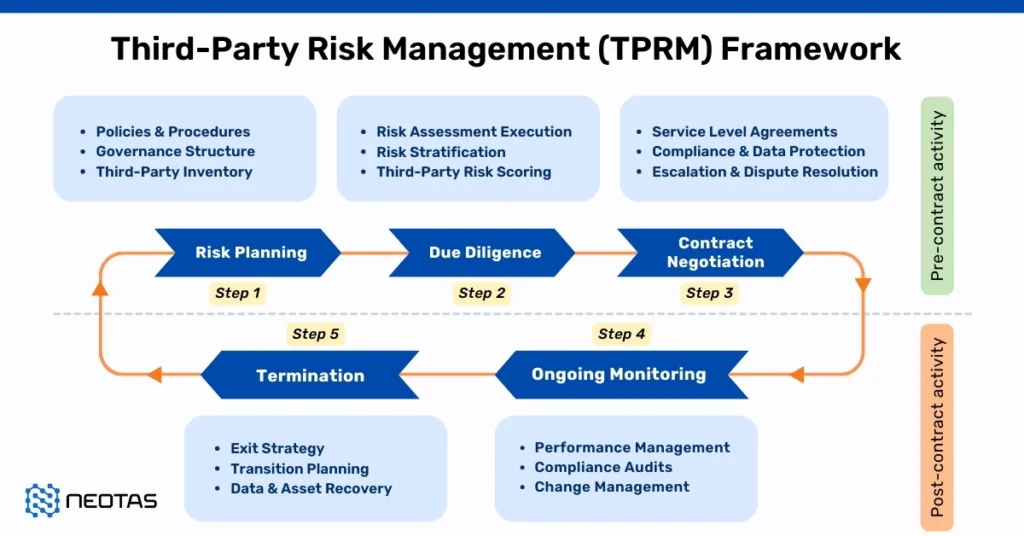

Implementing a Third-Party Risk Management (TPRM) Framework requires a structured approach to identify, assess, mitigate, and continuously monitor risks associated with third-party relationships. Below is a detailed breakdown of each implementation step to help organisations establish an effective TPRM framework.

Before engaging with third-party vendors, organisations must first define governance structures and establish clear policies that outline expectations, responsibilities, and compliance requirements.

Key Actions:

A third-party risk assessment is crucial before onboarding a vendor, ensuring that they meet security, financial, operational, and regulatory requirements.

Key Actions:

To mitigate third-party risks, it is crucial to incorporate legal and contractual protections when engaging with vendors.

Key Actions:

Risk assessments should not be a one-time event—continuous monitoring is essential to detect emerging risks and compliance violations throughout the vendor relationship.

Key Actions:

Despite preventive measures, security breaches, compliance violations, or service failures can still occur. A well-defined incident response plan ensures that the organisation can respond effectively to third-party-related incidents.

Key Actions:

Implementing a Third-Party Risk Management Framework requires a structured, proactive approach to identifying, assessing, and mitigating third-party risks while ensuring compliance with industry regulations. By following this five-step process, organisations can:

Next Steps:

By embedding third-party risk management best practices into your organisation’s operations, you can safeguard your business against vendor-related threats while maintaining strong and compliant third-party relationships.

For many organisations, third-party risk management stops at onboarding. Once a vendor is approved, the relationship moves forward on trust.

What’s the cost of missing these red flags?

The Neotas TPRM Framework helps businesses take a smarter approach by:

Download the Whitepaper

Download the WhitepaperComprehensive Guide to Third-Party Risk Management (TPRM): Framework, Best Practices, and Step-by-Step Implementation

Neotas offers an innovative solution to businesses grappling with Third-Party Risk Management (TPRM). In an era of increasing outsourcing, TPRM has become pivotal, and Neotas recognises this need. Through our enhanced due diligence platform, businesses can efficiently track and evaluate vendors and contractors, ensuring adherence to security protocols in a cost-effective manner.

The Neotas platform automates the vendor onboarding process, streamlining the addition of new vendors with remarkable ease and speed.

Neotas provides a customisable dashboard, enabling businesses to proactively identify and address emerging risks. By consolidating vital vendor information, Neotas facilitates the seamless integration of risk management into existing Customer Relationship Management (CRM) and Supply Chain Management (SCM) systems, ultimately helping businesses maximise profits while minimising risk exposure.

If you’re curious about whether our third-party risk management solutions and services align with your organisation, don’t hesitate to schedule a call. We’re here to help you make informed decisions tailored to your needs.

A Third-Party Risk Management Framework (TPRM Framework) is a structured approach to identifying, assessing, mitigating, and monitoring third-party risks across an organisation’s supply chain, vendors, and service providers.

Businesses today rely on third-party vendors, cloud service providers, and external suppliers to enhance operations. However, this also introduces third-party security risks, including data breaches, vendor compliance failures, supply chain disruptions, and operational inefficiencies. A well-structured TPRM framework ensures businesses can proactively mitigate vendor security risks, comply with industry regulations such as ISO 27001, SOC 2, GDPR, and NIST 800-161, and enhance operational resilience.

Implementing a robust Third-Party Risk Management Framework strengthens vendor risk oversight, enhances data security frameworks, and ensures third-party contract compliance.

A TPRM Framework is critical for cybersecurity and regulatory compliance because it helps businesses:

A comprehensive TPRM Framework helps businesses manage multiple third-party risk categories, including:

A TPRM Framework ensures businesses establish a vendor security governance framework to reduce third-party risks effectively.

A vendor risk assessment is a critical part of any Third-Party Risk Management Framework and involves:

A comprehensive vendor risk assessment ensures businesses select trusted, compliant, and secure third-party vendors.

To ensure a successful TPRM implementation, follow these best practices:

A well-structured TPRM Framework enhances third-party risk reduction strategies and strengthens supply chain security.

A Third-Party Risk Management Framework ensures compliance with ISO 27001, NIST, and GDPR by:

A strong TPRM compliance framework reduces regulatory risks and ensures data security resilience.

A Third-Party Risk Management Framework (TPRM Framework) is essential for third-party vendor risk mitigation by ensuring:

By integrating these third-party risk mitigation strategies, organisations can secure vendor ecosystems, enhance compliance oversight, and reduce financial and reputational risks.

The third-party risk management lifecycle consists of six critical phases:

Vendor Onboarding & Risk Assessment

Vendor Onboarding & Risk Assessment Third-Party Risk Classification

Third-Party Risk Classification Risk Mitigation & Security Controls

Risk Mitigation & Security Controls Contractual Risk Governance & Compliance

Contractual Risk Governance & Compliance Continuous Vendor Risk Monitoring

Continuous Vendor Risk Monitoring Third-Party Vendor Offboarding & Data Protection

Third-Party Vendor Offboarding & Data ProtectionA structured TPRM lifecycle enhances third-party oversight, mitigates supply chain risks, and strengthens enterprise security posture.

A TPRM Framework protects against the following third-party data security risks:

A third-party security governance framework ensures vendors meet cybersecurity best practices, encryption standards, and third-party risk assessment guidelines.

A comprehensive Third-Party Risk Management Framework must align with key regulatory and compliance mandates, including:

Ensuring vendors comply with global regulatory requirements strengthens business resilience, data security frameworks, and compliance auditing processes.

Automated third-party risk monitoring tools enhance TPRM compliance framework implementation by:

Top third-party risk monitoring tools include OneTrust, Prevalent, and UpGuard, which offer automated vendor risk scoring models and compliance tracking.

A third-party incident response plan ensures businesses can contain, investigate, and remediate vendor security breaches. Key steps include:

A structured TPRM incident response plan minimises third-party security risks and ensures business continuity after vendor-related breaches.

To measure the success of a Third-Party Risk Management Framework, businesses should track:

Effective third-party risk evaluation models provide data-driven insights into TPRM framework performance.

To future-proof third-party risk management strategies, businesses must:

By leveraging advanced cybersecurity measures and regulatory risk governance frameworks, organisations can create a future-ready Third-Party Risk Management Framework.

Choosing the right Third-Party Risk Management Framework (TPRM Framework) depends on industry requirements, regulatory compliance, and organisational risk tolerance. The key factors to consider include:

Regulatory & Compliance Requirements

Regulatory & Compliance Requirements Risk Domains & Scope of the TPRM Framework

Risk Domains & Scope of the TPRM Framework Third-Party Risk Mitigation Strategies

Third-Party Risk Mitigation Strategies Technology Integration & Automation

Technology Integration & Automation Scalability & Customisation

Scalability & CustomisationA comprehensive TPRM Framework ensures businesses can select, assess, and monitor third-party vendors effectively while minimising cybersecurity vulnerabilities and regulatory risks.

A risk management framework consists of five essential components that help businesses manage third-party vendor risks, cybersecurity risks, and operational threats:

A well-structured risk management framework enhances business resilience, vendor security governance, and regulatory compliance.

The 7-step Risk Management Framework (RMF) follows a structured approach to assessing, mitigating, and monitoring third-party vendor risks:

A risk management framework following these seven steps strengthens vendor oversight and security governance.

A TPRM System (Third-Party Risk Management System) is a technology-driven platform that enables businesses to automate third-party risk assessments, monitor vendor security risks, and ensure regulatory compliance.

A robust TPRM System enables organisations to proactively manage third-party risks, prevent security incidents, and strengthen vendor compliance frameworks.

To build a Third-Party Risk Management Program, follow these structured steps:

Establish TPRM Governance & Policies

Establish TPRM Governance & Policies Implement Vendor Risk Assessment Frameworks

Implement Vendor Risk Assessment Frameworks Deploy Third-Party Risk Monitoring Tools

Deploy Third-Party Risk Monitoring Tools Develop Incident Response & Risk Mitigation Strategies

Develop Incident Response & Risk Mitigation Strategies Conduct Continuous Vendor Audits & Compliance Reviews

Conduct Continuous Vendor Audits & Compliance ReviewsA well-structured TPRM program enhances third-party risk reduction strategies, regulatory compliance alignment, and vendor security resilience.

TPRM (Third-Party Risk Management) and GRC (Governance, Risk, and Compliance) frameworks both focus on risk oversight, but they serve distinct functions:

Businesses integrating both TPRM and GRC frameworks enhance enterprise-wide security, compliance tracking, and third-party vendor risk mitigation.

Protect your business from third-party risks—Strengthen your risk management strategy with Neotas TPRM Services

Neotas is an Enhanced Due Diligence Platform that leverages AI to join the dots between Corporate Records, Adverse Media and Open Source Intelligence (OSINT).

Schedule a Call or Book a Demo of Third-Party Risk Management Solutions

Neotas Enhanced Due Diligence covers 600Bn+ Archived web pages, 1.8Bn+ court records, 198M+ Corporate records, Global Social Media platforms, and more than 40,000 Media sources from over 100 countries to help you screen & manage risks.

risk management framework

rmf

third party risk management

tprm

nist risk management framework

nist rmf

third-party risk management

tprm meaning

it security risk management

rmf steps

third party risk

information security risk management

3rd party risk management

security risk management

cyber security risk management

risk framework

what is rmf

third party vendor

risk assessment framework

nist assessment

information risk management

what is tprm

security and risk management

cyber security and risk management

nist controls

cybersecurity risk management framework

risk management framework steps

rmf process

risiko management

risk management frameworks

third party vendor management

it risk management framework

nist risk assessment

t&r frameworks

3rd party vendor

rmf framework

risk monitoring

cyber risk management framework

third party risk management framework

vendor risk management program

serlect risks

third party management

third party vendor risk management

what is third party risk management

rmf cybersecurity

tprm assessment

7 steps of rmf

what is a third party vendor

information security and risk management

risk governance framework

third party risk compliance

third party compliance

third party risk software

nist rmf steps

3rd party vendor risk management

risk management framework (rmf)

7 steps of risk management process with example

third party risk assessments

third party risk management program

nist frameworks

third party risk management solution

nist rmf framework

rmf compliance

third party risk management policy

nist control framework

nist third party risk management

rmf nist

third party vendors

rmf risk management framework

third party security

third party access management

rmf cycle

third party risks

risk management framework nist

risk management controls

vendor risk management framework

risk management guide

third party cyber risk assessment

tprm framework

third party risk management process

nist compliance framework

third party cyber risk

information security framework

third-party risk management framework

third party risk management solutions

third party cyber risk management

risk & security management

risk and security management

nist rmf vs csf

third party risk assessment template

information security risk management program

third party threat

third party risk monitoring

third party risk management services

third party risk management technology

risk management framework examples

third party risk solutions

cyber risk framework

nist risk assessment framework

tprm software

risk management framework example

tprm program

what does tprm stand for

information security risk management framework

it third party risk management

business risk management framework

3rd party risk

third party management system

it security and risk management

tprm risk management

security risk model

risk assessment management system

what is tprm in cyber security

framework risk management

third party supplier management

third-party risk

risk management information security

it risk management system

third party risk management assessment

tprm process

nist risk management

types of risk management frameworks

vanta frameworks

importance of third party risk management

information security risk management process

third party risk management vendors

third party risk management regulations

3rd party compliance

rmf acronym

compliance risk management framework

cyber security risk management framework

third party security assessment

cyber security third party risk management

risk management in information security

nist risk assessment methodology

framework for risk management

risque management

third party risk management best practices

risk frameworks

3rd party vendor management

nist cybersecurity controls

third-party risk management examples

nist risk framework

infosec risk management

compliance risk assessment framework

security risk management plan

tprm solutions

supplier risk management program

risk management standards

3rd party management

tprm lifecycle

third party assessment

nist vendor management

third party vendor monitoring

rmf cyber

managing third party risk

third party risk cyber security

third party security management

cybersecurity risk assessment framework

third party risk governance

third party vendor risk assessment example

nist risk management framework steps

third party management risk

third party governance

nist csf vs rmf

shared assessments sig

vendor risk management best practices

risk management security

nist risk matrix

nist risk management framework 800-53

rmf 7 steps

it risk assessment framework

tprm platforms

nist cybersecurity risk assessment

third party vendor definition

7 steps of risk management process

risk analysis framework

risk security management

third party risk assessment framework

3rd party security assessment

security risk management program

nist cybersecurity risk assessment template

regulatory risk management framework

third party compliance management

third-party cyber risk management

third party risk management examples

rmf process steps

third party risk definition

nist rmf 7 steps

third party risk management system

3rd party vendor risk assessment

third party risk assessment process

third party compliance risk management

what is third party management

tprm risk assessment

nist cyber risk scoring

what is third-party risk management

tprm compliance

risk assessment frameworks

third party operational risk

threat management framework

management frameworks

risk managment framework

technology risk management framework

third party vendor risks

how to mitigate third party risk

what is third party risk

third party risk management workflow

third-party vendor

risk management framework cybersecurity

third party risk management compliance

higher education tprm

third party vendor risk

nist risk management framework (rmf)

tprm cybersecurity

cyber risk frameworks

technology risk framework

risk management frameworks list

risk management and security

how to manage third party risk

tprm policy

third party risk management guide

3rd party monitoring

third-party vendor risk management

cyber security risk assessment framework

security risk management framework

third-party management

go/tprm

rmf lifecycle

third party risk management as a service

manage third party risk

rmf tools

nist management framework

digital risk management framework

nist rmf 800-53

what is nist rmf

third party risk management programs

supplier risk management framework

rmf security controls

cyber risk assessment framework

third party risk management standards

third-party risk management best practices

third party information security

health tprm

third party cyber security risk management

sig shared assessments

cyber security third party risk

nist csf risk assessment

risk mitigation framework

cyber rmf

managing third party vendors

third-party risk management program

rmf nist 800-53

why is third party risk management important

it vendor management framework

third party risk management definition

third-party vendor examples

third party risk management controls

third party risk manager

rmf security

robust risk management program

3rd party risk management framework

risk management guidelines

rmf requirements

cyber security risk framework

3rd party risk assessment process

3rd party cyber risk

nist grc

third party risk assessment methodology

third-party risk examples

third party exposure

nist risk

third party risk management framework nist

nist risk management process

risk management framework rmf

nist 800-53 rmf

third party supplier risk

3rd party security risk assessment

nist third party risk management framework

security & risk management

vendor risk assessment framework

information technology risk management framework

risk based cybersecurity framework

risk assessment nist

cybersecurity rmf

cybersecurity third party risk management

third party risk reporting

risk management and compliance framework

federal tprm

what is third party risk assessment

what is rmf?

third party information security risk management

nist risk management framework template

third party risk mitigation

third party security risk assessment

third party security risk

cyber security rmf

securities risk management

third party compliance risk

nist vendor risk management

effective third party risk management

rmf cyber security

third party security risk management

third-party risk management market

risk management framwork

third party evaluation

tprm security

risk control framework

nist methodology

what is 3rd party risk management

nist tprm

3rd party assessment

third-party cyber risk

enterprise vendor risk management program

nist rmf controls

third party risk policy

nist 800 framework

information security compliance framework

risk information management

third party risk management tprm

third-party risk management process

nist cybersecurity risk management framework

third party risk regulations

nist rmf certification

third party risk management framework pdf

tprm best practices

risk assessment cybersecurity framework

cybersecurity risk management frameworks

what is third party vendor

3rd party security

third party risk management policy example

third party procurement

third party risk management audit

third party risk statistics

nist 800 rmf

third party risk management process flow

risk and control framework

risk management nist

third party relationship management

isms risk management

3rd party risk assessments

third party governance and risk management

which of the following poses a higher risk to ensuring business continuity?

third party management policy

third party compliance program

third-party risk management lifecycle

nist model

nist steps

tprm life cycle

third-party vendor management

risk framework management

thirdparty risk management

the risk management framework

it risk framework

nist risk assessment process

third party risk assessment best practices

third party risk management cyber security

third party risk due diligence

third party risk managment

third party managers

nist risk management framework 800 53

third-party risk assessment framework

third party risk management ongoing monitoring

cyber risk management frameworks

third party vendor security

what is nist risk management framework

non profit tprm

nist rmf process

nist rmf training

third party risk management frameworks

nist 800-53 risk management framework

third party risk management program template

the nist risk management approach includes all but which of the following elements?

nist 800-53 risk assessment

nist 800-53 vendor management

nist controls framework

third-party risk management policy

nist risk scoring matrix

what is third party vendor management

third party performance management

nist 800-53 risk assessment template

third-party risk management process flow

third party service provider risk assessment

list of nist frameworks

nist risk assessment tool

third party vendor management security best practices

rmf 800-53

third party risk management policies and procedures

third-party risk assessment example

rmf it

third party management process

third party management framework

nist rfm

nist cyber risk management framework

state & local tprm

it risk management frameworks

risk assessment framework nist

computer risk management

nist cyber risk assessment

third party information security assessment

third party risk management framework template

nist framework controls

third-party compliance

third party risk management checklist

third party risk examples

risk assessment controls

what are some things that are generally included on a third party security assessment report

third party risk management financial services

third party risk framework

third party vendor management program

information security management framework

what are some things that are generally included on a third party security assessment report?

risk models and frameworks

information risk management framework

nist risk assessments

nist third-party risk management framework

guidance for managing third party risk

rmf support

third-party risks examples

nist risk management framework training

third party threats

vendor risk management process flow

tprm services

third party risk assurance

rmf step

rmf documentation

third-party vendor risk assessment example

nist framework risk assessment

third-party risk management regulations

it risk assessment frameworks

third party risk scoring

risk and controls framework

third-party management best practices

security risk frameworks

risk management framework

rmf

third party risk management

tprm

nist risk management framework

nist rmf

third-party risk management

tprm meaning

it security risk management

rmf steps

third party risk

information security risk management

3rd party risk management

security risk management

cyber security risk management

risk framework

what is rmf

third party vendor

risk assessment framework

nist assessment

information risk management

what is tprm

security and risk management

cyber security and risk management

nist controls

cybersecurity risk management framework

risk management framework steps

rmf process

risiko management

risk management frameworks

third party vendor management

it risk management framework

nist risk assessment

t&r frameworks

3rd party vendor

rmf framework

risk monitoring

cyber risk management framework

third party risk management framework

vendor risk management program

serlect risks

third party management

third party vendor risk management

what is third party risk management

rmf cybersecurity

tprm assessment

7 steps of rmf

what is a third party vendor

information security and risk management

risk governance framework

third party risk compliance

third party compliance

third party risk software

nist rmf steps

3rd party vendor risk management

risk management framework (rmf)

7 steps of risk management process with example

third party risk assessments

third party risk management program

nist frameworks

third party risk management solution

nist rmf framework

rmf compliance

third party risk management policy

nist control framework

nist third party risk management

rmf nist

third party vendors

rmf risk management framework

third party security

third party access management

rmf cycle

third party risks

risk management framework nist

risk management controls

vendor risk management framework

risk management guide

third party cyber risk assessment

tprm framework

third party risk management process

nist compliance framework

third party cyber risk

information security framework

third-party risk management framework

third party risk management solutions

third party cyber risk management

risk & security management

risk and security management

nist rmf vs csf

third party risk assessment template

information security risk management program

third party threat

third party risk monitoring

third party risk management services

third party risk management technology

risk management framework examples

third party risk solutions

cyber risk framework

nist risk assessment framework

tprm software

risk management framework example

tprm program

what does tprm stand for

information security risk management framework

it third party risk management

business risk management framework

3rd party risk

third party management system

it security and risk management

tprm risk management

security risk model

risk assessment management system

what is tprm in cyber security

framework risk management

third party supplier management

third-party risk

risk management information security

it risk management system

third party risk management assessment

tprm process

nist risk management

types of risk management frameworks

vanta frameworks

importance of third party risk management

information security risk management process

third party risk management vendors

third party risk management regulations

3rd party compliance

rmf acronym

compliance risk management framework

cyber security risk management framework

third party security assessment

cyber security third party risk management

risk management in information security

nist risk assessment methodology

framework for risk management

risque management

third party risk management best practices

risk frameworks

3rd party vendor management

nist cybersecurity controls

third-party risk management examples

nist risk framework

infosec risk management

compliance risk assessment framework

security risk management plan

tprm solutions

supplier risk management program

risk management standards

3rd party management

tprm lifecycle

third party assessment

nist vendor management

third party vendor monitoring

rmf cyber

managing third party risk

third party risk cyber security

third party security management

cybersecurity risk assessment framework

third party risk governance

third party vendor risk assessment example

nist risk management framework steps

third party management risk

third party governance

nist csf vs rmf

shared assessments sig

vendor risk management best practices

risk management security

nist risk matrix

nist risk management framework 800-53

rmf 7 steps

it risk assessment framework

tprm platforms

nist cybersecurity risk assessment

third party vendor definition

7 steps of risk management process

risk analysis framework

risk security management

third party risk assessment framework

3rd party security assessment

security risk management program

nist cybersecurity risk assessment template

regulatory risk management framework

third party compliance management

third-party cyber risk management

third party risk management examples

rmf process steps

third party risk definition

nist rmf 7 steps

third party risk management system

3rd party vendor risk assessment

third party risk assessment process

third party compliance risk management

what is third party management

tprm risk assessment

nist cyber risk scoring

what is third-party risk management

tprm compliance

risk assessment frameworks

third party operational risk

threat management framework

management frameworks

risk managment framework

technology risk management framework

third party vendor risks

how to mitigate third party risk

what is third party risk

third party risk management workflow

third-party vendor

risk management framework cybersecurity

third party risk management compliance

higher education tprm

third party vendor risk

nist risk management framework (rmf)

tprm cybersecurity

cyber risk frameworks

technology risk framework

risk management frameworks list

risk management and security

how to manage third party risk

tprm policy

third party risk management guide

3rd party monitoring

third-party vendor risk management

cyber security risk assessment framework

security risk management framework

third-party management

go/tprm

rmf lifecycle

third party risk management as a service

manage third party risk

rmf tools

nist management framework

digital risk management framework

nist rmf 800-53

what is nist rmf

third party risk management programs

supplier risk management framework

rmf security controls

cyber risk assessment framework

third party risk management standards

third-party risk management best practices

third party information security

health tprm

third party cyber security risk management

sig shared assessments

cyber security third party risk

nist csf risk assessment

risk mitigation framework

cyber rmf

managing third party vendors

third-party risk management program

rmf nist 800-53

why is third party risk management important

it vendor management framework

third party risk management definition

third-party vendor examples

third party risk management controls

third party risk manager

rmf security

robust risk management program

3rd party risk management framework

risk management guidelines

rmf requirements

cyber security risk framework

3rd party risk assessment process

3rd party cyber risk

nist grc

third party risk assessment methodology

third-party risk examples

third party exposure

nist risk

third party risk management framework nist

nist risk management process

risk management framework rmf

nist 800-53 rmf

third party supplier risk

3rd party security risk assessment

nist third party risk management framework

security & risk management

vendor risk assessment framework

information technology risk management framework

risk based cybersecurity framework

risk assessment nist

cybersecurity rmf

cybersecurity third party risk management

third party risk reporting

risk management and compliance framework

federal tprm

what is third party risk assessment

what is rmf?

third party information security risk management

nist risk management framework template

third party risk mitigation

third party security risk assessment

third party security risk

cyber security rmf

securities risk management

third party compliance risk

nist vendor risk management

effective third party risk management

rmf cyber security

third party security risk management

third-party risk management market

risk management framwork

third party evaluation

tprm security

risk control framework

nist methodology

what is 3rd party risk management

nist tprm

3rd party assessment

third-party cyber risk

enterprise vendor risk management program

nist rmf controls

third party risk policy

nist 800 framework

information security compliance framework

risk information management

third party risk management tprm

third-party risk management process

nist cybersecurity risk management framework

third party risk regulations

nist rmf certification

third party risk management framework pdf

tprm best practices

risk assessment cybersecurity framework

cybersecurity risk management frameworks

what is third party vendor

3rd party security

third party risk management policy example

third party procurement

third party risk management audit

third party risk statistics

nist 800 rmf

third party risk management process flow

risk and control framework

risk management nist

third party relationship management

isms risk management

3rd party risk assessments

third party governance and risk management

which of the following poses a higher risk to ensuring business continuity?

third party management policy

third party compliance program

third-party risk management lifecycle

nist model

nist steps

tprm life cycle

third-party vendor management

risk framework management

thirdparty risk management

the risk management framework

it risk framework

nist risk assessment process

third party risk assessment best practices

third party risk management cyber security

third party risk due diligence

third party risk managment

third party managers

nist risk management framework 800 53

third-party risk assessment framework

third party risk management ongoing monitoring

cyber risk management frameworks

third party vendor security

what is nist risk management framework

non profit tprm

nist rmf process

nist rmf training

third party risk management frameworks

nist 800-53 risk management framework

third party risk management program template

the nist risk management approach includes all but which of the following elements?

nist 800-53 risk assessment

nist 800-53 vendor management

nist controls framework

third-party risk management policy

nist risk scoring matrix

what is third party vendor management

third party performance management

nist 800-53 risk assessment template

third-party risk management process flow

third party service provider risk assessment

list of nist frameworks

nist risk assessment tool

third party vendor management security best practices

rmf 800-53

third party risk management policies and procedures

third-party risk assessment example

rmf it

third party management process

third party management framework

nist rfm

nist cyber risk management framework

state & local tprm

it risk management frameworks

risk assessment framework nist

computer risk management

nist cyber risk assessment

third party information security assessment

third party risk management framework template

nist framework controls

third-party compliance

third party risk management checklist

third party risk examples

risk assessment controls

what are some things that are generally included on a third party security assessment report

third party risk management financial services

third party risk framework

third party vendor management program

information security management framework

what are some things that are generally included on a third party security assessment report?

risk models and frameworks

information risk management framework

nist risk assessments

nist third-party risk management framework

guidance for managing third party risk

rmf support

third-party risks examples

nist risk management framework training

third party threats

vendor risk management process flow

tprm services

third party risk assurance

rmf step

rmf documentation

third-party vendor risk assessment example

nist framework risk assessment

third-party risk management regulations

it risk assessment frameworks

third party risk scoring

risk and controls framework

third-party management best practices

security risk frameworks

risk management framework

rmf

third party risk management

tprm

nist risk management framework

nist rmf

third-party risk management

tprm meaning

it security risk management

rmf steps

third party risk

information security risk management

3rd party risk management

security risk management

cyber security risk management

risk framework

what is rmf

third party vendor

risk assessment framework

nist assessment

information risk management

what is tprm

security and risk management

cyber security and risk management

nist controls

cybersecurity risk management framework

risk management framework steps

rmf process

risiko management

risk management frameworks

third party vendor management

it risk management framework

nist risk assessment

t&r frameworks

3rd party vendor

rmf framework

risk monitoring

cyber risk management framework

third party risk management framework

vendor risk management program

serlect risks

third party management

third party vendor risk management

what is third party risk management

rmf cybersecurity

tprm assessment

7 steps of rmf

what is a third party vendor

information security and risk management

risk governance framework

third party risk compliance

third party compliance

third party risk software

nist rmf steps

3rd party vendor risk management

risk management framework (rmf)

7 steps of risk management process with example

third party risk assessments

third party risk management program

nist frameworks

third party risk management solution

nist rmf framework

rmf compliance

third party risk management policy

nist control framework

nist third party risk management

rmf nist

third party vendors

rmf risk management framework

third party security

third party access management

rmf cycle

third party risks

risk management framework nist

risk management controls

vendor risk management framework

risk management guide

third party cyber risk assessment

tprm framework

third party risk management process

nist compliance framework

third party cyber risk

information security framework

third-party risk management framework

third party risk management solutions

third party cyber risk management

risk & security management

risk and security management

nist rmf vs csf

third party risk assessment template

information security risk management program

third party threat

third party risk monitoring

third party risk management services

third party risk management technology

risk management framework examples

third party risk solutions

cyber risk framework

nist risk assessment framework

tprm software

risk management framework example

tprm program

what does tprm stand for

information security risk management framework

it third party risk management

business risk management framework

3rd party risk

third party management system

it security and risk management

tprm risk management

security risk model

risk assessment management system

what is tprm in cyber security

framework risk management

third party supplier management

third-party risk

risk management information security

it risk management system

third party risk management assessment

tprm process

nist risk management

types of risk management frameworks

vanta frameworks

importance of third party risk management

information security risk management process

third party risk management vendors

third party risk management regulations

3rd party compliance

rmf acronym

compliance risk management framework

cyber security risk management framework

third party security assessment

cyber security third party risk management

risk management in information security

nist risk assessment methodology

framework for risk management

risque management

third party risk management best practices

risk frameworks

3rd party vendor management

nist cybersecurity controls

third-party risk management examples

nist risk framework

infosec risk management

compliance risk assessment framework

security risk management plan

tprm solutions

supplier risk management program

risk management standards

3rd party management

tprm lifecycle

third party assessment

nist vendor management

third party vendor monitoring

rmf cyber

managing third party risk

third party risk cyber security

third party security management

cybersecurity risk assessment framework

third party risk governance

third party vendor risk assessment example

nist risk management framework steps

third party management risk

third party governance

nist csf vs rmf

shared assessments sig

vendor risk management best practices

risk management security

nist risk matrix

nist risk management framework 800-53

rmf 7 steps

it risk assessment framework

tprm platforms

nist cybersecurity risk assessment

third party vendor definition

7 steps of risk management process

risk analysis framework

risk security management

third party risk assessment framework

3rd party security assessment

security risk management program

nist cybersecurity risk assessment template

regulatory risk management framework

third party compliance management

third-party cyber risk management

third party risk management examples

rmf process steps

third party risk definition

nist rmf 7 steps

third party risk management system

3rd party vendor risk assessment

third party risk assessment process

third party compliance risk management

what is third party management

tprm risk assessment

nist cyber risk scoring

what is third-party risk management

tprm compliance

risk assessment frameworks

third party operational risk

threat management framework

management frameworks

risk managment framework

technology risk management framework

third party vendor risks

how to mitigate third party risk

what is third party risk

third party risk management workflow

third-party vendor

risk management framework cybersecurity

third party risk management compliance

higher education tprm

third party vendor risk

nist risk management framework (rmf)

tprm cybersecurity

cyber risk frameworks

technology risk framework

risk management frameworks list

risk management and security

how to manage third party risk

tprm policy

third party risk management guide

3rd party monitoring

third-party vendor risk management

cyber security risk assessment framework

security risk management framework

third-party management

go/tprm

rmf lifecycle

third party risk management as a service

manage third party risk

rmf tools

nist management framework

digital risk management framework

nist rmf 800-53

what is nist rmf

third party risk management programs

supplier risk management framework

rmf security controls

cyber risk assessment framework

third party risk management standards

third-party risk management best practices

third party information security

health tprm

third party cyber security risk management

sig shared assessments

cyber security third party risk

nist csf risk assessment

risk mitigation framework

cyber rmf

managing third party vendors

third-party risk management program

rmf nist 800-53

why is third party risk management important

it vendor management framework

third party risk management definition

third-party vendor examples

third party risk management controls

third party risk manager

rmf security

robust risk management program

3rd party risk management framework

risk management guidelines

rmf requirements

cyber security risk framework

3rd party risk assessment process

3rd party cyber risk

nist grc

third party risk assessment methodology

third-party risk examples

third party exposure

nist risk

third party risk management framework nist

nist risk management process

risk management framework rmf

nist 800-53 rmf

third party supplier risk

3rd party security risk assessment

nist third party risk management framework

security & risk management

vendor risk assessment framework

information technology risk management framework

risk based cybersecurity framework

risk assessment nist

cybersecurity rmf

cybersecurity third party risk management

third party risk reporting

risk management and compliance framework

federal tprm

what is third party risk assessment

what is rmf?

third party information security risk management

nist risk management framework template

third party risk mitigation

third party security risk assessment

third party security risk

cyber security rmf

securities risk management

third party compliance risk

nist vendor risk management

effective third party risk management

rmf cyber security

third party security risk management

third-party risk management market

risk management framwork

third party evaluation

tprm security

risk control framework

nist methodology

what is 3rd party risk management

nist tprm

3rd party assessment

third-party cyber risk

enterprise vendor risk management program

nist rmf controls

third party risk policy

nist 800 framework

information security compliance framework

risk information management

third party risk management tprm

third-party risk management process

nist cybersecurity risk management framework

third party risk regulations

nist rmf certification

third party risk management framework pdf

tprm best practices

risk assessment cybersecurity framework

cybersecurity risk management frameworks

what is third party vendor

3rd party security

third party risk management policy example

third party procurement

third party risk management audit

third party risk statistics

nist 800 rmf

third party risk management process flow

risk and control framework

risk management nist

third party relationship management

isms risk management

3rd party risk assessments

third party governance and risk management

which of the following poses a higher risk to ensuring business continuity?

third party management policy

third party compliance program

third-party risk management lifecycle

nist model

nist steps

tprm life cycle

third-party vendor management

risk framework management

thirdparty risk management

the risk management framework

it risk framework

nist risk assessment process

third party risk assessment best practices

third party risk management cyber security

third party risk due diligence

third party risk managment

third party managers

nist risk management framework 800 53

third-party risk assessment framework

third party risk management ongoing monitoring

cyber risk management frameworks

third party vendor security

what is nist risk management framework

non profit tprm

nist rmf process

nist rmf training

third party risk management frameworks

nist 800-53 risk management framework

third party risk management program template

the nist risk management approach includes all but which of the following elements?

nist 800-53 risk assessment

nist 800-53 vendor management

nist controls framework

third-party risk management policy

nist risk scoring matrix

what is third party vendor management

third party performance management

nist 800-53 risk assessment template

third-party risk management process flow

third party service provider risk assessment

list of nist frameworks

nist risk assessment tool

third party vendor management security best practices

rmf 800-53

third party risk management policies and procedures

third-party risk assessment example

rmf it

third party management process

third party management framework

nist rfm

nist cyber risk management framework

state & local tprm

it risk management frameworks

risk assessment framework nist

computer risk management

nist cyber risk assessment

third party information security assessment

third party risk management framework template

nist framework controls

third-party compliance

third party risk management checklist

third party risk examples

risk assessment controls

what are some things that are generally included on a third party security assessment report

third party risk management financial services

third party risk framework

third party vendor management program

information security management framework

what are some things that are generally included on a third party security assessment report?

risk models and frameworks

information risk management framework

nist risk assessments

nist third-party risk management framework

guidance for managing third party risk

rmf support

third-party risks examples

nist risk management framework training

third party threats

vendor risk management process flow

tprm services

third party risk assurance

rmf step

rmf documentation

third-party vendor risk assessment example

nist framework risk assessment

third-party risk management regulations

it risk assessment frameworks

third party risk scoring

risk and controls framework

third-party management best practices

security risk frameworks

risk management framework

rmf

third party risk management

tprm

nist risk management framework

nist rmf

third-party risk management

tprm meaning

it security risk management

rmf steps

third party risk

information security risk management

3rd party risk management

security risk management

cyber security risk management

risk framework

what is rmf

third party vendor

risk assessment framework

nist assessment

information risk management

what is tprm

security and risk management

cyber security and risk management

nist controls

cybersecurity risk management framework

risk management framework steps

rmf process

risiko management

risk management frameworks

third party vendor management

it risk management framework

nist risk assessment

t&r frameworks

3rd party vendor

rmf framework

risk monitoring

cyber risk management framework

third party risk management framework

vendor risk management program

serlect risks

third party management

third party vendor risk management

what is third party risk management

rmf cybersecurity

tprm assessment

7 steps of rmf

what is a third party vendor

information security and risk management

risk governance framework

third party risk compliance

third party compliance

third party risk software

nist rmf steps

3rd party vendor risk management

risk management framework (rmf)

7 steps of risk management process with example

third party risk assessments

third party risk management program

nist frameworks

third party risk management solution

nist rmf framework

rmf compliance

third party risk management policy

nist control framework

nist third party risk management

rmf nist

third party vendors

rmf risk management framework

third party security

third party access management

rmf cycle

third party risks

risk management framework nist

risk management controls

vendor risk management framework

risk management guide

third party cyber risk assessment

tprm framework

third party risk management process

nist compliance framework

third party cyber risk

information security framework

third-party risk management framework

third party risk management solutions

third party cyber risk management

risk & security management

risk and security management

nist rmf vs csf

third party risk assessment template

information security risk management program

third party threat

third party risk monitoring

third party risk management services

third party risk management technology

risk management framework examples

third party risk solutions

cyber risk framework

nist risk assessment framework

tprm software

risk management framework example

tprm program

what does tprm stand for

information security risk management framework

it third party risk management

business risk management framework

3rd party risk

third party management system

it security and risk management

tprm risk management

security risk model

risk assessment management system

what is tprm in cyber security

framework risk management

third party supplier management

third-party risk

risk management information security

it risk management system

third party risk management assessment

tprm process

nist risk management

types of risk management frameworks

vanta frameworks

importance of third party risk management

information security risk management process

third party risk management vendors

third party risk management regulations

3rd party compliance

rmf acronym

compliance risk management framework

cyber security risk management framework

third party security assessment

cyber security third party risk management

risk management in information security

nist risk assessment methodology

framework for risk management

risque management

third party risk management best practices

risk frameworks

3rd party vendor management

nist cybersecurity controls

third-party risk management examples

nist risk framework

infosec risk management

compliance risk assessment framework

security risk management plan

tprm solutions

supplier risk management program

risk management standards

3rd party management

tprm lifecycle

third party assessment

nist vendor management

third party vendor monitoring

rmf cyber

managing third party risk

third party risk cyber security

third party security management

cybersecurity risk assessment framework

third party risk governance

third party vendor risk assessment example

nist risk management framework steps

third party management risk

third party governance

nist csf vs rmf

shared assessments sig

vendor risk management best practices

risk management security

nist risk matrix

nist risk management framework 800-53

rmf 7 steps

it risk assessment framework

tprm platforms

nist cybersecurity risk assessment

third party vendor definition

7 steps of risk management process

risk analysis framework

risk security management

third party risk assessment framework

3rd party security assessment

security risk management program

nist cybersecurity risk assessment template

regulatory risk management framework

third party compliance management

third-party cyber risk management

third party risk management examples

rmf process steps

third party risk definition

nist rmf 7 steps

third party risk management system

3rd party vendor risk assessment

third party risk assessment process

third party compliance risk management

what is third party management

tprm risk assessment

nist cyber risk scoring

what is third-party risk management

tprm compliance

risk assessment frameworks

third party operational risk

threat management framework

management frameworks

risk managment framework

technology risk management framework

third party vendor risks

how to mitigate third party risk

what is third party risk

third party risk management workflow

third-party vendor

risk management framework cybersecurity

third party risk management compliance

higher education tprm

third party vendor risk

nist risk management framework (rmf)

tprm cybersecurity

cyber risk frameworks

technology risk framework

risk management frameworks list

risk management and security

how to manage third party risk

tprm policy

third party risk management guide

3rd party monitoring

third-party vendor risk management

cyber security risk assessment framework

security risk management framework

third-party management

go/tprm

rmf lifecycle

third party risk management as a service

manage third party risk

rmf tools

nist management framework

digital risk management framework

nist rmf 800-53

what is nist rmf

third party risk management programs

supplier risk management framework

rmf security controls

cyber risk assessment framework

third party risk management standards

third-party risk management best practices

third party information security

health tprm

third party cyber security risk management

sig shared assessments

cyber security third party risk

nist csf risk assessment

risk mitigation framework

cyber rmf

managing third party vendors

third-party risk management program

rmf nist 800-53

why is third party risk management important

it vendor management framework

third party risk management definition

third-party vendor examples

third party risk management controls

third party risk manager

rmf security

robust risk management program

3rd party risk management framework

risk management guidelines

rmf requirements

cyber security risk framework

3rd party risk assessment process

3rd party cyber risk

nist grc

third party risk assessment methodology

third-party risk examples

third party exposure

nist risk

third party risk management framework nist

nist risk management process

risk management framework rmf

nist 800-53 rmf

third party supplier risk

3rd party security risk assessment

nist third party risk management framework

security & risk management

vendor risk assessment framework

information technology risk management framework

risk based cybersecurity framework

risk assessment nist

cybersecurity rmf

cybersecurity third party risk management

third party risk reporting

risk management and compliance framework

federal tprm

what is third party risk assessment

what is rmf?

third party information security risk management

nist risk management framework template

third party risk mitigation

third party security risk assessment

third party security risk

cyber security rmf

securities risk management

third party compliance risk

nist vendor risk management

effective third party risk management

rmf cyber security

third party security risk management

third-party risk management market

risk management framwork

third party evaluation

tprm security

risk control framework

nist methodology

what is 3rd party risk management

nist tprm

3rd party assessment

third-party cyber risk

enterprise vendor risk management program

nist rmf controls

third party risk policy

nist 800 framework

information security compliance framework

risk information management

third party risk management tprm

third-party risk management process

nist cybersecurity risk management framework

third party risk regulations

nist rmf certification

third party risk management framework pdf

tprm best practices

risk assessment cybersecurity framework

cybersecurity risk management frameworks

what is third party vendor

3rd party security

third party risk management policy example

third party procurement

third party risk management audit

third party risk statistics

nist 800 rmf

third party risk management process flow

risk and control framework

risk management nist

third party relationship management

isms risk management

3rd party risk assessments

third party governance and risk management

which of the following poses a higher risk to ensuring business continuity?

third party management policy

third party compliance program

third-party risk management lifecycle

nist model

nist steps

tprm life cycle

third-party vendor management

risk framework management

thirdparty risk management

the risk management framework

it risk framework

nist risk assessment process

third party risk assessment best practices

third party risk management cyber security

third party risk due diligence

third party risk managment

third party managers

nist risk management framework 800 53

third-party risk assessment framework

third party risk management ongoing monitoring

cyber risk management frameworks

third party vendor security

what is nist risk management framework

non profit tprm

nist rmf process

nist rmf training

third party risk management frameworks

nist 800-53 risk management framework

third party risk management program template

the nist risk management approach includes all but which of the following elements?

nist 800-53 risk assessment

nist 800-53 vendor management

nist controls framework

third-party risk management policy

nist risk scoring matrix

what is third party vendor management

third party performance management

nist 800-53 risk assessment template

third-party risk management process flow

third party service provider risk assessment

list of nist frameworks

nist risk assessment tool

third party vendor management security best practices

rmf 800-53

third party risk management policies and procedures

third-party risk assessment example

rmf it

third party management process

third party management framework

nist rfm

nist cyber risk management framework

state & local tprm

it risk management frameworks

risk assessment framework nist

computer risk management

nist cyber risk assessment

third party information security assessment

third party risk management framework template

nist framework controls

third-party compliance

third party risk management checklist

third party risk examples

risk assessment controls

what are some things that are generally included on a third party security assessment report

third party risk management financial services

third party risk framework

third party vendor management program

information security management framework

what are some things that are generally included on a third party security assessment report?

risk models and frameworks

information risk management framework

nist risk assessments

nist third-party risk management framework

guidance for managing third party risk

rmf support

third-party risks examples

nist risk management framework training

third party threats

vendor risk management process flow

tprm services

third party risk assurance

rmf step

rmf documentation

third-party vendor risk assessment example

nist framework risk assessment

third-party risk management regulations

it risk assessment frameworks

third party risk scoring

risk and controls framework

third-party management best practices

security risk frameworks

risk management framework

risk management framework

third party risk management

third party risk monitoring

risk management framework

risk management framework

third party risk management

third party risk management

it security risk management

rmf steps

third party risk

it security risk management

third party risk management

security risk management

cyber security and risk management

risk management framework

risk management framework

ssid meaning

risk management framework

nist assessment

what risks are involved in information management?

third party risk management

security risk management

cybersecurity risk management

nist controls

risk management framework

rmf steps

rmf steps

risk management

risk management frameworks

third party vendor management

risk management framework

nist 800-30

t&r frameworks

third party vendor

risk management framework

risk monitoring

risk management framework

third party risk management

vendor risk management

serlect risks

third party management

third party risk management

third party risk management

risk management framework

tprm

rmf steps

ssid meaning

it security risk management

risk governance framework

third party risk management

third party compliance

third-party risk management software

nist rmf steps

third party risk management

risk management framework

7 steps of risk management process with example

third party risk assessment

third party risk management

nist frameworks

third-party risk management software

risk management framework

risk management framework

third-party risk management