Vendor Due Diligence Report

Conducting a comprehensive vendor due diligence (VDD) is a critical aspect of effective third-party risk management (TPRM). It involves a thorough examination of a vendor’s background, capabilities, financial stability, and compliance posture to ensure that the risks associated with engaging with that vendor are identified, assessed, and mitigated appropriately.

A VDD report is a detailed document that captures the findings and recommendations resulting from this evaluation process. It serves as a valuable resource for decision-makers, providing them with a comprehensive understanding of the vendor’s suitability and potential risks, enabling informed decisions regarding vendor selection and ongoing risk management.

The vendor due diligence report typically encompasses the following key components:

1. Executive Summary:

This section provides a concise overview of the due diligence process, highlighting the key findings, risk assessments, and recommendations. It serves as a high-level summary for senior management and stakeholders.

2. Vendor Profile:

The report should include detailed information about the vendor’s background, including its history, ownership structure, geographical presence, and industry experience. This section helps establish the vendor’s credibility and reputation within the market.

3. Service Offerings and Capabilities:

A comprehensive analysis of the vendor’s service offerings and capabilities is essential. This includes evaluating the vendor’s technical expertise, resource allocation, and ability to meet the organization’s specific requirements effectively and efficiently.

4. Financial Assessment:

Assessing the vendor’s financial stability is crucial to ensure their long-term viability and ability to fulfill contractual obligations. This section may include an analysis of the vendor’s financial statements, credit ratings, and any potential financial risks or concerns.

5. Operational and Business Continuity Assessment:

The report should evaluate the vendor’s operational processes, infrastructure, and business continuity plans. This assessment aims to identify potential risks related to service disruptions, data loss, or other operational vulnerabilities that could impact the organization’s operations.

6. Cybersecurity and Data Protection Evaluation:

In today’s digital landscape, cybersecurity and data protection are paramount concerns. The VDD report should assess the vendor’s cybersecurity posture, data handling practices, and compliance with relevant regulations and industry standards, such as the General Data Protection Regulation (GDPR) or industry-specific requirements.

7. Compliance and Regulatory Assessment:

Depending on the industry and the nature of the services provided, the vendor may be subject to various regulatory requirements. The report should evaluate the vendor’s compliance with applicable laws, regulations, and industry standards, as well as their approach to governance, risk management, and internal control frameworks.

8. Third-Party Risk Assessment:

If the vendor relies on sub-contractors or other third-party providers, the due diligence process should extend to evaluating the associated risks. This section should assess the vendor’s third-party risk management practices and the potential implications for the organization.

9. Risk Mitigation Strategies:

Based on the identified risks and vulnerabilities, the report should outline recommended risk mitigation strategies. These may include contractual provisions, security controls, monitoring mechanisms, or contingency plans to effectively manage and reduce the potential impact of identified risks.

10. Conclusion and Recommendations:

The final section of the VDD report should provide a clear conclusion and recommendations regarding the suitability of the vendor for the intended engagement. It should summarize the key findings, highlight any critical risks or concerns, and provide guidance on the next steps, whether it involves proceeding with the vendor engagement, negotiating additional safeguards, or exploring alternative options.

The VDD report serves as a comprehensive record of the evaluation process, enabling stakeholders to make informed decisions and implement appropriate risk management strategies. It is crucial that the report is objective, thorough, and accurately reflects the findings of the due diligence process.

Effective vendor due diligence is an ongoing process that should be revisited periodically, as vendor relationships, regulatory landscapes, and risk profiles evolve over time. Regular updates to the VDD report ensure that the organization maintains a current understanding of the risks associated with its third-party engagements and can proactively address any emerging issues or concerns.

Read more about Third-Party Risk, TPRM software, and TPRM processes.

Read the detailed guide on Vendor Due Diligence Checklist

How can Neotas Vendor Due Diligence report help?

Enhance your vendor due diligence process with Neotas. Our rigorous analysis minimises risks, expedites sales, and increases value creation. Gain buyer confidence through objective assessments. Through our enhanced due diligence platform, businesses can efficiently track and evaluate vendors and contractors, ensuring adherence to security protocols in a cost-effective manner.

The Neotas platform automates the vendor onboarding process, streamlining the addition of new vendors with remarkable ease and speed.

Moreover, Neotas provides a customisable dashboard, enabling businesses to proactively identify and address emerging risks. By consolidating vital vendor information, Neotas facilitates the seamless integration of risk management into existing Customer Relationship Management (CRM) and Supply Chain Management (SCM) systems, ultimately helping businesses maximise profits while minimising risk exposure.

Request a Demo

If you’re curious about whether our Vendor Due Diligence solutions and services align with your organisation, don’t hesitate to schedule a call. We’re here to help you make informed decisions tailored to your needs.

Vendor Due Diligence Solutions:

- Enhanced Due Diligence

- Management Due Diligence

- Customer Due Diligence

- Simplified Due Diligence

- Third Party Risk Management

- Vendor Due Diligence

- Vendor Due Diligence (VDD) Guide

- Vendor Due Diligence Report

- Vendor Due Diligence Checklist

- Vendor Due Diligence Questionnaire

- Vendor Due Diligence Process

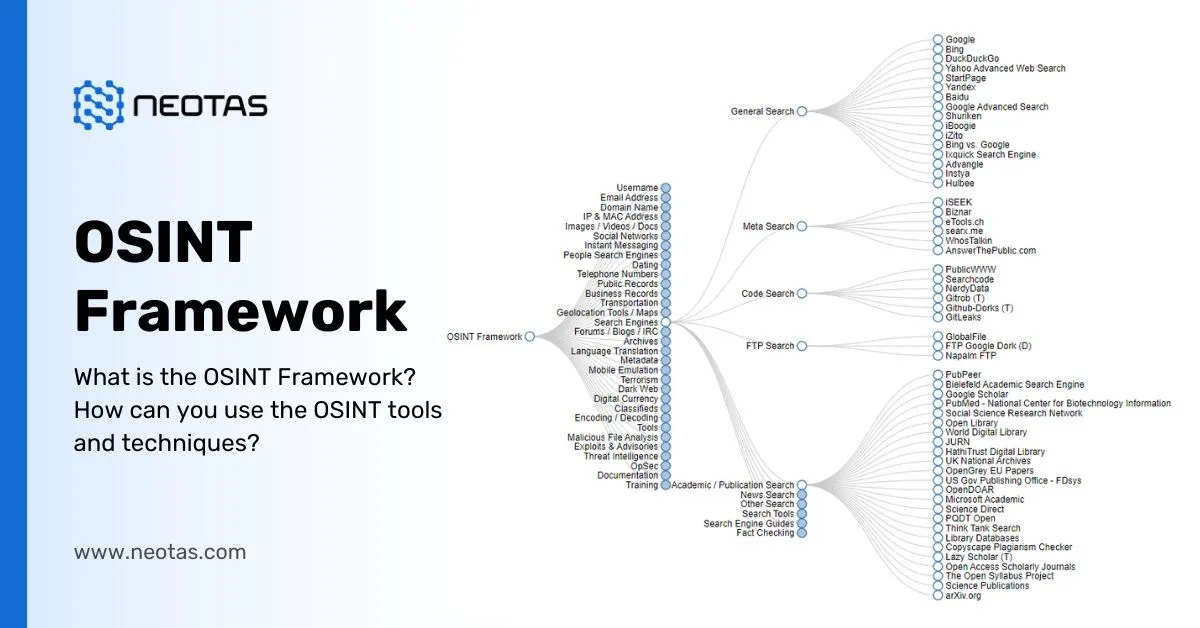

- Open Source Intelligence (OSINT)

- Introducing the Neotas Enhanced Due Diligence Platform

Vendor Due Diligence Case Studies:

- Third Party Risk Management (TPRM) Using OSINT

- Open-source Intelligence For Supply Chain – OSINT

- ESG Risk Management Framework with Neotas’ OSINT Integration

- Open Source Intelligence In AML Compliance | Case Study

- Identifying Difficult And Dangerous Senior Managers

- ESG Risk Investigation Uncovers Supply Chain Risks

- Financial Crime Compliance & Risk Management Trends

- Network Analysis Reveals International Links In Credit Risk Case

- Network Analysis and Due Diligence – Terrorist Financing

- Using OSINT For Sources Of Wealth Checks

- ESG Risks Uncovered In Investigation For Global Private …

- PEP Screening: Undisclosed Political Links Uncovered For European Organisation

- Risk-Based Approach (RBA) to AML & KYC risk management

- Anti-Money Laundering (AML)

- Supply Chain Risk Management

- Due Diligence Explained: Types, Checklist, Process, Reports

FAQs on Vendor Due Diligence (VDD)

Why is a VDD Report important?

A VDD Report is crucial because it helps organisations identify and mitigate potential risks associated with engaging with a third-party vendor. It evaluates the vendor’s capabilities, financial stability, compliance posture, and risk management practices, ensuring that the organisation’s interests, regulatory requirements, and security concerns are addressed effectively.

What information is typically included in a VDD Report?

A comprehensive VDD Report typically includes sections on the vendor’s profile, service offerings, financial assessment, operational and business continuity assessment, cybersecurity and data protection evaluation, compliance and regulatory assessment, third-party risk assessment, risk mitigation strategies, and a detailed conclusion and recommendations.

How is a VDD Report prepared?

A VDD Report is prepared through a structured process that involves planning and scoping, data collection and vendor questionnaires, documentation review, site visits and interviews, risk assessment and analysis, third-party risk evaluation, and remediation and risk mitigation strategies. Cross-functional teams collaborate to gather and analyze relevant information.

What are the key areas assessed in a VDD Report?

The key areas assessed in a VDD Report include the vendor’s financial stability, operational processes, business continuity plans, cybersecurity posture, data protection practices, compliance with relevant regulations and industry standards, third-party risk management practices, and overall risk profile.

How often should a VDD Report be updated?

VDD Reports should be updated periodically, typically on an annual or biennial basis, or whenever there are significant changes in the vendor’s operations, risk profile, or regulatory environment. Regular updates ensure that the organisation maintains an accurate understanding of the risks associated with the vendor engagement.

Who should be involved in the VDD process?

The VDD process should involve a cross-functional team comprising representatives from various departments, such as procurement, legal, information security, risk management, and subject matter experts. This collaborative approach ensures a comprehensive evaluation and effective risk mitigation strategies.

How does a VDD Report contribute to risk management?

A VDD Report is a crucial component of an organisation’s overall risk management strategy. It provides a detailed assessment of the potential risks associated with a vendor engagement, enabling the organisation to implement appropriate risk mitigation strategies, maintain regulatory compliance, and protect its operations, customers, and reputation.

How can an organisation ensure the effectiveness of its VDD process?

To ensure the effectiveness of its VDD process, an organisation should establish clear policies and procedures, implement robust governance and oversight mechanisms, conduct regular training for personnel involved in the process, and foster a culture of continuous improvement and adaptation to changing risk landscapes and regulatory requirements.