Money Laundering Advisory Notice: High Risk Third Countries

Recent regulatory changes by HM Government have brought about new challenges for banks, payment providers, andfinancial institutions dealing with high-risk third countries. Neotas launches automated solution to deal with KYC backlogs due to changes in high-risk countries list. Improve AML efficiency with automated CDD and EDD for high risk countries.

With Bulgaria re-included and South Africa added for the first time, compliance teams face heightened requirements in carrying out enhanced due diligence checks on their customers and correspondent banking relationships in those areas.

With the UK’s historically close ties to South Africa in particular, many firms now find themselves having to review both their KYC checks on existing customers and also apply EDD checks on new relationships for all customer relationships such as individuals, companies trusts for banks, and correspondent banks. This has created a hiatus of additional AML compliance work for compliance teams over and above existing requirements adding to already heavily overloaded teams.

The current list can be found in the Money Laundering Advisory Notice: High Risk Third Countries issued by HM Treasury about risks posed by jurisdictions with unsatisfactory money laundering and terrorist financing controls.

List of High Risk Third Countries: https://www.gov.uk/government/publications/money-laundering-advisory-notice-high-risk-third-countries–2/money-laundering-advisory-notice-high-risk-third-countries

These changes can add significant additional new due diligence work for both customers already onboarded and new customers.

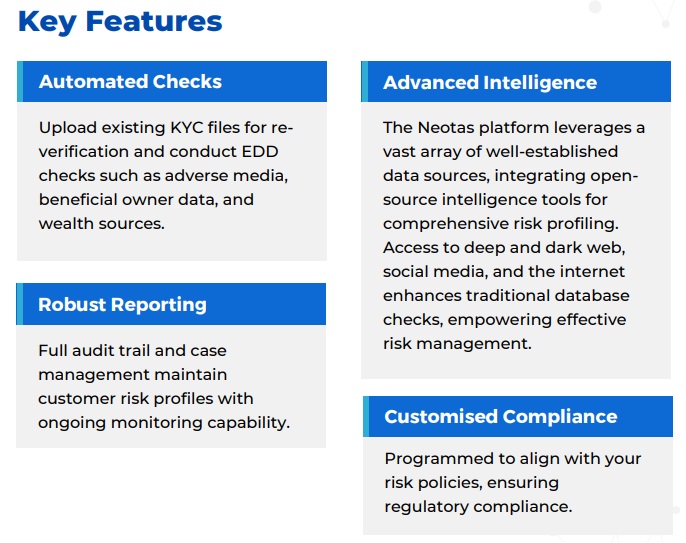

Neotas recently launched a tech based solution that automates the CDD processes for both new and existing customers and improves the efficiency of dealing with backlogs.

Here are the details: Money Laundering Advisory Notice: High Risk Third Countries

The Neotas Solution

Neotas, a leader in automated EDD technology solutions, has developed a tech-based solution to help firms deal with the extra workload efficiently and effectively. Designed to integrate with an existing AML control framework, the Neotas solution can implemented in a very short space of time freeing up valuable compliance resources to manage risks and not processes.

Neotas leads the way in automating complex customer due diligence processes and existing customers are realising up to 50% improvements in process efficiency as many of the typically manual, inefficient processes are eliminated.

Experience firsthand how Neotas AML compliance and regulatory solutions can transform your organisation. Improve AML efficiency with automated CDD and EDD for high risk countries.

Request a demo today to:

- See Our Solutions in Action: Get a live walkthrough of the Neotas platform, and explore how our tools and features can address your specific compliance challenges.

- Discuss Your Compliance Needs: Let us understand your unique compliance scenarios and how we can tailor our solutions to best fit your use case specific requirements. Schedule a Call

Appendix:

Money Laundering Advisory Notice: List of countries

On 27 October 2023, the FATF published two statements identifying jurisdictions with strategic deficiencies in their AML/CTF regimes.

In response to the latest FATF statements, HM Treasury advises firms to consider the following jurisdictions:

*These jurisdictions are subject to financial sanctions measures at the time of publication of this notice which require firms to take additional measures. Details can be found on the Financial targets by regime collection page.

*To see the most recent list of high-risk third countries go to: HM Treasury Advisory Notice: High Risk Third Countries

Read more in our EDD Checklist 2024 Guide for High-Risk Customers.

Enhanced Due Diligence Checklist

Enhanced Due Diligence Checklist – Best practices & step by step guide for KYC, AML, fraud prevention & more.

Who are High-Risk Customers – Learn about the types of high risk customers.

Due Diligence Solutions:

- Enhanced Due Diligence

- Management Due Diligence

- Customer Due Diligence

- Simplified Due Diligence

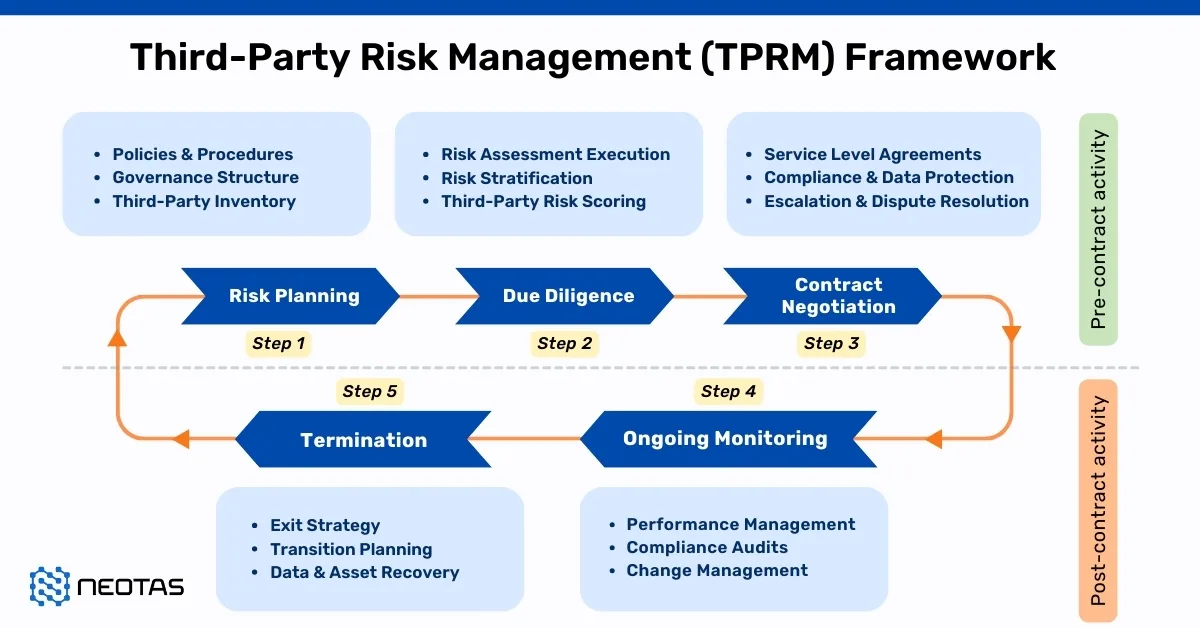

- Third Party Risk Management

- Open Source Intelligence (OSINT)

- Introducing the Neotas Enhanced Due Diligence Platform

Due Diligence Case Studies:

- Case Study: OSINT for EDD & AML Compliance

- Overcoming EDD Challenges on High Risk Customers

- Neotas Open Source Intelligence (OSINT) based AML Solution sees beneath the surface

- ESG Risks Uncovered In Investigation For Global Private Equity Firm

- Management Due Diligence Reveals Abusive CEO

- Ongoing Monitoring Protects Credit Against Subsidiary Threat

- AML Compliance and Fraud Detection – How to Spot a Money Launderer and Prevent It

- OSINT Framework, OSINT Tools, OSINT Techniques, and how to use OSINT framework.

- Open Source Intelligence (OSINT) in the Fight Against Financial Crime

- Reduce & Manage Business Risk with Neotas Open Source Intelligence (OSINT) Solutions

- Using OSINT for Sources of Wealth Checks

- Open Source Intelligence (OSINT) based AML Solution sees beneath the surface

- Enhancing ESG Risk Management Framework with Neotas’ OSINT Integration

- How Open Source Intelligence (OSINT) is transforming enhanced due diligence and investigations in AML compliance

- Detecting Modern Slavery In Your Supply Chain using Open-source Intelligence

- Creating an effective framework for managing risk with suppliers and third parties using open-source intelligence (OSINT)

- Using Open Source Intelligence For Enhanced Due Diligence

- Money Laundering Advisory Notice: High Risk Third Countries

Manage Financial Compliance and Business Risk with Enhanced Due Diligence and OSINT.

Neotas is an Enhanced Due Diligence Platform that leverages AI to join the dots between Corporate Records, Adverse Media and Open Source Intelligence (OSINT).

Schedule a Call or Book a Demo of Neotas Enhanced Due Diligence Platform.

New Whitepaper and Checklist

New Whitepaper and Checklist