How to design, implement, measure, and evolve a regulator-ready policy that ensures robust vendor governance

In this guide you will discover what a TPRM policy is, the objectives it must meet, its essential components, implementation best practices, metrics and maturity models, industry-specific examples, emerging trends, and downloadable templates you can adopt for your organisation.

Modern organisations depend on an expanding network of third parties — from IT service providers and cloud platforms to suppliers and consultants. Each connection introduces potential risks: data breaches, regulatory non-compliance, operational failures, or reputational harm.

A well-defined Third-Party Risk Management (TPRM) Policy provides the governance structure to identify, assess, monitor, and mitigate these risks consistently across the enterprise.

Regulators such as the FCA, OCC, and European authorities under DORA and NIS2 now expect formal, board-approved vendor oversight policies. Without them, organisations face not only compliance penalties but also greater vulnerability to supply chain disruption and cyber threats.

This guide explains what a TPRM Policy is, why it is critical, and how to build one that is measurable, auditable, and aligned with global regulatory standards. It combines practical frameworks, real-world insights, and a downloadable TPRM Policy Template to help you design a policy that protects resilience, compliance, and reputation.

A strong TPRM Policy is more than just a compliance formality — it is a business imperative for every organisation seeking trust, continuity, and operational control.

A Third-Party Risk Management Policy is a formal governance document that defines how an organisation identifies, assesses, mitigates, and monitors risks arising from external entities — such as vendors, suppliers, contractors, or service providers — that access its systems, handle sensitive data, or perform business-critical operations.

The policy outlines the principles, accountability structure, and processes used to manage third-party risks throughout the vendor lifecycle — from onboarding and due diligence to continuous monitoring and offboarding.

Its primary objective is to ensure that vendor relationships remain compliant, secure, and resilient, thereby safeguarding the organisation against financial loss, operational disruption, data breaches, and reputational damage.

A strong TPRM Policy also provides a clear framework for regulatory alignment, enabling the organisation to demonstrate due diligence and governance maturity to auditors, regulators, and investors.

Although often used interchangeably, these terms serve different purposes:

| Term | Description |

|---|---|

| Policy | Sets governance principles, scope, and accountability at the board level. It defines what must be done. |

| Framework | Provides the operational structure, risk models, and methodologies for implementing the policy. It defines how it will be done. |

| Procedures | Detail the specific workflows, checklists, and tools used by teams to carry out policy and framework requirements. |

Together, they form a unified system of vendor governance — ensuring consistency, transparency, and measurable outcomes across all third-party engagements.

Third Party: Any external organisation that provides goods, services, or access to systems or data — including suppliers, consultants, cloud service providers, or outsourcing partners.

Fourth Party: An entity subcontracted by a third party. These indirect dependencies can pose hidden risks if not properly monitored or disclosed.

Effective TPRM policies extend oversight beyond direct vendors to include fourth-party and supply chain risks, which are often the source of cascading failures and regulatory scrutiny.

A well-defined Third-Party Risk Management Policy (TPRM Policy) ensures that vendor oversight is structured, accountable, and measurable across the organisation. Its governance objectives align directly with the organisation’s wider risk management, compliance, and resilience strategy.

Every TPRM Policy must establish clear ownership for third-party risk. The Board of Directors or equivalent governing body typically approves the policy and delegates execution to the Chief Risk Officer (CRO), Chief Compliance Officer (CCO), or a dedicated TPRM function.

Defined accountability ensures that vendor risks are monitored at the same level of scrutiny as financial or operational risks — a key expectation under frameworks such as the FCA’s SYSC 8, the OCC’s Heightened Standards, and the EU’s DORA regulation.

The policy provides a structured means to comply with evolving regulatory obligations.

Examples include:

OCC (US): Outsourcing oversight and due diligence guidance.

FCA and PRA (UK): Requirements for operational resilience and third-party service dependencies.

DORA and NIS2 (EU): Mandatory risk classification, ICT resilience, and vendor monitoring obligations.

CSDDD and Modern Slavery Act: Supply chain transparency and ESG accountability.

By documenting governance measures, a TPRM Policy demonstrates proactive compliance and audit readiness, helping organisations avoid regulatory penalties and reputational harm.

The policy’s central function is to systematically identify, assess, and mitigate third-party risks — from financial instability to cybersecurity, ESG violations, and data privacy breaches.

A TPRM Policy sets risk thresholds (risk appetite) and defines escalation procedures for residual risks that exceed approved levels. This ensures that risk decisions are informed, justified, and recorded, strengthening both transparency and resilience.

A robust TPRM Policy ensures that leadership teams receive accurate, timely information on vendor exposures. Standardised assessments, performance dashboards, and risk reports support decision-making across procurement, finance, and compliance functions.

This visibility enables the Board and senior executives to prioritise resources, respond faster to vendor incidents, and balance operational agility with regulatory expectations.

Third-party ecosystems evolve rapidly. An effective TPRM Policy embeds review cycles, performance metrics, and audit feedback loops to ensure the programme remains relevant and aligned with emerging threats and regulations.

Periodic updates and policy reviews are essential to maintaining organisational resilience — ensuring the TPRM function evolves alongside the business.

A TPRM Policy transforms third-party oversight from a compliance formality into a strategic governance instrument. It allows leadership to demonstrate operational control, regulatory discipline, and a clear risk culture — all of which are critical to maintaining trust with regulators, investors, and customers.

A Third-Party Risk Management Policy should clearly define how an organisation governs third-party relationships throughout their lifecycle. The policy’s structure must balance clarity with enforceability — combining governance principles, operational standards, and evidence-based controls.

Below are the core components every TPRM Policy should include to ensure completeness, regulatory alignment, and audit readiness.

The policy begins by defining what it covers and why it exists.

Scope: Specifies which types of external relationships are subject to the policy — including suppliers, vendors, contractors, technology partners, intermediaries, and service providers. It should also clarify applicability across business units, geographies, and contract types.

Purpose: Outlines the organisation’s intention — to protect data, ensure compliance, and maintain operational resilience by managing third-party risks systematically.

A concise scope statement prevents ambiguity and ensures that all stakeholders understand the policy’s reach and objectives.

Accountability is central to effective third-party risk management. The policy must assign clear roles, responsibilities, and decision rights across governance levels:

| Role | Responsibility |

|---|---|

| Board / Risk Committee | Approves the policy, monitors high-risk vendors, reviews quarterly reports. |

| Chief Risk or Compliance Officer | Owns the policy, oversees implementation, ensures regulatory alignment. |

| Procurement / Business Units | Identify third-party engagements, perform due diligence, maintain records. |

| Legal / IT / Security Functions | Review contracts, data protection clauses, and cybersecurity standards. |

| Internal Audit | Provides independent assurance of policy adherence and effectiveness. |

A RACI (Responsible–Accountable–Consulted–Informed) matrix can strengthen clarity and ensure cross-functional coordination.

A strong policy must articulate the organisation’s risk appetite — defining the level of risk it is willing to accept in third-party relationships — and establish a vendor classification system.

Common criteria for vendor classification include:

Vendors are often categorised into tiers (Critical, High, Medium, Low), with corresponding due diligence and monitoring requirements. This proportionate approach ensures that resources focus on the highest-risk relationships.

No vendor relationship should begin without documented due diligence. This section defines the minimum due diligence requirements and approval steps before engagement.

Key elements include:

The policy should require evidence-based validation — not self-attestation — to maintain regulatory credibility.

Contracts formalise risk controls and should contain standard clauses aligned with the TPRM Policy.

Common mandatory clauses include:

Each contract should reference the TPRM Policy explicitly to ensure enforceability.

Risk management does not end at onboarding. This section establishes expectations for continuous vendor oversight:

Continuous monitoring ensures early detection of issues before they escalate into regulatory or operational crises.

Even mature programmes face exceptions. This clause defines how policy deviations and vendor incidents are handled.

An auditable escalation path demonstrates accountability and regulator confidence.

The policy should include a review cycle — typically annually, or sooner if regulatory or operational changes occur.

Periodic reviews incorporate lessons learned from audits, incidents, and new compliance requirements.

Each revision should:

Continuous improvement transforms the policy into a living governance document that evolves with the business environment.

Annexes strengthen adaptability by tailoring the policy to specific risk domains or industries. Examples include:

Including modular annexes allows organisations to customise their TPRM Policy while maintaining a consistent governance structure.

A complete TPRM Policy combines these elements into one coherent system — aligning board-level accountability with operational discipline and evidence-based monitoring.

| Component | Purpose | Outcome |

|---|---|---|

| Scope & Purpose | Defines what and why | Clear policy boundaries |

| Governance & Roles | Assigns ownership | Accountability and oversight |

| Risk Classification | Defines risk tiers | Proportionate controls |

| Onboarding & Due Diligence | Validates vendor integrity | Reduced exposure |

| Contracts & SLAs | Formalises controls | Enforceable standards |

| Ongoing Monitoring | Maintains visibility | Early issue detection |

| Escalation & Exceptions | Defines process | Faster resolution |

| Review & Updates | Ensures relevance | Continuous improvement |

| Annexes | Adds depth | Sector-specific compliance |

Download Regulator-Ready TPRM Policy Template, learn the essential components and governance objectives of a strong Third-Party Risk Management program.

Creating a Third-Party Risk Management (TPRM) Policy is only the first step. To be effective, the policy must be operationalised — embedded into daily procurement, compliance, and vendor oversight workflows. Implementation transforms a static document into a living governance mechanism that drives measurable outcomes and regulatory confidence.

Before rollout, assess your organisation’s current maturity in managing third-party risks. This involves:

A gap assessment establishes a factual starting point for policy implementation and helps prioritise critical remediation areas.

Implementation requires visible leadership endorsement. Board or executive approval not only ensures accountability but also sets the tone across the organisation that third-party governance is a business priority, not a compliance formality.

Senior support helps allocate sufficient resources, enforces cross-departmental cooperation, and legitimises policy enforcement during audits or procurement conflicts.

Rolling out a TPRM Policy across multiple functions or geographies should follow a phased approach:

Pilot Phase: Begin with high-risk vendor categories or a single business unit. Test workflows, forms, and review cycles.

Refinement: Capture feedback, adjust roles and approval processes, and fine-tune vendor classification models.

Organisation-wide Rollout: Extend coverage to all business areas, ensuring consistent adoption of the policy, procedures, and templates.

A phased rollout avoids disruption, builds internal confidence, and allows iterative learning before full deployment.

To sustain adoption, integrate TPRM processes into existing systems such as:

Procurement and contract management tools (for vendor registration and approval workflows).

GRC or risk platforms (for tracking assessments, KPIs, and escalations).

Cybersecurity monitoring systems (for continuous vendor performance visibility).

Automated workflows reduce manual effort, improve auditability, and ensure that third-party oversight is not dependent on individual teams or spreadsheets.

A TPRM Policy is effective only if teams understand and apply it consistently.

Training should target different stakeholder groups:

| Audience | Focus |

|---|---|

| Procurement Teams | Vendor onboarding, risk tiering, and due diligence checklists. |

| Compliance & Risk | Escalation paths, exceptions register, regulatory obligations. |

| IT & Security | Continuous monitoring, cyber risk assessment, data access controls. |

| Senior Management | Oversight responsibilities, KPI dashboards, policy governance. |

Include vendor awareness sessions when appropriate — helping suppliers understand your organisation’s expectations and compliance requirements.

Automation is a major enabler of scalable vendor governance.

Integrating AI-powered monitoring tools and OSINT-based due diligence platforms can significantly improve efficiency by:

Automation not only reduces administrative workload but also strengthens accuracy, consistency, and early-warning capabilities.

Governance should include defined escalation routes, exceptions procedures, and reporting cycles:

Embedding governance at multiple levels ensures transparency and regulatory defensibility.

Post-implementation, ongoing measurement is critical. Use predefined KPIs (see Section 6) to evaluate whether the policy is achieving its intended outcomes — such as reduced onboarding times, increased vendor coverage, and fewer audit findings.

Findings from monitoring cycles should directly feed into policy improvement, vendor training, and technology optimisation.

The goal is to establish a feedback loop — turning continuous observation into continuous improvement.

Periodic internal audits validate both the policy’s existence and its operational effectiveness.

Independent assurance demonstrates to regulators and senior leadership that the organisation has:

Audits should test sample vendor files, escalation records, and incident responses to confirm compliance with policy requirements.

Finally, integrate the TPRM Policy with existing enterprise frameworks such as:

Enterprise Risk Management (ERM) – aligning third-party risks with overall risk appetite.

Information Security and Data Protection Policies – ensuring vendor access is properly governed.

Business Continuity and Incident Response Plans – linking vendor dependencies to resilience strategies.

Integration prevents siloed governance and ensures that third-party oversight supports broader corporate objectives.

Effective implementation of a Third-Party Risk Management Policy requires a structured, pragmatic approach — combining leadership commitment, automation, training, and governance integration.

The outcome is a living system that protects business continuity, evidences compliance, and builds trust across the organisation’s extended ecosystem.

Measuring the effectiveness of a Third-Party Risk Management (TPRM) Policy is essential for proving that controls are not only in place but working as intended. Clear metrics enable transparency, accountability, and regulatory confidence.

KPIs for Third-Party Risk Management typically fall into four categories: Coverage, Efficiency, Quality, and Outcome.

These show how comprehensively the policy is applied across the vendor base.

Examples:

Measure how quickly and cost-effectively third-party processes are executed.

Examples:

Evaluate the accuracy and compliance of third-party management activities.

Examples:

Measure the ultimate effectiveness of risk controls.

Examples:

Each KPI should be assigned a target or benchmark aligned with regulatory expectations and organisational capacity. For example:

| KPI | Target Benchmark |

|---|---|

| % of vendors classified by risk | >95% |

| % of high-risk vendors with enhanced due diligence | 100% |

| Vendor onboarding cycle time | ≤20 business days (high risk), ≤10 (low/medium) |

| % of alerts triaged within SLA | >90% |

| % of policy exceptions documented | 100% |

| % of audit findings closed within timeframe | >90% |

Benchmarks provide measurable thresholds for performance review and audit readiness.

Measurement alone is insufficient without transparent reporting.

Organisations should establish two distinct dashboards:

Operational Dashboard (for compliance teams):

Displays live onboarding queues, overdue reassessments, open exceptions, and risk alerts by severity.

Board Dashboard (for executives):

Summarises vendor risk distribution, trends, key incidents, and improvement actions using heat maps or scorecards.

Effective visualisation translates complex data into actionable insights — allowing decision-makers to understand risk posture at a glance.

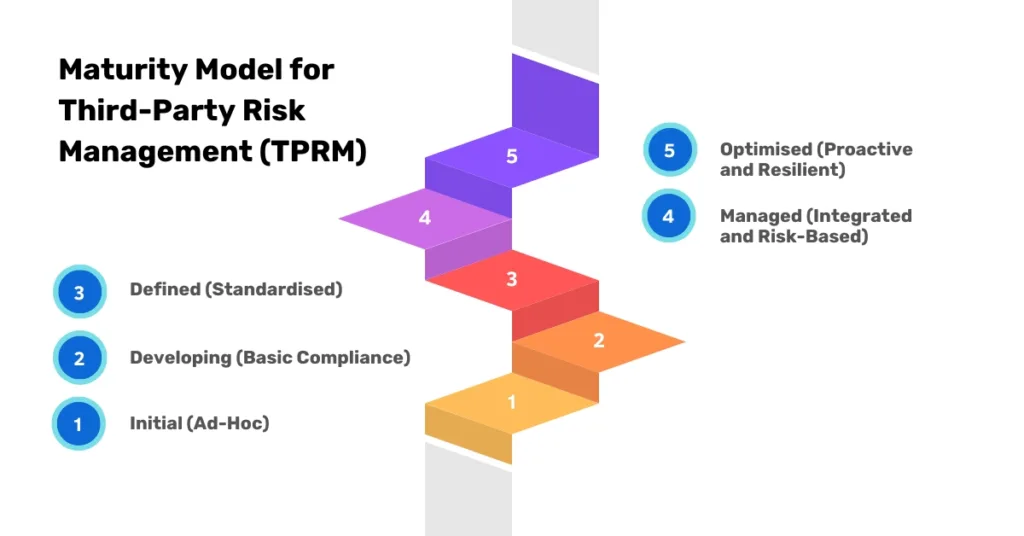

A maturity model helps organisations evaluate the sophistication of their third-party risk management policy and processes. It defines clear stages of capability, enabling leadership to set realistic improvement targets.

| Level | Description | Characteristics |

|---|---|---|

| 1. Ad Hoc | Minimal structure or documentation. | Vendor oversight inconsistent; compliance reactive. |

| 2. Basic | Generic policy in place. | Manual processes; limited visibility; focus on high-risk vendors only. |

| 3. Defined | Policy board-approved and standardised. | Tiered risk classification; periodic monitoring; central vendor database. |

| 4. Managed | Integrated and automated processes. | Continuous monitoring; KPIs tracked; exceptions logged; audit trails maintained. |

| 5. Optimised | Embedded in enterprise governance. | Predictive analytics, proactive alerts, and board-level dashboards demonstrating measurable risk reduction. |

Progressing from Level 2 to Level 4 is often a two- to three-year journey, depending on organisational size, resources, and regulatory pressure.

Measurement should feed directly into decision-making:

A mature TPRM programme treats metrics as both performance evidence and learning tools, ensuring continual alignment between intent, execution, and impact.

Metrics and maturity models give life to a Third-Party Risk Management Policy. They turn qualitative governance into measurable assurance — providing the evidence regulators, auditors, and boards expect from a well-governed, resilient enterprise.

Even with a well-drafted Third-Party Risk Management Policy, many programmes falter due to weak execution, limited accountability, or inconsistent oversight. Recognising these pitfalls early allows leadership to maintain control and ensure sustained compliance.

Lack of Executive Ownership

Without visible board and C-suite sponsorship, third-party risk management lacks influence and resourcing. Executive endorsement signals strategic importance and drives organisation-wide adherence.

Inconsistent Policy Application

Varying standards across business units or regions create control gaps and audit exposure. Consistent application of due diligence and monitoring processes is essential for regulatory credibility.

Over-Reliance on Manual Processes

Manual spreadsheets and fragmented systems lead to inefficiencies and errors. Automation and integrated platforms are vital to scale oversight effectively.

Poor Data Quality and Limited Vendor Visibility

Outdated or incomplete vendor records undermine decision-making. A single, verified vendor inventory is the foundation of reliable risk management.

Siloed Responsibilities

Fragmentation between procurement, compliance, and IT functions causes oversight failures. Cross-functional governance and shared ownership ensure accountability.

Neglecting Fourth-Party Risks

Indirect suppliers often pose hidden risks. Extending policy scope to include subcontractors enhances transparency and resilience.

Failure to Review and Update the Policy

A static policy quickly becomes obsolete. Annual reviews and regulatory horizon scanning maintain alignment with evolving requirements.

Over-Complexity and Administrative Burden

Excessive controls can slow business operations. Policies should balance proportionality with compliance effectiveness.

Weak Incident and Exception Management

Unrecorded incidents and policy deviations erode audit trails. A formal escalation and exception register is non-negotiable for regulator confidence.

Lack of Continuous Improvement

Without periodic assessment, programmes stagnate. Embedding KPIs and maturity reviews ensures continual optimisation.

Sustained success in third-party risk management depends on disciplined execution, consistent governance, accurate data, and visible leadership ownership.

Download Regulator-Ready TPRM Policy Template, learn the essential components and governance objectives of a strong Third-Party Risk Management program.

Every vendor you onboard is either strengthening your resilience—or quietly adding hidden exposure. Use this operational playbook and checklist not as theory, but as a live control you can run today. Build discipline into your procurement, prove audit readiness, and gain leadership confidence by showing vendor risk is being managed with precision.

👉 Download the TPRM Policy Template now and put it into practice before the next audit or board review.

Templates are only powerful when adapted to your context. If you want a practical walkthrough of how to embed this vendor risk assessment framework into your procurement and compliance workflows, let’s talk. Our team can show you how to tailor the playbook, automate monitoring, and align with regulatory expectations.

👉 Schedule A Discovery Call with our experts today and turn vendor risk management into a competitive advantage.

A Third-Party Risk Management Policy (TPRM Policy) is a formal governance document that defines how an organisation identifies, assesses, monitors, and mitigates risks arising from external vendors, suppliers, contractors, and service providers. It ensures consistent vendor oversight, regulatory compliance, and risk transparency across the supply chain.

A TPRM Policy is critical for protecting organisations from financial, operational, cybersecurity, and reputational risks caused by vendor failures or non-compliance. It demonstrates regulatory readiness, establishes accountability, and supports board-level risk oversight — essential under frameworks such as DORA, NIS2, FCA, and OCC.

Core components include: scope and purpose, governance roles, risk classification, vendor onboarding and due diligence, contractual controls, continuous monitoring, incident escalation, and policy review. Together, these form a complete TPRM framework aligned with global regulatory standards.

Ultimate ownership typically rests with the Board Risk Committee, with day-to-day responsibility delegated to the Chief Risk Officer (CRO) or Chief Compliance Officer (CCO). Approval by senior management ensures enterprise-wide authority, accountability, and alignment with corporate governance frameworks.

A TPRM Policy should be formally reviewed at least annually or whenever major regulatory, technological, or business changes occur. Periodic updates ensure the policy remains relevant, effective, and compliant with evolving standards such as DORA, NIS2, and ESG due diligence regulations.

The policy defines strategic intent and governance principles — what must be done.

The framework provides the operational model — how it is done, including procedures, workflows, and controls.

Together they ensure a structured, measurable approach to vendor risk management across the enterprise.

A TPRM Policy mitigates multiple risk domains: cybersecurity, data privacy, financial stability, ESG and sustainability, anti-bribery and corruption (ABC), legal compliance, and operational continuity. It ensures a consistent approach to risk identification, assessment, and remediation across vendors and partners.

The policy provides a documented framework to demonstrate adherence to laws and supervisory expectations such as OCC (US), FCA and PRA (UK), DORA and NIS2 (EU), GDPR, and CSDDD. It establishes audit-ready evidence that third-party risks are being governed systematically.

Effectiveness is measured through key performance indicators (KPIs) covering:

Maturity models also help benchmark progress from ad hoc to optimised governance.

Best practices include: securing executive sponsorship, performing a baseline risk assessment, adopting a phased rollout, integrating with existing procurement and GRC systems, and automating monitoring workflows. Training and regular reviews reinforce sustainable adoption.

A strong TPRM Policy mandates security questionnaires, contractual data protection clauses, breach notification timelines, and ongoing monitoring of vendor cyber posture. It aligns with recognised standards such as ISO 27001, NIST Cybersecurity Framework, and GDPR compliance requirements.

Modern TPRM Policies require vendors to disclose their subcontractors and maintain control over their supply chains. This enables organisations to identify fourth-party dependencies, monitor extended networks, and manage systemic risk across the entire vendor ecosystem.

Frequent challenges include lack of executive ownership, inconsistent application, manual data handling, siloed responsibilities, and outdated vendor inventories. Success depends on automation, centralised governance, and consistent cross-functional collaboration.

ESG integration extends vendor oversight to environmental, social, and ethical risk management. Policies increasingly include human rights, modern slavery, and climate risk assessments to meet compliance under frameworks such as CSDDD and Modern Slavery Act.

You can download a regulator-ready TPRM Policy Template (PDF) that includes sample clauses, workflows, KPIs, and regulatory mapping. The template provides a practical foundation to design a compliant, auditable, and industry-aligned vendor risk management policy.

Tags: Third-Party Risk Management Policy, TPRM Policy Template, Vendor Risk Management Framework, Due Diligence Policy, Supply Chain Risk Governance, TPRM Best Practices, TPRM KPIs, TPRM Implementation, ESG in TPRM, Cybersecurity Risk Management, Fourth-Party Risk Oversight, Regulatory Compliance (DORA, NIS2, OCC, FCA).

financial crime compliance

financial crimes compliance

what is financial crime compliance

financial crime and compliance

financial crime and compliance management

financial crime compliance jobs

financial crime compliance solutions

financial crimes compliance jobs

compliance and financial crime

cost of financial crime compliance

enterprise financial crimes compliance

fcc financial crime compliance

anti financial crime compliance

conduct financial crime and compliance

financial crime compliance analyst

financial crime compliance analyst salary

financial crime compliance certification

financial crime compliance course

financial crime compliance definition

financial crime compliance framework

financial crime compliance in banking

financial crime compliance meaning

financial crime compliance risk management

global financial crimes compliance

true cost of financial crime compliance global report

what is financial crimes compliance

Neotas Enhanced Due Diligence covers 600Bn+ Archived web pages, 1.8Bn+ court records, 198M+ Corporate records, Global Social Media platforms, and more than 40,000 Media sources from over 100 countries to help you screen & manage risks.

Download the TPRM Policy Framework and build a compliance-first vendor oversight programme that stands up to regulator and board scrutiny.

vendor risk assessment template

vendor risk assessment template xls

vendor risk assessment questionnaire template

vendor risk assessment template excel

vendor management risk assessment template

bank vendor risk assessment template

free vendor risk assessment template

vendor risk management assessment template

third-party vendor risk assessment template

thirdparty vendor risk assessment template

vendor risk assessment questionnaire template pdf

free vendor risk assessment questionnaire template

vendor risk assessment template equation

vendor risk assessment questionnaire template excel

it vendor risk assessment template excel

vendor risk assessment template pdf

third party vendor risk assessment template

vendor risk assessment template – excel

soc 2 vendor risk assessment template

vendor risk assessment report template

it vendor risk assessment template

free vendor risk assessment template xls

vendor risk assessment template free

vendor risk assessment template xls excel

vendor risk assessment software

customer and vendor risk assessment software

software for vendor risk assessment

compare vendor risk assessment software solutions

vendor risk assessment

vendor management risk assessment

vendor risk assessment software

vendor security risk assessment

vendor risk assessment tools

vendor risk assessment template

automated vendor risk assessment

vendor risk assessment process

3rd party vendor risk assessment

third party vendor risk assessment

customer and vendor risk assessment software

vendor risk assessment checklist

vendor risk assessment questionnaire

information security vendor risk assessment

vendor risk assessment report

vendor risk assessment matrix

third party vendor risk assessment example

risk assessment third party vendor

vendor risk assessment criteria

hipaa vendor risk assessment

vendor cyber risk assessment

vendor risk assessment for banks

vendor risk assessment example

what is vendor risk assessment

vendor risk assessment tool

vendor risk assessment template xls

risk assessment for vendor management

vendor risk assessment questionnaire pdf

nist vendor risk assessment questionnaire

vendor financial risk assessment

vendor risk assessment services

ai vendor risk assessment

what is a vendor risk assessment

vendor due diligence risk assessment

vendor risk assessment policy

how to perform vendor risk assessment

vendor risk assessment program

vendor risk assessment procedure

vendor risk assessment questionnaire template

vendor management risk assessment questionnaire

vendor management risk assessment matrix

vendor risk management assessment matrix

nist vendor risk assessment

vendor risk assessment template excel

vendor risk assessment framework

vendor information security risk assessment

vendor risk assessment servicenow

vendor management risk assessment template

bank vendor risk assessment template

free vendor risk assessment template

risk assessment vendor selection

health risk assessment vendor

healthcare vendor risk assessment

vendor risk assessment form

vendor risk assessment questionnare

vendor risk assessment questions

risk assessment vendor management

vendor risk management assessment template

vendor risk assessment jobs

bank vendor management risk assessment

risk assessment for vendor qualification

vendor risk assessment checklist xls

sample vendor risk assessment

compare vendor risk assessment tools using ai for public procurement contracts.

third-party vendor risk assessment

vendor risk assessment library

vendor risk assessment resume

vendor risk assessment definition

third-party vendor risk assessment template

thirdparty vendor risk assessment template

vendor management risk assessment sample

risk assessment thirdparty vendor

vendor cybersecurity risk assessment

continuous vendor risk assessment

third party vendor risk assessment questionnaire

vendor qualification risk assessment

vendor risk assessment pdf

third-party vendor risk assessment example

vendor risk assessment tools ai public procurement contracts

social media archive services this vendor can also provide risk assessment monitoring

vendor risk assessment best practices

thirdparty vendor risk assessment example

vendor risk assessment scorecard

vendor management risk assessment

vendor risk assessment report sample

vendor risk management assessment

vendor risk assessment audits

cbanc network vendor management risk assessment

vendor risk assessment, reasonable security

vra vendor risk assessment

vendor risk assessment tools tech vendor credibility

vendor risk assessment questionnaire template pdf

sample vendor risk assessment questionnaire

free vendor risk assessment questionnaire template

what is vendor risk assessment process?

vendor risk assessment template equation

vendor risk assessment (vra)

vendor risk assessment process steps

vendor risk assessment methodology

how to do a vendor risk assessment

vendor management risk assessment

risk assessment for vendor management

vendor management risk assessment questionnaire

vendor management risk assessment matrix

vendor risk management assessment matrix

vendor management risk assessment template

risk assessment vendor management

vendor risk management assessment template

bank vendor management risk assessment

vendor management risk assessment sample

vendor management risk assessment

vendor risk management assessment

network vendor management risk assessment

vendor risk management business risk assessment

vendor management risk assessment

risk assessment for vendor management

vendor management risk assessment questionnaire

vendor management risk assessment matrix

vendor risk management assessment matrix

vendor management risk assessment template

risk assessment vendor management

vendor risk management assessment template

bank vendor management risk assessment

vendor management risk assessment sample

vendor management risk assessment

vendor risk management assessment

network vendor management risk assessment

vendor risk management business risk assessment vendor management risk assessment

risk assessment for vendor management

vendor management risk assessment questionnaire

vendor management risk assessment matrix

vendor risk management assessment matrix

vendor management risk assessment template

risk assessment vendor management

vendor risk management assessment template

bank vendor management risk assessment

vendor management risk assessment sample

ffiec vendor management risk assessment

vendor risk management assessment

vendor management risk assessment

vendor risk management business risk assessment

vendor risk assessment

vendor management risk assessment

vendor risk assessment software

vendor security risk assessment

vendor risk assessment tools

vendor risk assessment template

automated vendor risk assessment

vendor risk assessment process

3rd party vendor risk assessment

third party vendor risk assessment

customer and vendor risk assessment software

vendor risk assessment checklist

vendor risk assessment questionnaire

information security vendor risk assessment

vendor risk assessment report

vendor risk assessment matrix

third party vendor risk assessment example

risk assessment third party vendor

vendor risk assessment criteria

hipaa vendor risk assessment

vendor cyber risk assessment

vendor risk assessment for banks

vendor risk assessment example

what is vendor risk assessment

vendor risk assessment tool

vendor risk assessment template xls

risk assessment for vendor management

vendor risk assessment questionnaire pdf

nist vendor risk assessment questionnaire

vendor financial risk assessment

vendor risk assessment services

ai vendor risk assessment

what is a vendor risk assessment

vendor due diligence risk assessment

vendor risk assessment policy

how to perform vendor risk assessment

vendor risk assessment program

vendor risk assessment procedure

vendor risk assessment questionnaire template

vendor management risk assessment questionnaire

vendor management risk assessment matrix

vendor risk management assessment matrix

nist vendor risk assessment

vendor risk assessment template excel

vendor risk assessment framework

vendor information security risk assessment

vendor risk assessment

vendor management risk assessment template

bank vendor risk assessment template

free vendor risk assessment template

An advanced Due Diligence Platform that leverages AI to join the dots between Social Media, Corporate Records, Adverse Media and Open Source Intelligence (OSINT).

Our platform offers the most advanced insights, so you can respond to risks immediately.

With insights spanning global jurisdictions, your business is never in the dark.

Whether you manage a small portfolio or a global enterprise, our platform adapts to your needs

Ready to Transform Your Third-Party Risk Approach?

| Cookie | Duration | Description |

|---|---|---|

| AWSALBTG | 7 days | AWS Application Load Balancer Cookie. Load Balancing Cookie: Used to encode information about the selected target group. |

| AWSALBTGCORS | 7 days | AWS Classic Load Balancer Cookie: Used to map the session to the instance. This cookie is identical to the original ELB cookie except for the attribute &SameSite=None; |

| cookielawinfo-checkbox-advertisement | 1 year | Set by the GDPR Cookie Consent plugin, this cookie is used to record the user consent for the cookies in the "Advertisement" category . |

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| CookieLawInfoConsent | 1 year | Records the default button state of the corresponding category & the status of CCPA. It works only in coordination with the primary cookie. |

| debug | never | Cookie used to debug code and website issues |

| shown | session | Session cookie to control number of times a pop up is shown. |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| __cf_bm | 30 minutes | This cookie, set by Cloudflare, is used to support Cloudflare Bot Management. |

| AnalyticsSyncHistory | 1 month | Used to store information about the time a sync took place with the lms_analytics cookie |

| bcookie | 2 years | LinkedIn sets this cookie from LinkedIn share buttons and ad tags to recognize browser ID. |

| bscookie | 2 years | LinkedIn sets this cookie to store performed actions on the website. |

| lang | session | LinkedIn sets this cookie to remember a user's language setting. |

| lidc | 1 day | LinkedIn sets the lidc cookie to facilitate data center selection. |

| UserMatchHistory | 1 month | LinkedIn sets this cookie for LinkedIn Ads ID syncing. |

| Cookie | Duration | Description |

|---|---|---|

| li_gc | 2 years | Used to store consent of guests regarding the use of cookies for non-essential purposes |

| rl_anonymous_id | 1 year | Generates an unique anonymous Id to identify a user and attach to a subsequent event. |

| rl_user_id | 1 year | to store a unique user ID for the purpose of Marketing/Tracking |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | The _ga cookie, installed by Google Analytics, calculates visitor, session and campaign data and also keeps track of site usage for the site's analytics report. The cookie stores information anonymously and assigns a randomly generated number to recognize unique visitors. |

| _gat_gtag_UA_107495977_1 | 1 minute | Set by Google to distinguish users. |

| _gat_UA-107495977-1 | 1 minute | A variation of the _gat cookie set by Google Analytics and Google Tag Manager to allow website owners to track visitor behaviour and measure site performance. The pattern element in the name contains the unique identity number of the account or website it relates to. |

| _gcl_au | 3 months | Provided by Google Tag Manager to experiment advertisement efficiency of websites using their services. |

| _gid | 1 day | Installed by Google Analytics, _gid cookie stores information on how visitors use a website, while also creating an analytics report of the website's performance. Some of the data that are collected include the number of visitors, their source, and the pages they visit anonymously. |

| attribution_user_id | 1 year | This cookie is set by Typeform for usage statistics and is used in context with the website's pop-up questionnaires and messengering. |

| CONSENT | 2 years | YouTube sets this cookie via embedded youtube-videos and registers anonymous statistical data. |

| Cookie | Duration | Description |

|---|---|---|

| _fbp | 3 months | This cookie is set by Facebook to display advertisements when either on Facebook or on a digital platform powered by Facebook advertising, after visiting the website. |

| fr | 3 months | Facebook sets this cookie to show relevant advertisements to users by tracking user behaviour across the web, on sites that have Facebook pixel or Facebook social plugin. |

| IDE | 1 year 24 days | Google DoubleClick IDE cookies are used to store information about how the user uses the website to present them with relevant ads and according to the user profile. |

| test_cookie | 15 minutes | The test_cookie is set by doubleclick.net and is used to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | A cookie set by YouTube to measure bandwidth that determines whether the user gets the new or old player interface. |

| YSC | session | YSC cookie is set by Youtube and is used to track the views of embedded videos on Youtube pages. |

| yt-remote-connected-devices | never | YouTube sets this cookie to store the video preferences of the user using embedded YouTube video. |

| yt-remote-device-id | never | YouTube sets this cookie to store the video preferences of the user using embedded YouTube video. |

| yt.innertube::nextId | never | This cookie, set by YouTube, registers a unique ID to store data on what videos from YouTube the user has seen. |

| yt.innertube::requests | never | This cookie, set by YouTube, registers a unique ID to store data on what videos from YouTube the user has seen. |