Enhanced Due Diligence Checklist for AML

An Enhanced Due Diligence (EDD) checklist for Anti-Money Laundering (AML) purposes should be comprehensive and tailored to the specific risks associated with the customer or transaction.

Here are some key elements that should be included in the Enhanced Due Diligence Checklist for AML:

- Customer Identification and Verification:

- Verify the customer’s identity using reliable and independent sources

- Obtain and validate identification documents (e.g., passport, national ID)

- Conduct a thorough background check on the customer

- Beneficial Ownership Identification:

- Identify and verify the ultimate beneficial owners of the legal entity

- Understand the ownership and control structure of the entity

- Source of Funds/Wealth:

- Determine the source of the customer’s funds or wealth

- Obtain and verify supporting documentation (e.g., bank statements, tax returns)

- Assess the plausibility and legitimacy of the declared sources

- Risk Assessment:

- Conduct a comprehensive risk assessment of the customer

- Consider factors such as country risk, industry risk, and the customer’s profile

- Assign an appropriate risk rating (e.g., low, medium, high)

- Adverse Media Screening:

- Perform thorough adverse media screening on the customer and related parties

- Identify any potential links to criminal activities, sanctions, or negative news

- Network Analysis:

- Map and analyze the customer’s business relationships and networks

- Uncover any potential connections to high-risk individuals or entities

- Leverage advanced technologies like natural language processing (NLP)

- Ongoing Monitoring:

- Implement ongoing monitoring of the customer’s activities and transactions

- Review and update the customer’s risk profile periodically

- Identify any suspicious or unusual patterns of activity

- Documentation and Record-Keeping:

- Maintain comprehensive documentation of the EDD process

- Keep records of all information obtained and decisions made

- Ensure compliance with regulatory requirements for record retention

It’s crucial to tailor the EDD checklist to the specific risks associated with the customer or transaction. For example, if the customer is a politically exposed person (PEP) or operates in a high-risk industry, additional due diligence measures may be necessary.

By implementing a robust EDD checklist, organisations can demonstrate a commitment to combating money laundering and terrorist financing, while also protecting their reputation and ensuring compliance with AML regulations. Failure to conduct adequate due diligence can result in severe consequences, including regulatory fines, reputational damage, and potential legal liabilities.

About Neotas Enhanced Due Diligence

Neotas Platform covers 600Bn+ archived web pages, 1.8Bn+ court records, 198M+ corporate records, global social media platforms, and 40,000+ Media sources from over 100 countries to help you build a comprehensive picture of the team. It’s a world-first, searching beyond Google. Neotas’ diligence uncovers illicit activities, reducing financial and reputational risk.

Due Diligence Solutions:

- Enhanced Due Diligence

- Management Due Diligence

- Customer Due Diligence

- Simplified Due Diligence

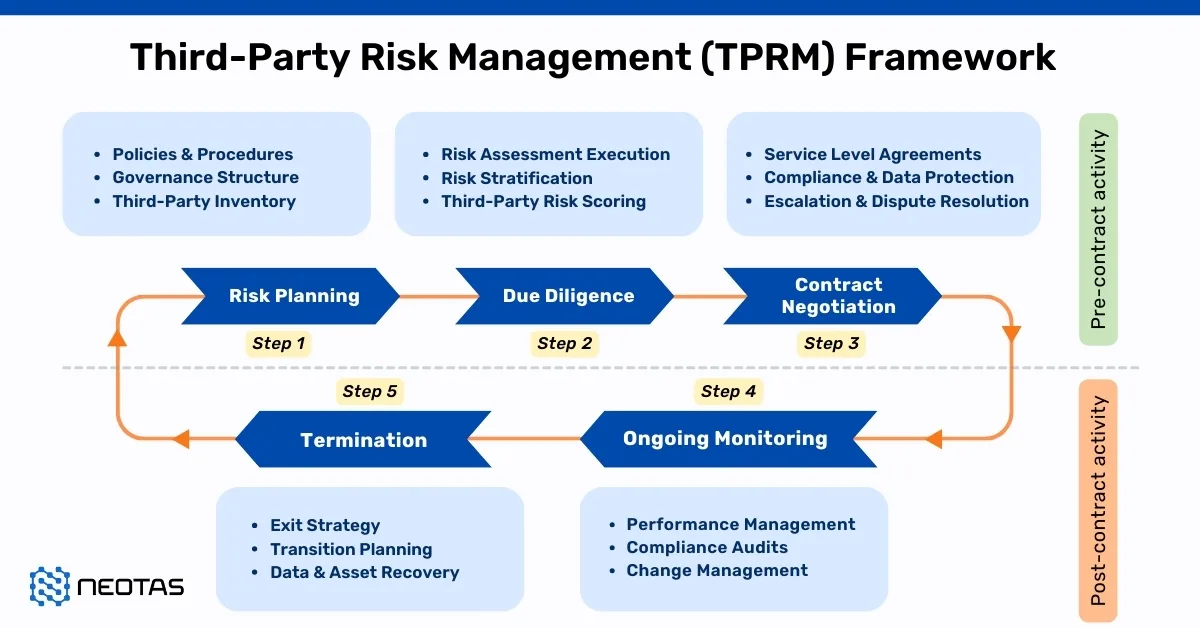

- Third Party Risk Management

- Open Source Intelligence (OSINT)

- Introducing the Neotas Enhanced Due Diligence Platform

Due Diligence Case Studies:

- Case Study: OSINT for EDD & AML Compliance

- Overcoming EDD Challenges on High Risk Customers

- Neotas Open Source Intelligence (OSINT) based AML Solution sees beneath the surface

- ESG Risks Uncovered In Investigation For Global Private Equity Firm

- Management Due Diligence Reveals Abusive CEO

- Ongoing Monitoring Protects Credit Against Subsidiary Threat

- AML Compliance and Fraud Detection – How to Spot a Money Launderer and Prevent It

- OSINT Framework, OSINT Tools, OSINT Techniques, and how to use OSINT framework.

- Open Source Intelligence (OSINT) in the Fight Against Financial Crime

- Reduce & Manage Business Risk with Neotas Open Source Intelligence (OSINT) Solutions

- Using OSINT for Sources of Wealth Checks

- Open Source Intelligence (OSINT) based AML Solution sees beneath the surface

- Enhancing ESG Risk Management Framework with Neotas’ OSINT Integration

- How Open Source Intelligence (OSINT) is transforming enhanced due diligence and investigations in AML compliance

- Detecting Modern Slavery In Your Supply Chain using Open-source Intelligence

- Creating an effective framework for managing risk with suppliers and third parties using open-source intelligence (OSINT)

- Using Open Source Intelligence For Enhanced Due Diligence

Manage Financial Compliance and Business Risk with Enhanced Due Diligence and OSINT.

Neotas is an Enhanced Due Diligence Platform that leverages AI to join the dots between Corporate Records, Adverse Media and Open Source Intelligence (OSINT).

Schedule a Call or Book a Demo of Neotas Enhanced Due Diligence Platform.